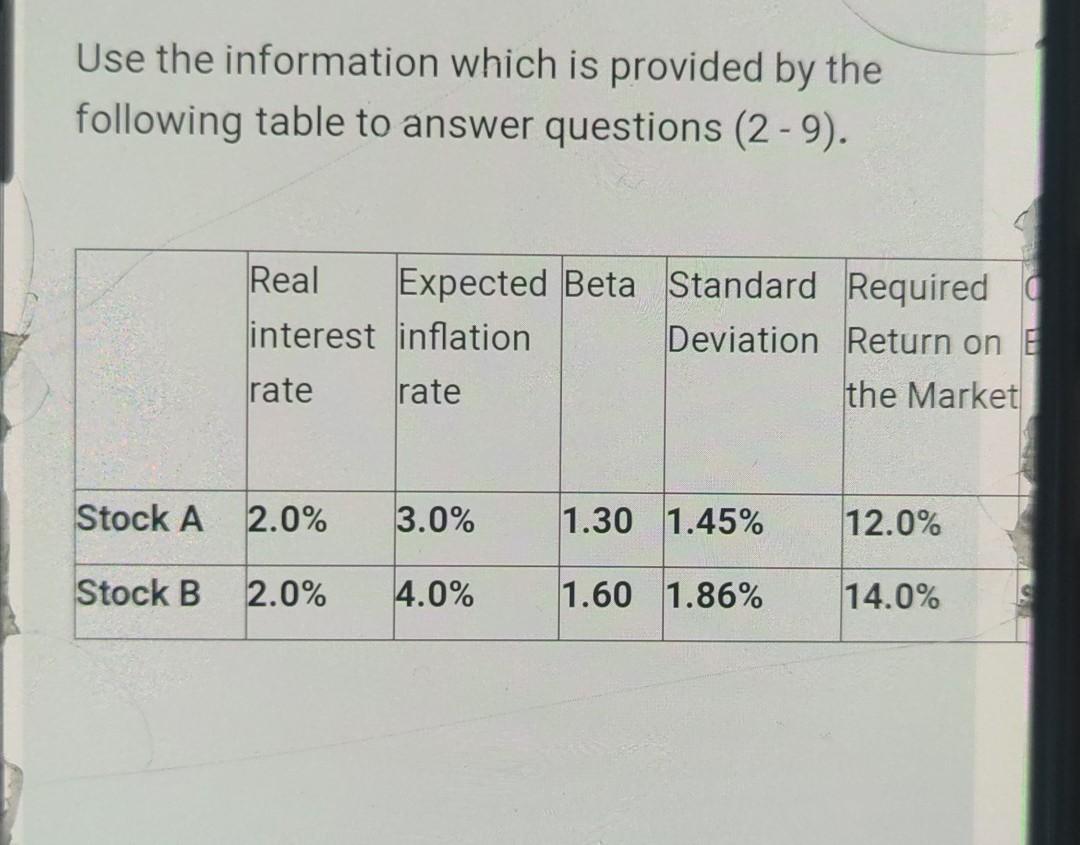

Question: Use the information which is provided by the following table to answer questions (2 - 9). Real Expected Beta Standard Required interest inflation Deviation Return

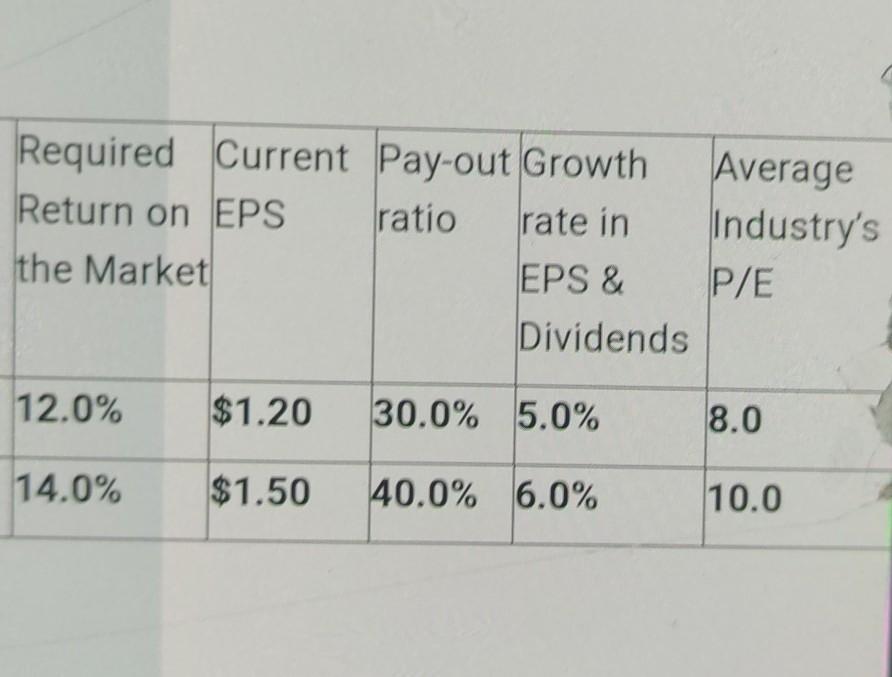

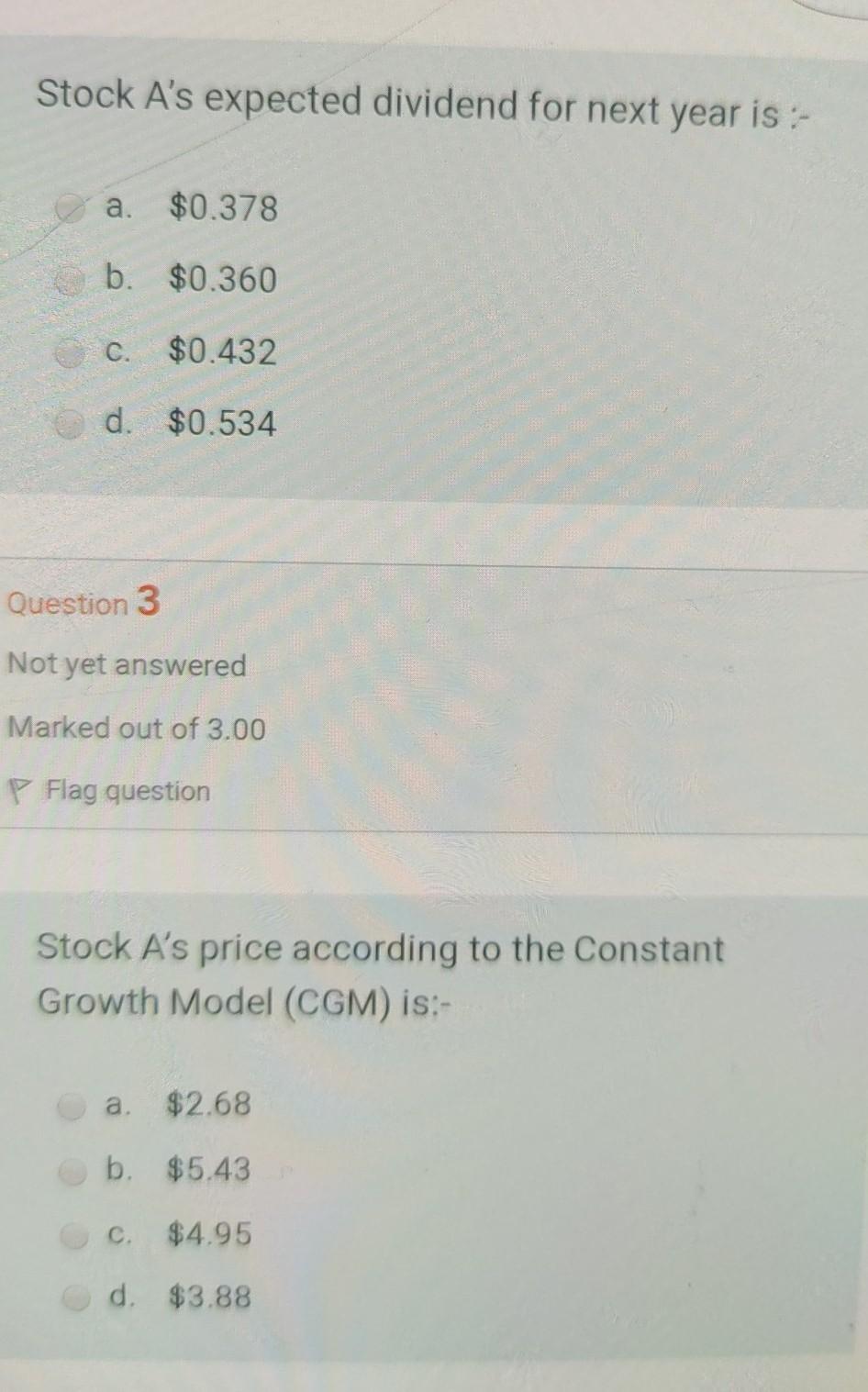

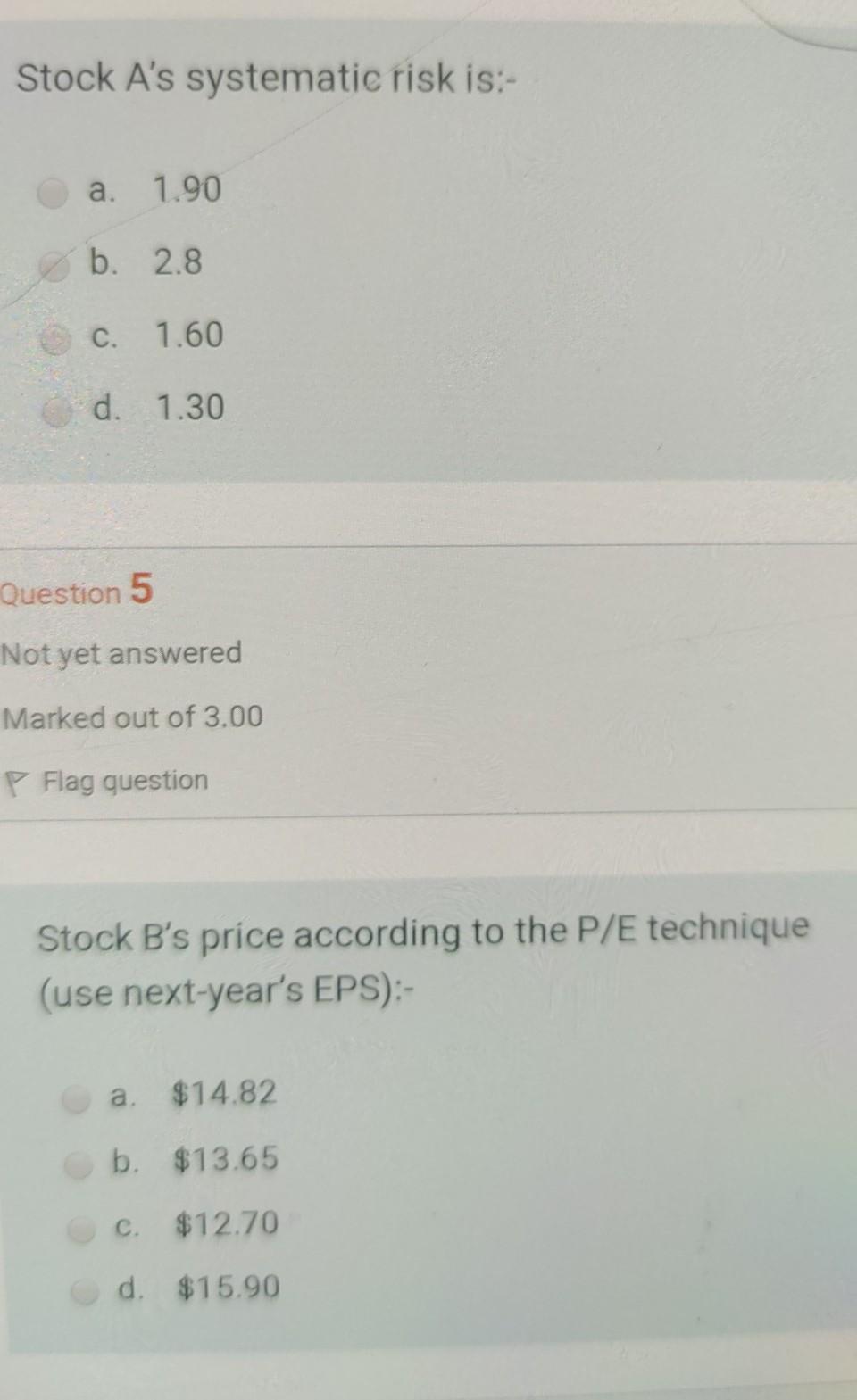

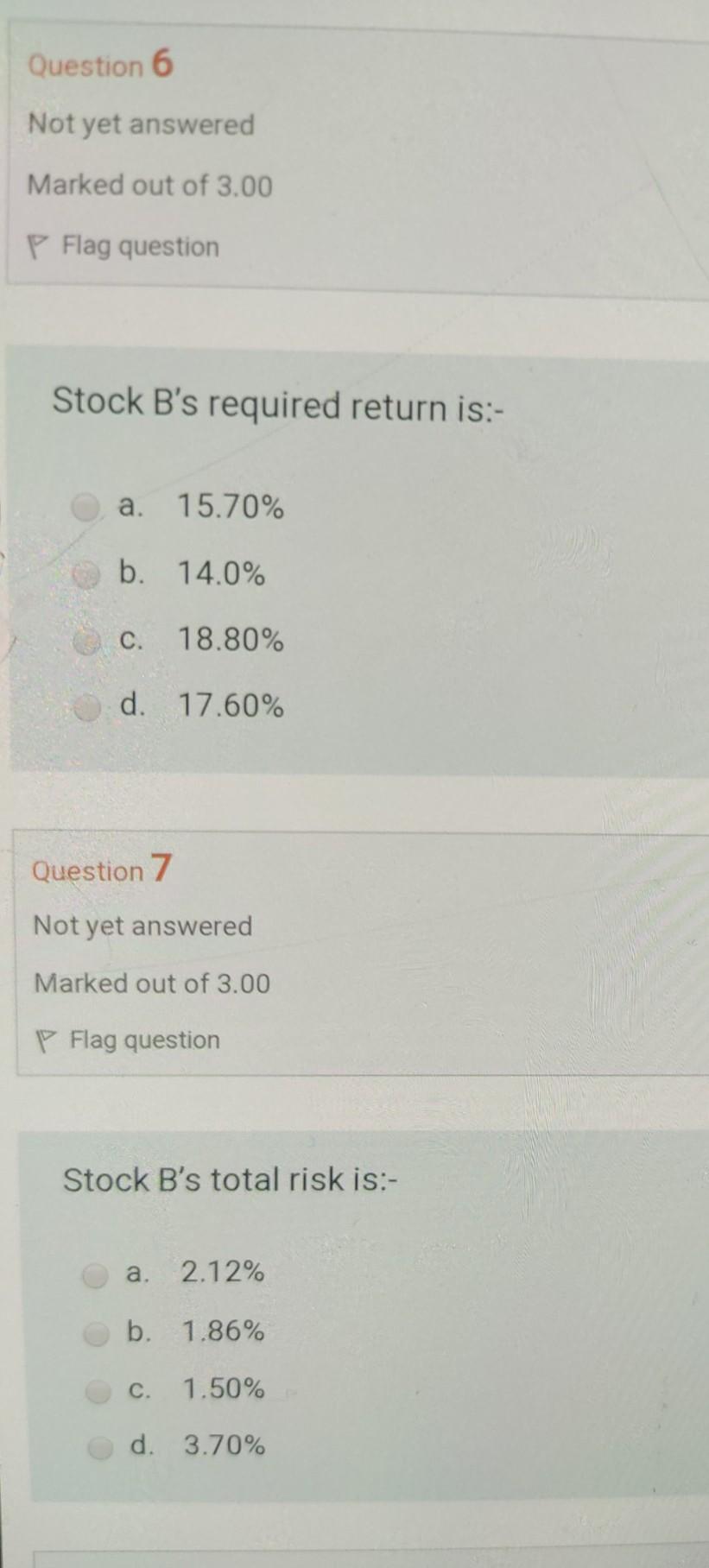

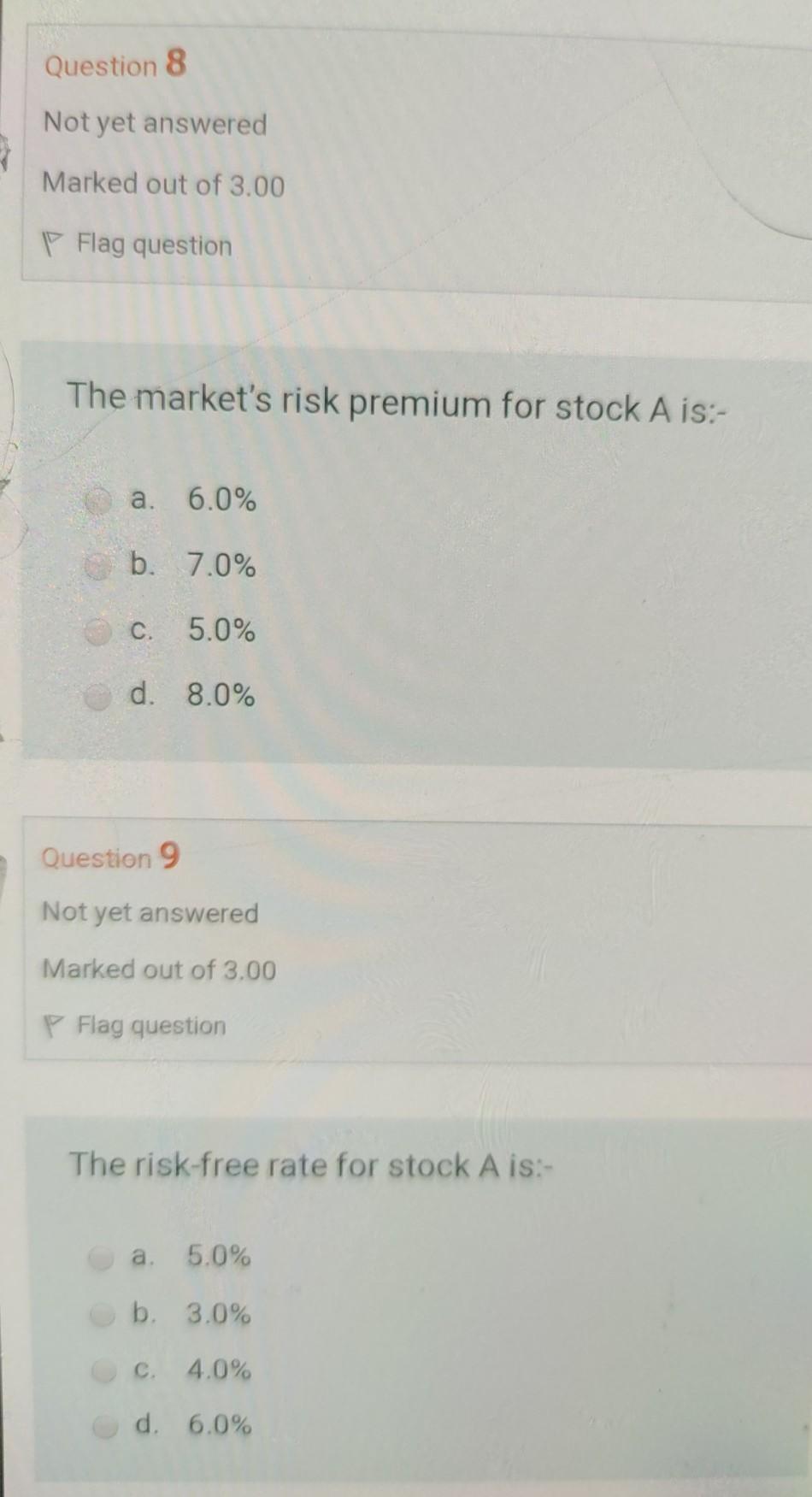

Use the information which is provided by the following table to answer questions (2 - 9). Real Expected Beta Standard Required interest inflation Deviation Return on ! rate rate the Market Stock A 2.0% 3.0% 1.30 1.45% 12.0% Stock B 2.0% 4.0% 1.60 1.86% 14.0% Required Current Pay-out Growth Average Return on EPS ratio rate in Industry's the Market EPS & P/E Dividends 12.0% $1.20 30.0% 5.0% 8.0 14.0% $1.50 40.0% 6.0% 10.0 Stock A's expected dividend for next year is :- a. $0.378 b. $0.360 C. $0.432 d. $0.534 Question 3 Not yet answered Marked out of 3.00 Flag question Stock A's price according to the Constant Growth Model (CGM) is: a. $2.68 b. $5.43 C. $4.95 d. $3.88 Stock A's systematic risk is:- a. 1.90 b. 2.8 C. 1.60 d. 1.30 Question 5 Not yet answered Marked out of 3.00 Flag question Stock B's price according to the P/E technique (use next-year's EPS):- a. $14.82 b. $13.65 C. $12.70 d. $15.90 Question 6 Not yet answered Marked out of 3.00 P Flag question Stock B's required return is:- a. 15.70% b. 14.0% c. 18.80% d. 17.60% Question 7 Not yet answered Marked out of 3.00 Flag question Stock B's total risk is:- a. 2.12% b. 1.86% C. 1.50% d. 3.70% Question 8 Not yet answered Marked out of 3.00 P Flag question The market's risk premium for stock A is:- a. 6.0% b. 7.0% C. 5.0% d. 8.0% Question 9 Not yet answered Marked out of 3.00 Flag question The risk-free rate for stock A is:- a. 5.0% b. 3.0% C. 4.0% d. 6.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts