Question: Use the information which is provided for the ABC Corp to calculate:- 1 - The AARR. 2 - The accounting PBP. 3 - The Cash-Flow

Use the information which is provided for the ABC Corp to calculate:-

1 - The AARR.

2 - The accounting PBP.

3 - The Cash-Flow based PBP.

4 - The IRR.

5 - The NPV.

PLEASE ANSWER WITH TYPING NOT HAND PHOTO

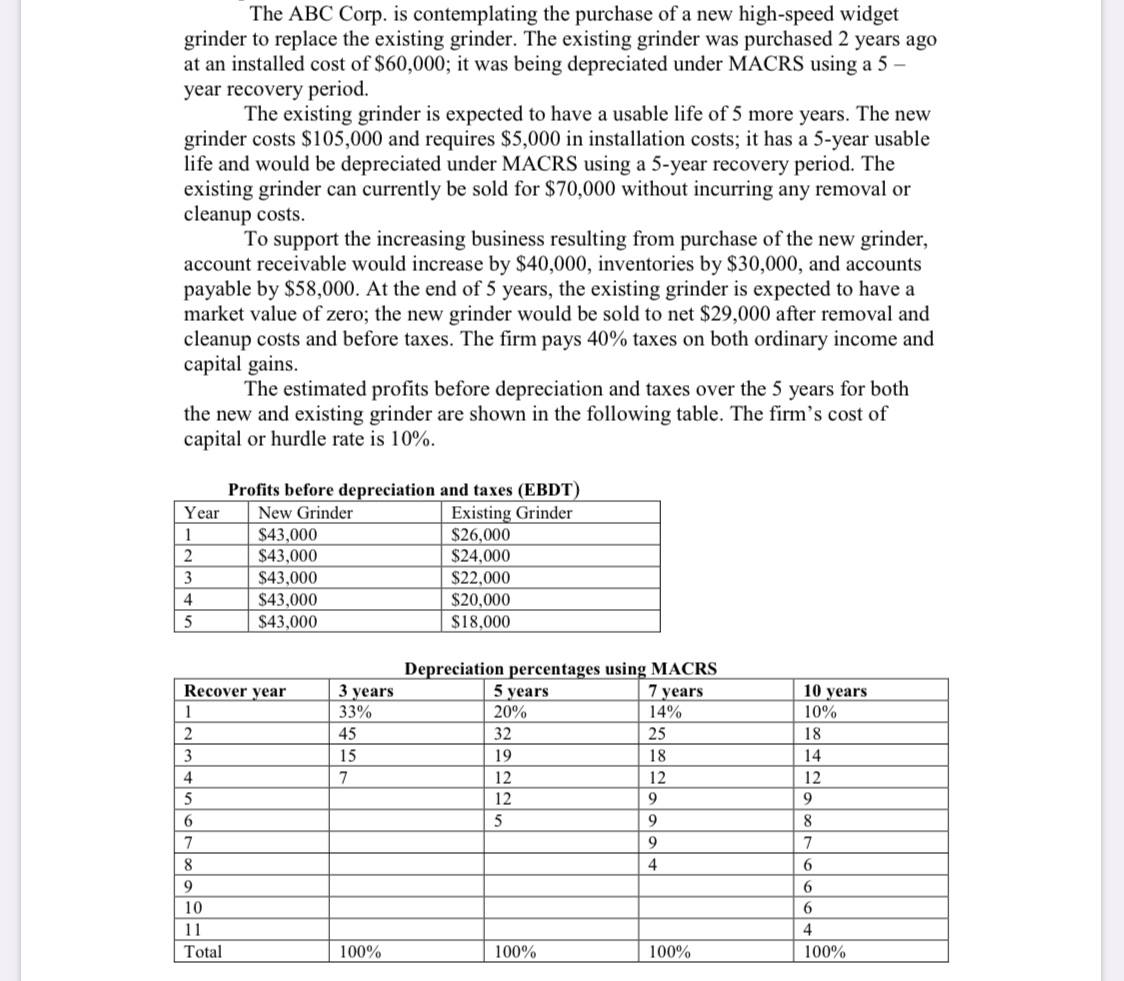

The ABC Corp. is contemplating the purchase of a new high-speed widget grinder to replace the existing grinder. The existing grinder was purchased 2 years ago at an installed cost of $60,000; it was being depreciated under MACRS using a 5 year recovery period. The existing grinder is expected to have a usable life of 5 more years. The new grinder costs $105,000 and requires $5,000 in installation costs; it has a 5-year usable life and would be depreciated under MACRS using a 5-year recovery period. The existing grinder can currently be sold for $70,000 without incurring any removal or cleanup costs. To support the increasing business resulting from purchase of the new grinder, account receivable would increase by $40,000, inventories by $30,000, and accounts payable by $58,000. At the end of 5 years, the existing grinder is expected to have a market value of zero; the new grinder would be sold to net $29,000 after removal and cleanup costs and before taxes. The firm pays 40% taxes on both ordinary income and capital gains. The estimated profits before depreciation and taxes over the 5 years for both the new and existing grinder are shown in the following table. The firm's cost of capital or hurdle rate is 10%. Year 1 2 3 4 5 Profits before depreciation and taxes (EBDT) New Grinder Existing Grinder $43,000 $26,000 $43,000 $24,000 $43,000 $22,000 $43,000 $20,000 $43,000 $18,000 Recover year 2 3 3 years 33% 45 15 7 Depreciation percentages using MACRS 5 years 7 years 20% 14% 32 25 19 18 12 12 12 9 5 9 9 4 4 10 years 10% 18 14 12 9 8 7 6 5 6 7 8 9 10 11 Total 6 6 4 100% 100% 100% 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts