Question: Use the NPV method to determine whether Stenback Products should invest in the following projects: Project A: Costs $260,000 and offers seven annual net cash

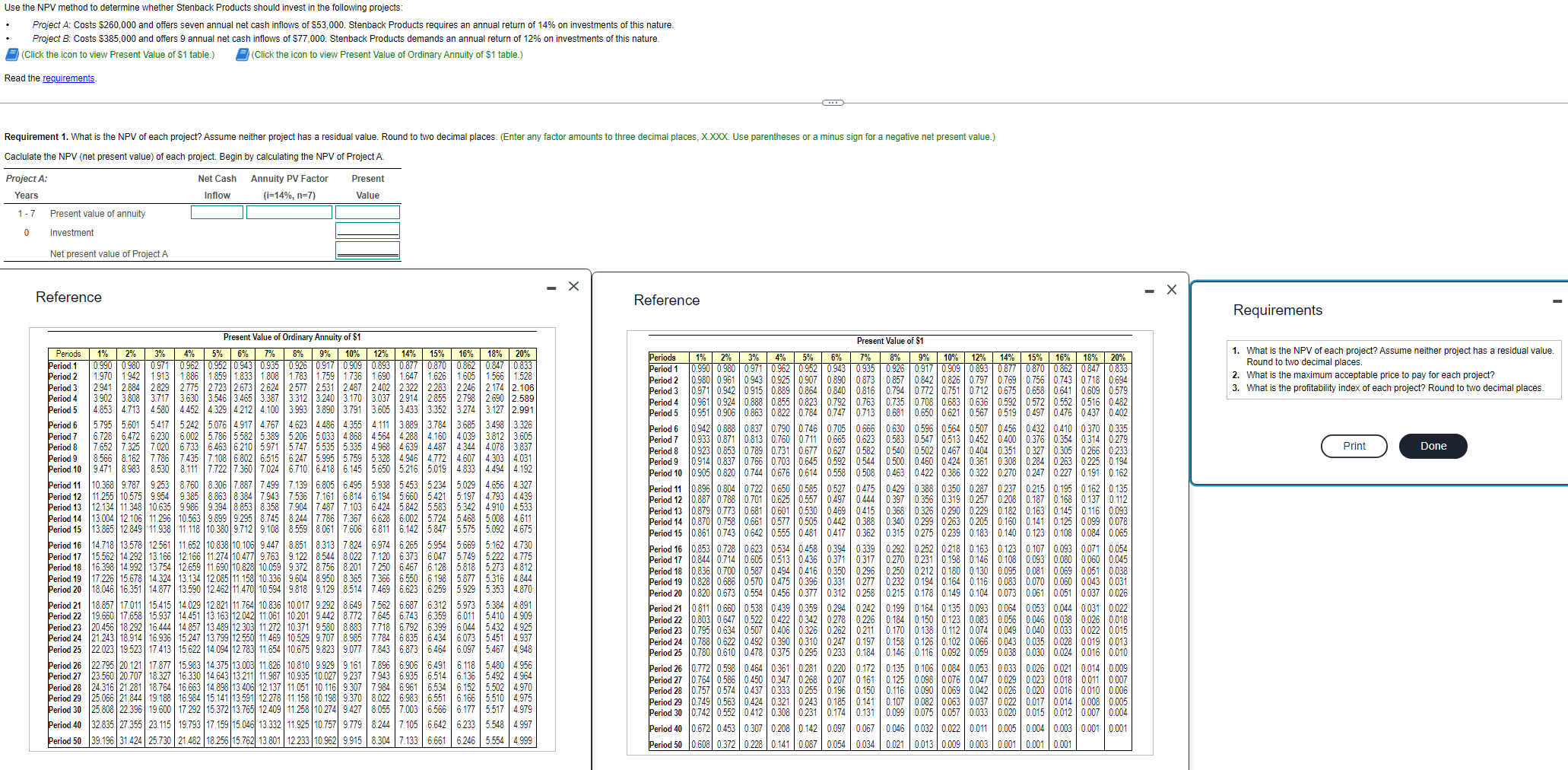

Use the NPV method to determine whether Stenback Products should invest in the following projects: Project A: Costs $260,000 and offers seven annual net cash inflows of $53,000. Stenback Products requires an annual return of 14% on investments of this nature Project B: Costs $385,000 and offers 9 annual net cash inflows of $77,000. Stenback Products demands an annual return of 12% on investments of this nature \# (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Reference Reference R.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts