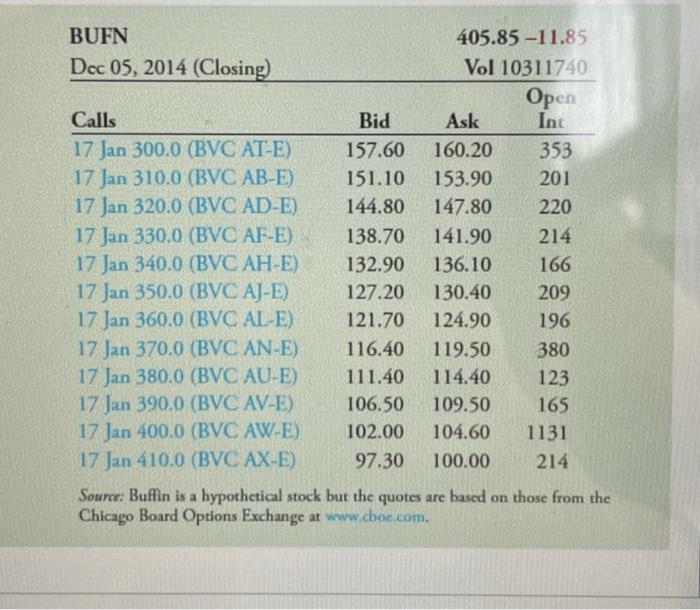

Question: Use the option data from the table to determine the rate Buffin would have paid if it had issued $101.98 billion in zero-coupon debt due

Use the option data from the table to determine the rate Buffin would have paid if it had issued $101.98 billion in zero-coupon debt due in January 2017. Suppose Buffin currently had 299.95 million shares outstanding, implying a market value of $121.73

billion. The current two-year risk-free rate is 4.50%.

The yield on the Buffin debt is %.

BUFN 405.85 -11.85 Dec 05, 2014 (Closing) Vol 10311740 Open Calls Bid Ask Int 17 Jan 300.0 (BVC AT-E) 157.60 160.20 353 17 Jan 310.0 (BVC AB-E) 151.10 153.90 201 17 Jan 320.0 (BVC AD-E) 144.80 147.80 220 17 Jan 330.0 (BVC AF-E) 138.70 141.90 214 17 Jan 340.0 (BVC AH-E) 132.90 136.10 166 17 Jan 350.0 (BVC AJ-E) 127.20 130.40 209 17 Jan 360.0 (BVC AL-E) 121.70 124.90 196 17 Jan 370.0 (BVC AN-E) 116.40 119.50 380 17 Jan 380.0 (BVC AU-E) 111.40 114.40 123 17 Jan 390.0 (BVC AV-E) 106.50 109.50 165 17 Jan 400.0 (BVC AW-E) 102.00 104.60 1131 17 Jan 410.0 (BVC AX-E) 97.30 100.00 214 Source: Buffin is a hypothetical stock but the quotes are based on those from the Chicago Board Options Exchange at www.coe.com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts