Question: Use the NPV method to determine whether Root Products should invest in the following projects: . Project A costs $285,000 and offers seven annual

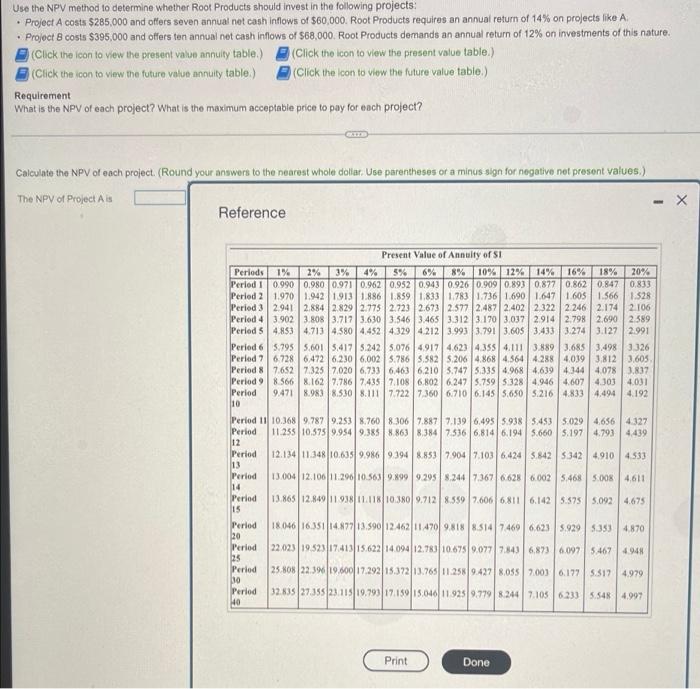

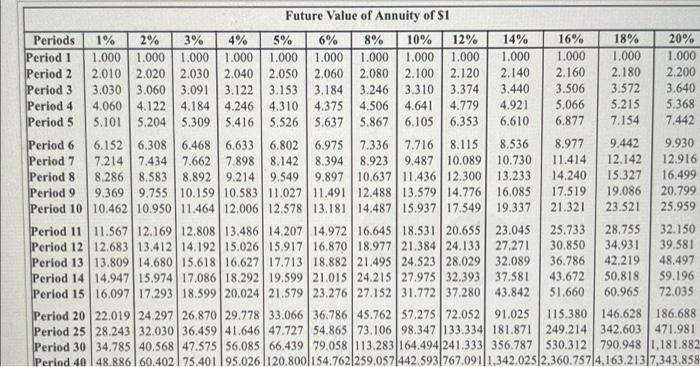

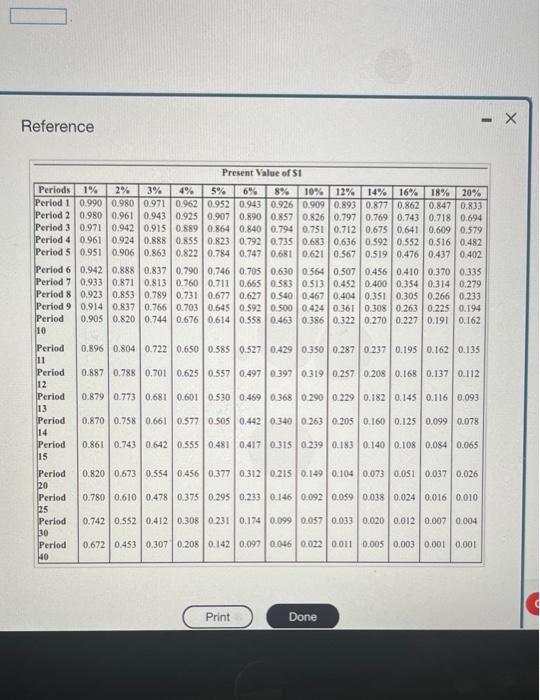

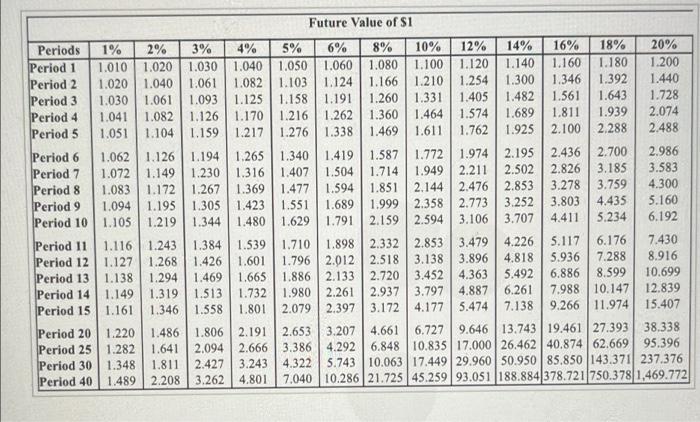

Use the NPV method to determine whether Root Products should invest in the following projects: . Project A costs $285,000 and offers seven annual net cash inflows of $60,000. Root Products requires an annual return of 14% on projects like A Project B costs $395,000 and offers ten annual net cash inflows of $68,000. Root Products demands an annual return of 12% on investments of this nature. (Click the icon to view the present value annuity table.) (Click the icon to view the future value annuity table.) Requirement (Click the icon to view the present value table.) (Click the icon to view the future value table.) What is the NPV of each project? What is the maximum acceptable price to pay for each project? Calculate the NPV of each project. (Round your answers to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) The NPV of Project A is Reference Present Value of Annuity of $1. 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% Periods 1% Period 1 0.990 Period 2 1.970 Period 3 2.941 Period 4 3.902 Period 5 4.853 Period 6 5.795 5.601 5.417 5.242 5.076 4.917 4.623 4.355 4.111 3.889 3.685 3.498 3.3261 Period 7 6.728 6.472 6.230 6.002 5.786 5.582 5.206 4.868 4.564 4.288 4.039 3.812 3.605, Period 8 7.652 7.325 7.020 6.733 6.463 6.210 5.747 5.335 4.968 4.639 4.344 4.078 3.837 Period 9 8.566 8.162 7.786 7.435 7.108 6.802 6.247 5.759 5.328 4.946 4.607 4.303 4.031 Period 9.471 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.650 5.216 4.833 4.494 4.192 10 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 1.942 1913 1.886 1.859 1.833 1.783 1.736 1.690 1.647 1.605 1.566 1.528 2.884 2.829 2.775 2.723 2.673 2.577 2.487 2.402 2.322 2.246 2.174 2.106 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 2.798 2.690 2.589 4.713 4.580 4.452 4.329 4.212 3.993 3.791 3.605 3.433 3.274 3.127 2.991 Period 11 10.368 9.787 9.253 8.760 8.306 7.887 7.139 6.495 5.938 5.453 5.029 4.656 4.327 Period 11.255 10.575 9.954 9.385 8.863 8.384 7.536 6.814 6.194 5.660 5.197 4.793 4.439) 12 Period 13 Period 14 12.134 11.348 10.635 9.986 9.394 8.853 7.904 7.103 6.424 5.842 5.342 4.910 4.533 13.004 12.106 11.296 10.563 9.899 9.295 8.244 7.367 6.628 6.002 5.468 5.008 4,611 Period 13.865 12.849 11.938 11.118 10.380 9.712 8.559 7.606 6.811 6.142 5.575 5.092 4.675 15 Period 18.046 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7.469 6.623 5.929 5.353 4.870 20 Period 25 22.023 19.523 17.413 15.622 14.094 12.783 10.675 9.077 7.843 6.873 6.097 5.467 4.948) Period 25.808 22.396 19.600 17.292 15.372 13.765 11.258 9.427 8.055 7.003 6.177 5.517 4.979 30 Period 401 32.835 27.355 23.115 19.793 17.159 15.046 11.925 9.779 8.244 7.105 6.233 5.548 4.997 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts