Question: Use the percentage method of withholding, a FICA rate of 6.2%, a Medicare rate of 1.45%, an SDI rate of 1%, and a state

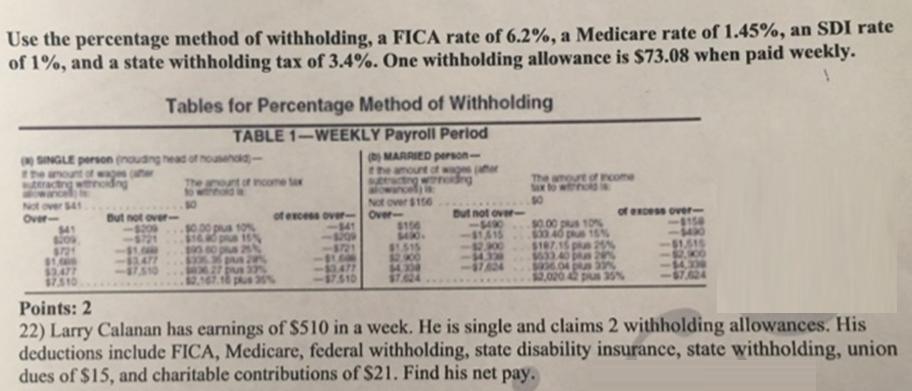

Use the percentage method of withholding, a FICA rate of 6.2%, a Medicare rate of 1.45%, an SDI rate of 1%, and a state withholding tax of 3.4%. One withholding allowance is $73.08 when paid weekly. Tables for Percentage Method of Withholding TABLE 1-WEEKLY Payroll Period SINGLE person (nouding head of nousend- The anount of wages er MARRIED person- the anourt of wages er sutracting wrodng alowancel) i Not over $156 The anount ot ncome tax to withhold i The amourt o Pcome Sx to wnok N Not over S41 of excess over- -1154 of excess over-Over- Dut not over- Over- $41 But not over 4209 -$721 $0.00 pus 10% 30 40 plus 1SS $107.15 pu 2s 33.40 p 2n L04 plus 3 1,00042plus 35% $106 10% 16.80 prua 15 20% -141 125- -$0.477 $7.510 $1.515 $2.00 $4.304 $7.624 41415 42.300 -$43 $1.515 $2.900 $4.300 -67.024 $3.477 plus 20% Points: 2 22) Larry Calanan has earnings of $510 in a week. He is single and claims 2 withholding allowances. His deductions include FICA, Medicare, federal withholding, state disability insurance, state withholding, union dues of $15, and charitable contributions of $21. Find his net pay.

Step by Step Solution

3.42 Rating (174 Votes )

There are 3 Steps involved in it

An8 Given that use the perscentage Nethod of witholdinq a FICA rate o... View full answer

Get step-by-step solutions from verified subject matter experts