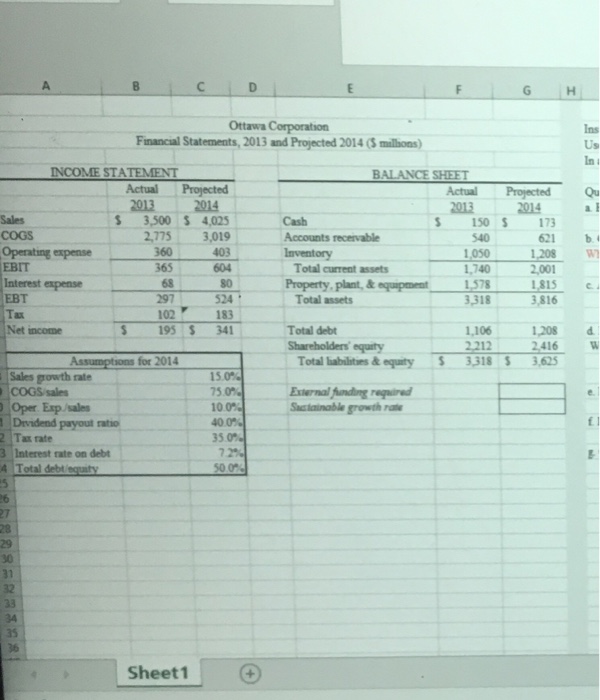

Question: Use the pro forma financial statements to answer the questions below. Change the assumptions in the assumptions box as needed to answer the questions. In

Ottawa Corporation Financial Statements, 2013 and Projected 2014 ( millions) INCOME STATEMENT Actual Projected S 3,500 S 4,025 2,775 3,019 Actual ProjectedQu 2013 2914a 2013 2014 150 S 173 Cas Accounts receivable 621 b 1208 w 403 1,050 EBIT Interest expense EBT Tax Net income Total current assets 740 3318 3,816 1,106 2,001 Property, plant, &equipment 1578 1815 297524Total assets 102 Total deb Shareholders equity S 195 34 1208 d 2212 416 Total babilities&equity 3,318 3,625 for 2014 15.09 Sales gowth rate COGS/sales Oper Exp/sales Drvidend payout ratio Saciainable growth rae 400% 2 Tax rate 3 Interest rate on debt 50 0 Sheet1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts