Question: Use the present value tables in Arpendix A and Appendix B to compute the NPV of each of the following cash inflows: Required: a. $105,000

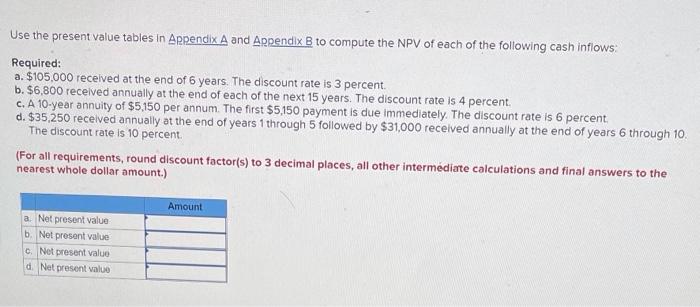

Use the present value tables in Arpendix A and Appendix B to compute the NPV of each of the following cash inflows: Required: a. $105,000 received at the end of 6 years. The discount rate is 3 percent b. $6,800 received annually at the end of each of the next 15 years. The discount rate is 4 percent. c. A 10-year annuity of $5,150 per annum. The first $5,150 payment is due immediately. The discount rate is 6 percent d. $35,250 received annually at the end of years 1 through 5 followed by $31,000 received annually at the end of years 6 through 10. The discount rate is 10 percent. (For all requirements, round discount factor(s) to 3 decimal places, all other intermediate calculations and final answers to the nearest whole dollar amount.) Amount a. Net present value b. Net present value 0 Not present value d. Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts