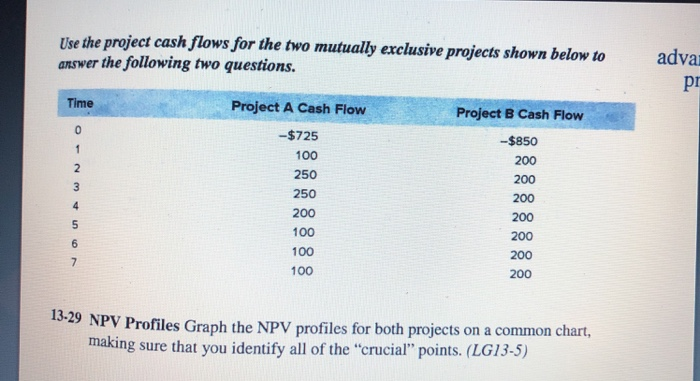

Question: Use the project cash flows for the two mutually exclusive projects shown below to answer the following two questions. adva Time Project A Cash Flow

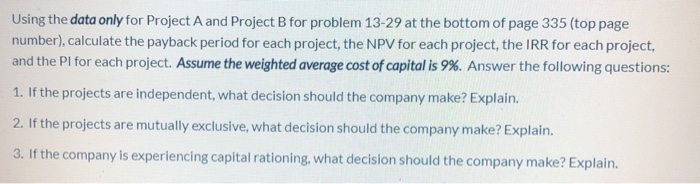

Use the project cash flows for the two mutually exclusive projects shown below to answer the following two questions. adva Time Project A Cash Flow -$725 100 Project B Cash Flow -$850 200 200 13-29 NPV Profiles Graph the NPV profiles for both projects on a common chart, making sure that you identify all of the "crucial" points. (LG13-5) Using the data only for Project A and Project B for problem 13-29 at the bottom of page 335 (top page number), calculate the payback period for each project, the NPV for each project, the IRR for each project, and the PI for each project. Assume the weighted average cost of capital is 9%. Answer the following questions: 1. If the projects are independent, what decision should the company make? Explain. 2. If the projects are mutually exclusive, what decision should the company make? Explain. 3. If the company is experiencing capital rationing, what decision should the company make? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts