Question: Use the link below as a reference but use the numbers in the attached image instead of the numbers in the link. Revenue and cash

Use the link below as a reference but use the numbers in the attached image instead of the numbers in the link.

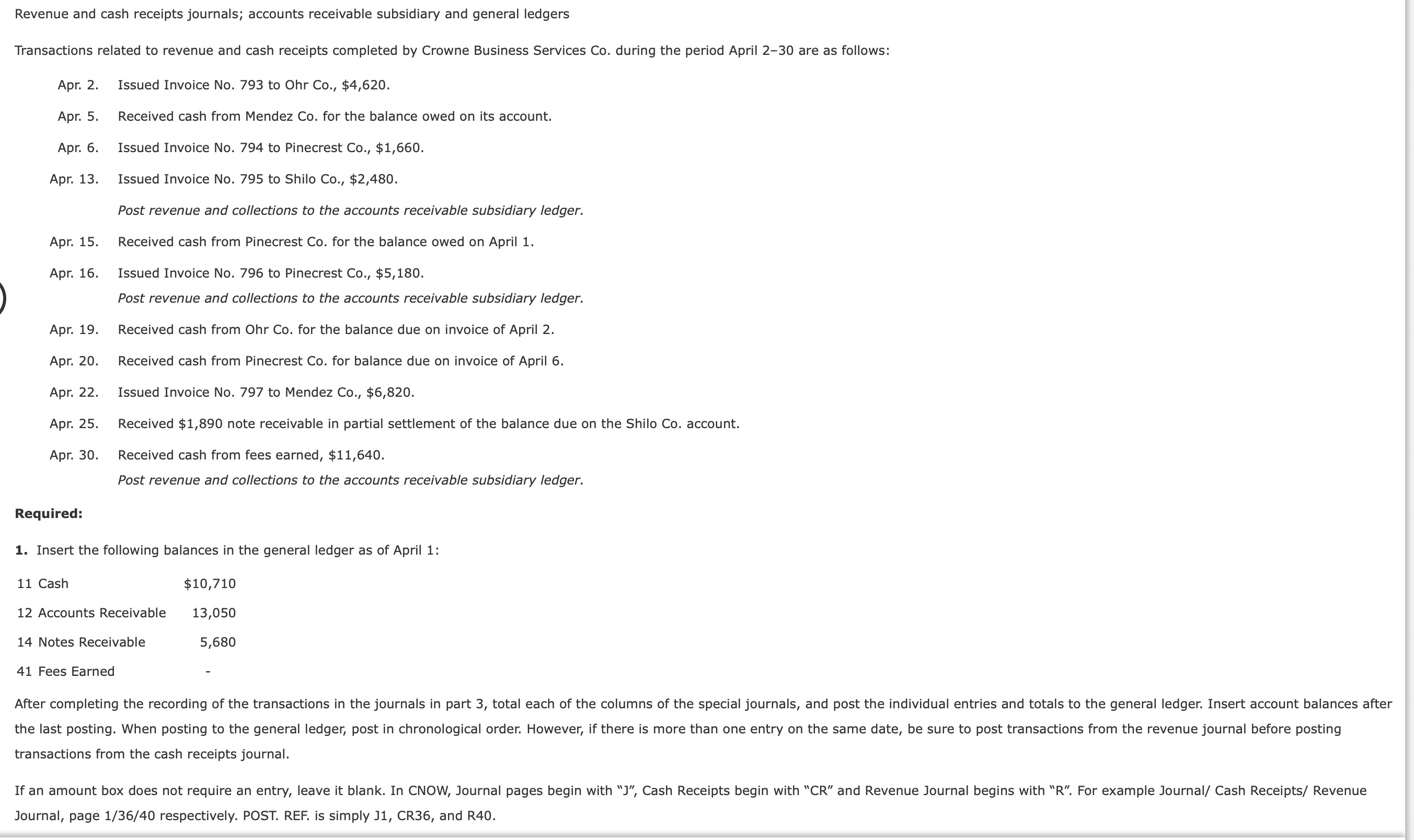

Revenue and cash receipts journals; accounts receivable subsidiary and general ledgers Transactions related to revenue and cash receipts completed by Crowne Business Services Co. during the period April 230 are as follows: Apr. 2. Issued Invoice No. 793 to 0hr Co., $4,620. Apr. 5. Received cash from Mendez Co. for the balance owed on its account. Apr. 6. Issued Involce No. 794 to Plnecrest Co., $1,660. Apr. 13. Issued Invoice No. 795 to Shilo Co., $2,480. Post revenue and collections to the accounts receivable subsidiary ledger. Apr. 15. Received cash from Plnecrest Co. for the balance owed on April 1. Apr. 16. Issued Invoice No. 796 to Plnecrest Co., $5,180. Post revenue and collections to the accounts receivable subsidiary ledger. Apr. 19. Received cash from 0hr Co. for the balance due on invoice of April 2. Apr. 20. Received cash from Plnecrest Co. for balance due on Involce of April 6. Apr. 22. Issued Invoice No. 797 to Mendez 0)., $6,820. Apr. 25. Received $1,890 note receivable in partial settlement of the balance due on the Shilo Co. account. Apr. 30. Received cash from fees earned, $11,640. Post revenue and collect/ans to the accounts receivable subs/diary ledger. Requ ired: 1. Insert the following balances in the general ledger as of April 1: 11 Cash $10,710 12 Accounts Receivable 13,050 14 Notes Receivable 5,680 41 Fees Earned - After completing the recording of the transactions in the journals in part 3, total each of the columns of the special journals, and post the individual entries and totals to the general ledger. Insert account balances alter the last posting. When posting to the general ledger, post in chronological order. However, if there is more than one entry on the same date, be sure to post transactions from the revenue journal before posting transactions from the cash receipts journal. If an amount box does not require an entry, leave it blank. In CNOW, Journal pages begin with \"J", Cash Receipts begin with \"CR" and Revenue Journal begins with \"R\". For example Journal/ Cash Receipts/ Revenue Journal, page 1/36/40 respectively. POST. REF. is simply J1, CR36, and R40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts