Question: Use the NPV method to determine whether Stenback Products should invest in the following projects Project A costs $285000 and offers seven annual net cash

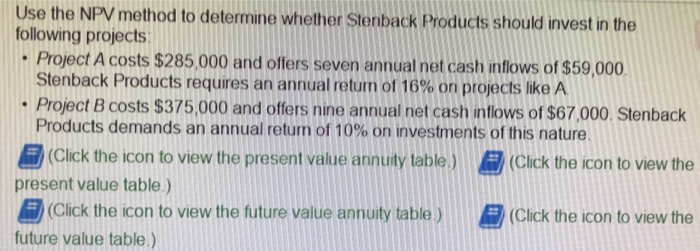

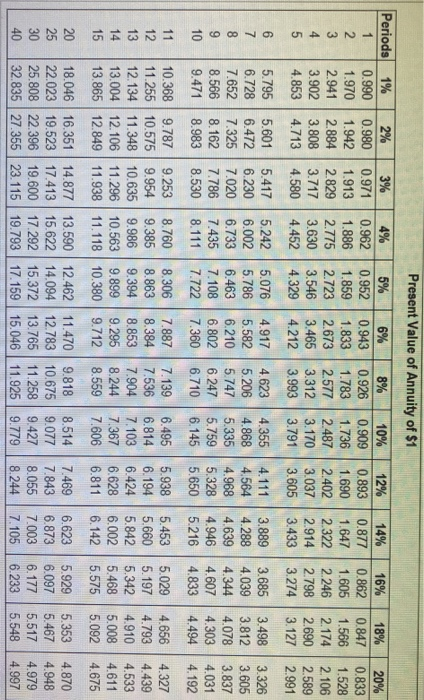

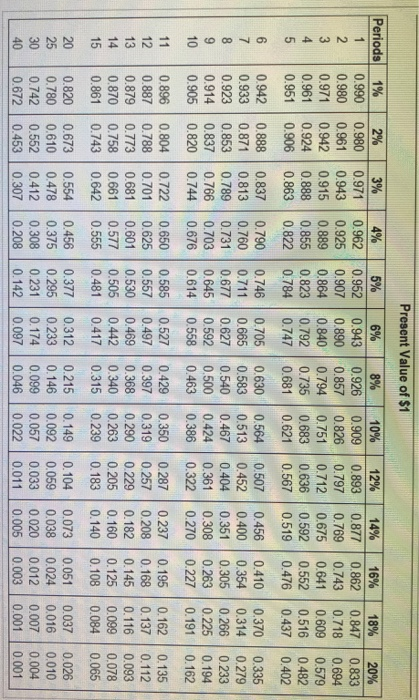

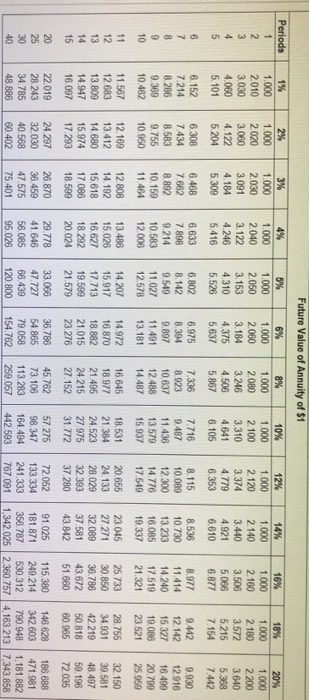

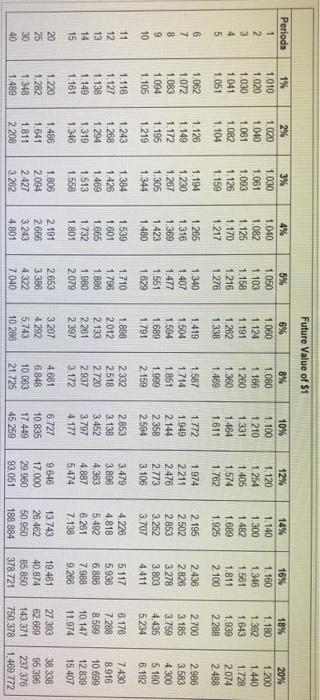

Use the NPV method to determine whether Stenback Products should invest in the following projects Project A costs $285000 and offers seven annual net cash inflows of $59,000 Stenback Products requires an annual return of 16% on projects like A . Project B costs $375,000 and offers nine annual net cash inflows of $67,000. Stenback Products demands an annual return of 10% on investments of this nature (Click the icon to view the present value annuity table(Cick the icon to view the present value table) (Cick the icon to view the future vaiue annuty table)(Cick the icon to view the future value table.) Now calculate the maximum acceptable price to pay for each project (Round your answers to the nearest whole dollar.) Project A is S 801 34566 899 01222 33344 44444 4444 778 1 48034 3 33444 44455 5555 2 0 345 10122 6% 002 005 zab 198 24 ess 009 194 007 egg 009 197 012 400 $15 900 007 17 10122 3 34444 55555 5666 966 3 63 94 21 568 00 14 28 00 10 394 101223 34445 55566 6677 2% ses sso 400 007 005 275 111 004 998 22 $50 0 SOB 194 400 84 05 24 84481 935 $25 011 101233 44455 56666 7788 96701 71 481 of 1 01233 44556 66777 8999 770 9 441 727 I 9753 01233 45566 77788 9 2 7202 747 76 04 01234 45667 78899 1235 283 ese | 5%-997 ese rza 56 29 07 6 6 10 22 006 ses 194 199 360 ASL 004 012 199 7417 2 5 01234 56678 89901 3579 11 29 17 80 10 20 86 01234 56778 99111 479 9 8461 39-9987 0 3 3533 01234 56788 9 10 11 12 11 22 27 012 0 1 2 3 4 5 6. 7. 89 10 1 2 3 1 18 22 25 32 0-2345 0500 12345 6789 2 593 5238 00000 0, 0 0 0 0 00000 00 7 7671 3 100000 00000 00000 0000 6%-86 43 64 55 47 41 ASA 005 ass 27 195 160 45 125 08 ost 004 012 003 4%-87 700 75 sse 51 $50 400 201 998 210 201 200 102 160 140 73 38 20 005 2% ses ese 56 50 45 004 201 102 201 201 220 201 193 104 ose O3 011 1-009 eas 750 ses ezi 004 13 67 24 360 360 013 250 003 200 140 002 007 002 8%-$25 8 7 35 001 30 83 Sad 500 63 120 997 998 140 15 15 140 000 04 23126 0 100000 00000 00000 0000 529 111 000 2 7 433 027 5 77927 2347 es 00000 00000 00000 0000 27428 61744 95 90 8 8 8 47666 002 $25-82 750 160 750 103 ers sso eas 001 57 ess $50 $15 SOB 200 1358 63 739 66 44 22 0 8 6 2 54 8 2 7 2 5443 124 72 1%-990 990 97 001 95 94 egg $25 014 005 96 997 ers ero 001 220 750 776 8 0 12345

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts