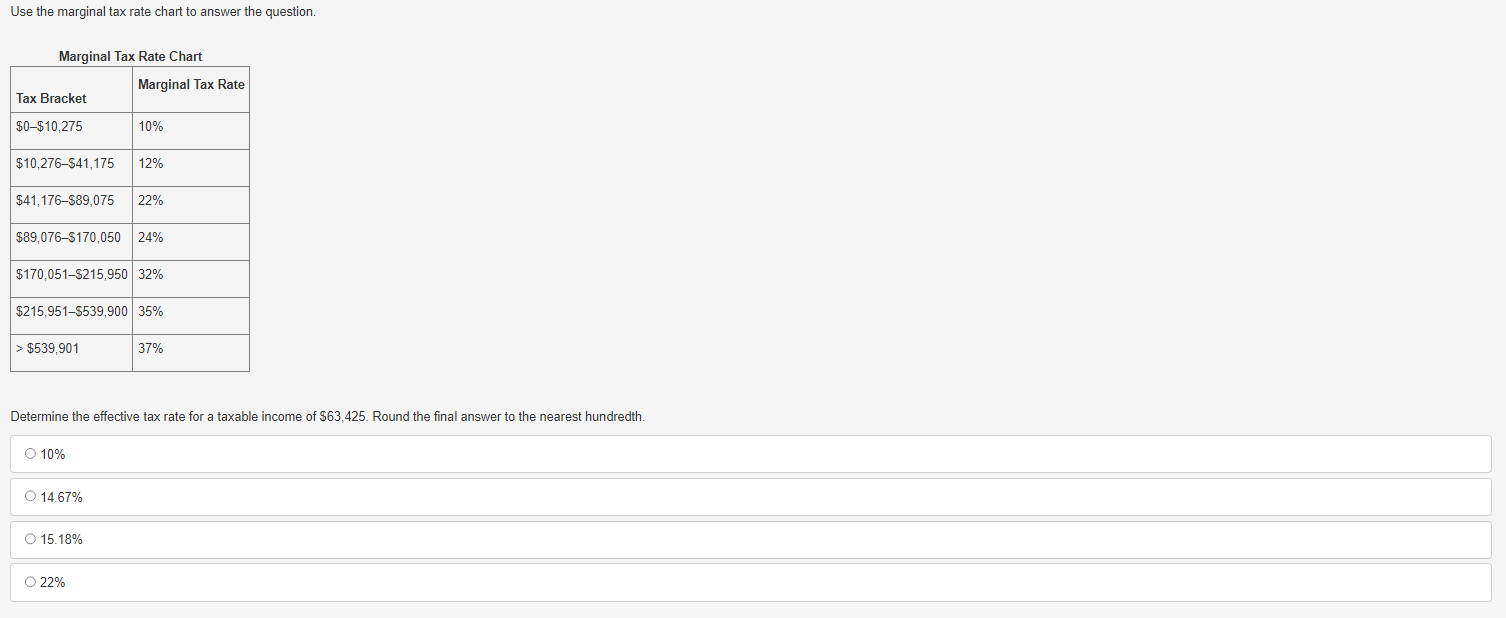

Question: Use the marginal tax rate chart to answer the question. Marginal Tax Rate Chart Marginal Tax Rate Tax Bracket $0-$10,275 10% $10,276-$41,175 12% $41,176-$89,075 22%

Use the marginal tax rate chart to answer the question. Marginal Tax Rate Chart Marginal Tax Rate Tax Bracket $0-$10,275 10% $10,276-$41,175 12% $41,176-$89,075 22% $89,076-$170,050 24% $170,051-$215,950 32% $215,951-$539,900 35% > $539,901 37% Determine the effective tax rate for a taxable income of $63,425. Round the final answer to the nearest hundredth. O 10% O 14.67% O 15.18% O 22%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock