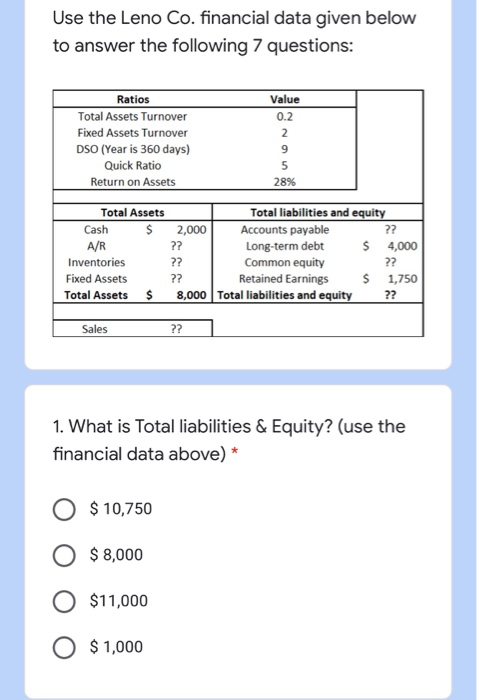

Question: Use the Leno Co. financial data given below to answer the following 7 questions: Value Ratios Total Assets Turnover Fixed Assets Turnover DSO (Year is

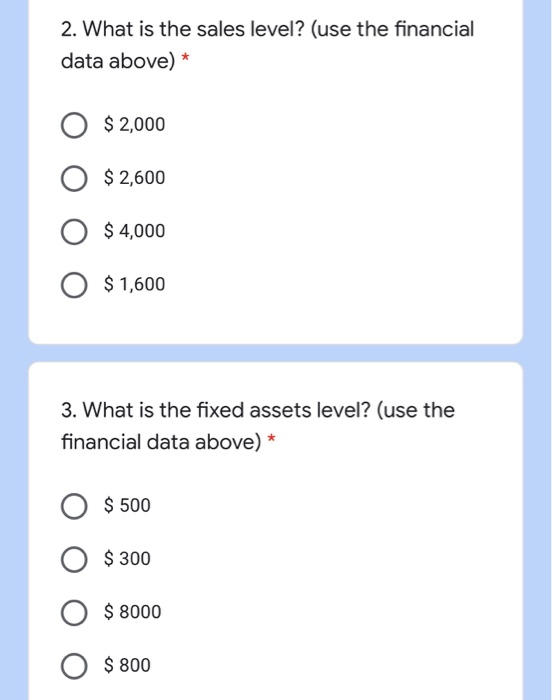

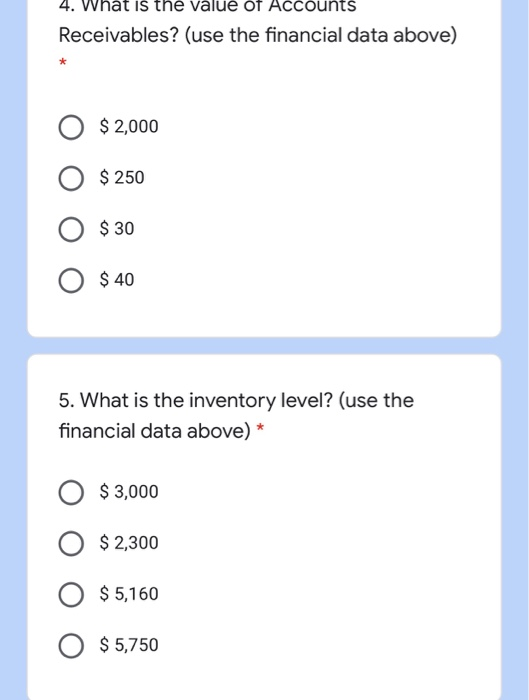

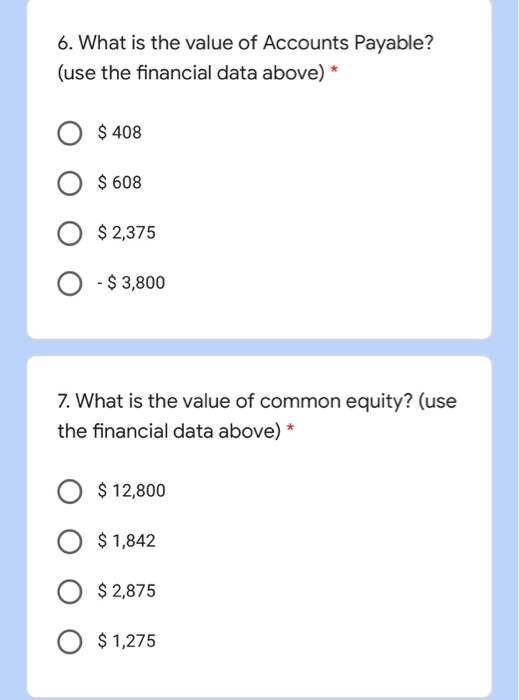

Use the Leno Co. financial data given below to answer the following 7 questions: Value Ratios Total Assets Turnover Fixed Assets Turnover DSO (Year is 360 days) Quick Ratio Return on Assets 28% Cash Total Assets $ A/R Inventories Fixed Assets Total Assets $ 2,000 ?? ?? ?? 8,000 Total liabilities and equity Accounts payable ?? Long-term debt $ 4,000 Common equity Retained Earnings $ 1,750 Total liabilities and equity ?? Sales ?? 1. What is Total liabilities & Equity? (use the financial data above) * O $ 10,750 O $ 8,000 O O $11,000 $1,000 2. What is the sales level? (use the financial data above) * O $ 2,000 O $ 2,600 $ 4,000 O $ 1,600 3. What is the fixed assets level? (use the financial data above) * O $ 500 O $ 300 $ 8000 O $ 800 4. vnat is tne value of Accounts Receivables? (use the financial data above) O $ 2,000 O $ 250 O $ 30 O $40 O O 5. What is the inventory level? (use the financial data above) * O $3,000 O $ 2,300 O $5,160 $ 5,750 O 6. What is the value of Accounts Payable? (use the financial data above) * O $ 408 O $ 608 O $ 2,375 O -$ 3,800 7. What is the value of common equity? (use the financial data above) * O $ 12,800 O $ 1,842 O $ 2,875 O $ 1,275

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts