Question: Use the NPV method to determine whether Rouse Products should invest in the following projects? - Project A: Costs $295,000 and offers seven annual net

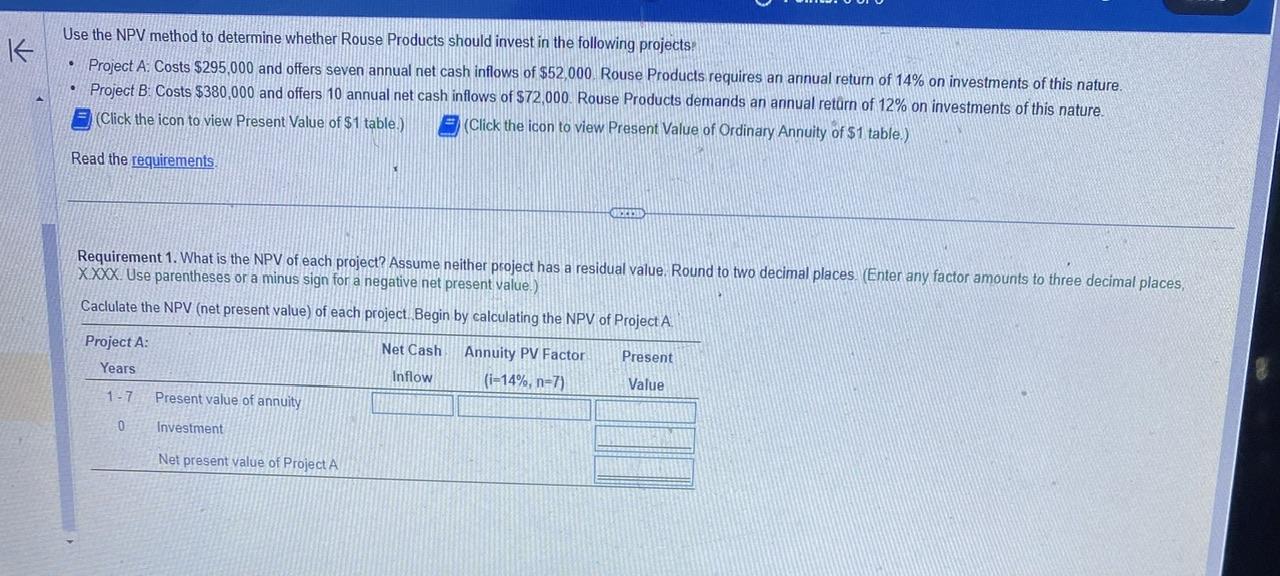

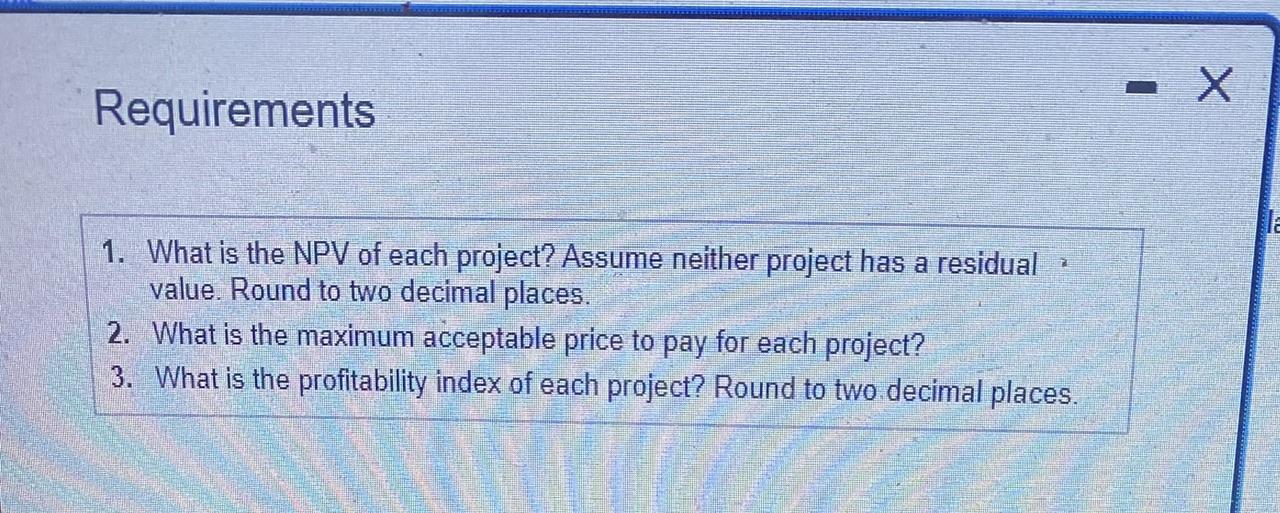

Use the NPV method to determine whether Rouse Products should invest in the following projects? - Project A: Costs $295,000 and offers seven annual net cash inflows of $52,000. Rouse Products requires an annual return of 14% on investments of this nature. - Project B: Costs $380,000 and offers 10 annual net cash inflows of $72,000. Rouse Products demands an annual return of 12% on investments of this nature. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of \$1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, XXXX. Use parentheses or a minus sign for a negative net present value.) Requirements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts