Question: Use the information provided in the table below, which shows forward P/E multiples and key value drivers for firms in the restaurant sector, to answer

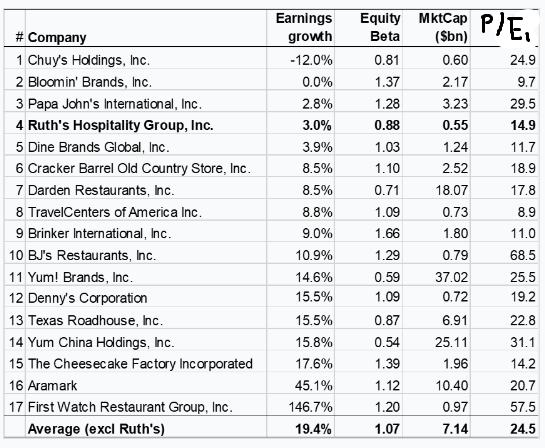

Use the information provided in the table below, which shows forward P/E multiples and key value drivers for firms in the restaurant sector, to answer the following 3 questions about valuing Ruth's Hospitality Group, Inc.

The following table shows P/E multiples and their key value drivers for 17 restaurant firms listed on U.S. stock exchanges.

1. Which of the key value drivers would you expect to be most important in valuing a firm's equity using forward P/E multiples, and why?

2. If you are going to evaluate Ruth's Hospitality Group, Inc. using forward P/E multiples, which firms would you include in your comparable set? Justify your choices using key value drivers.

3. What is the implied equity value of Ruth's Hospitality Group, Inc. based on the P/E multiples of your comp set of firms, chosen in Question?Use $36.2 million as the expected forward earnings (E1) of Ruth's.

# Company 1 Chuy's Holdings, Inc. 2 Bloomin' Brands, Inc. 3 Papa John's International, Inc. 4 Ruth's Hospitality Group, Inc. 5 Dine Brands Global, Inc. 6 Cracker Barrel Old Country Store, Inc. 7 Darden Restaurants, Inc. 8 TravelCenters of America Inc. 9 Brinker International, Inc. 10 BJ's Restaurants, Inc. 11 Yum! Brands, Inc. 12 Denny's Corporation 13 Texas Roadhouse, Inc. 14 Yum China Holdings, Inc. 15 The Cheesecake Factory Incorporated 16 Aramark 17 First Watch Restaurant Group, Inc. Average (excl Ruth's) Earnings Equity MktCap growth Beta ($bn) -12.0% 0.81 0.60 0.0% 1.37 2.17 2.8% 1.28 3.23 3.0% 0.88 0.55 1.03 1.24 1.10 2.52 0.71 1.09 1.66 1.29 0.59 1.09 0.87 0.54 1.39 1.12 1.20 1.07 3.9% 8.5% 8.5% 8.8% 9.0% 10.9% 14.6% 15.5% 15.5% 15.8% 17.6% 45.1% 146.7% 19.4% 18.07 0.73 1.80 0.79 37.02 0.72 6.91 25.11 1.96 10.40 0.97 7.14 P/E. 24.9 9.7 29.5 14.9 11.7 18.9 17.8 8.9 11.0 68.5 25.5 19.2 22.8 31.1 14.2 20.7 57.5 24.5

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

1 When valuing a firms equity using forward PE multiples some of the most important key value drivers are earnings growth the risk profile as indicate... View full answer

Get step-by-step solutions from verified subject matter experts