Question: Use the provided Financial Data (Excel file) for Coke and Pepsi to complete the following analysis: 1. Calculate the current ratio and quick ratio for

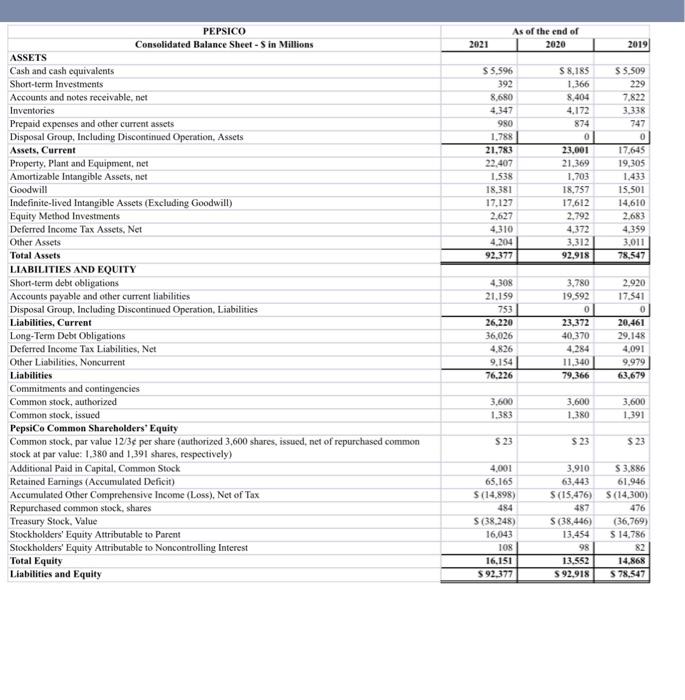

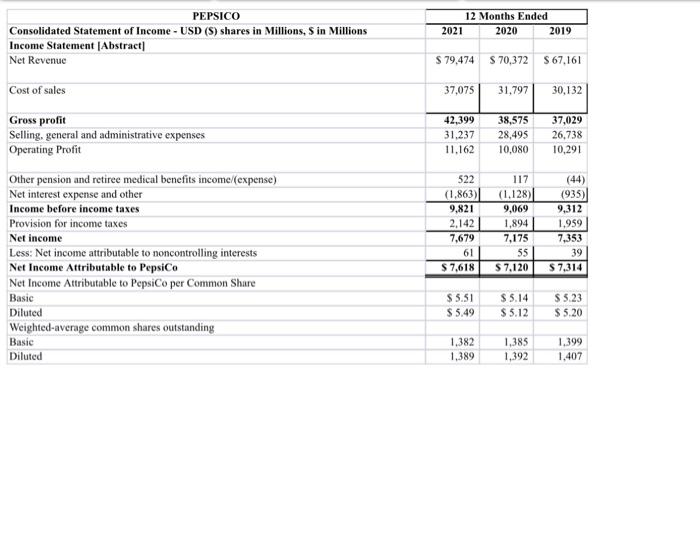

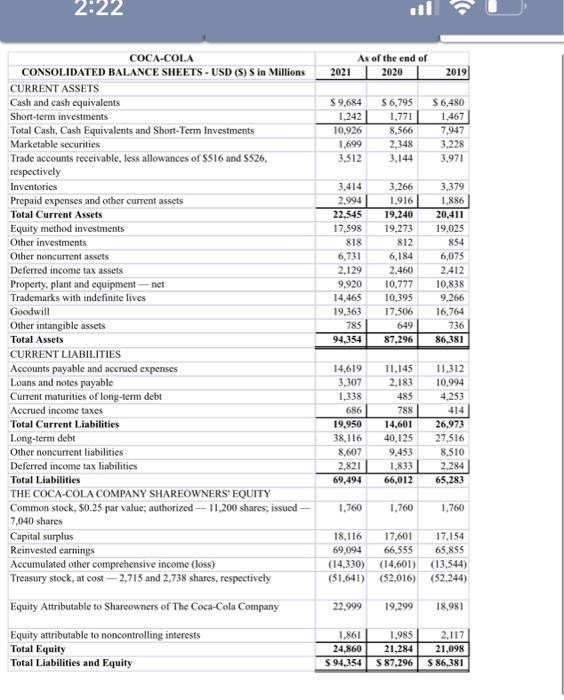

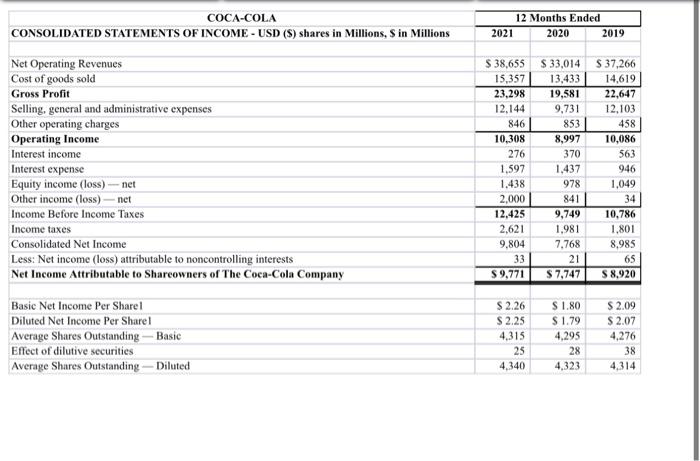

\begin{tabular}{|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{c} PEPSICO \\ Conselidated Balance Sheet $ in Millions \end{tabular}} & \multicolumn{3}{|c|}{ As of the end of } \\ \hline & 2021 & 2020 & 2019 \\ \hline \multicolumn{4}{|l|}{ ASSETS } \\ \hline Cash and cash equivalents & $5,596 & $8,185 & $5,509 \\ \hline Short-term lnvestments & 392 & 1,366 & 229 \\ \hline Accounts and notes receivable, net & 8,690 & 8,404 & 7,822 \\ \hline Inventories & 4,347 & 4,172 & 3,338 \\ \hline Prepaid expenses and other current assets & 980 & 874 & 747 \\ \hline Disposal Group, Including Discontinued Operation, Assets & 1,788 & 0 & 0 \\ \hline Assets, Current & 21,783 & 23,001 & 17,645 \\ \hline Property, Plant and Equipment, net & 22,407 & 21,369 & 19,305 \\ \hline Amortizable Intangible Assets, net & 1,538 & 1,703 & 1.433 \\ \hline Goodwill & 18,381 & 18,757 & 15,501 \\ \hline Indefinite-lived Intangible Assets (Excluding Goodwill) & 17,127 & 17,612 & 14,610 \\ \hline Equity Method Investments & 2,627 & 2.792 & 2,683 \\ \hline Deferred Income Tax Assets, Net & 4,310 & 4,372 & 4,359 \\ \hline Other Assets & 4,204 & 3,312 & 3.011 \\ \hline Total Assets & 92,377 & 92,918 & 78,547 \\ \hline \multicolumn{4}{|l|}{ LIABILITIES AND EQUITY } \\ \hline Short-term debt obligations & 4,308 & 3,780 & 2,920 \\ \hline Accounts payable and other current liabilities & 21.159 & 19,592 & 17.541 \\ \hline Disposal Group, Including Discontinued Operation, Liabilities & 753 & 0 & 0 \\ \hline Liabilities, Current & 26,220 & 23,372 & 20.461 \\ \hline Long-Term Debs Obligations & 36,026 & 40,370 & 29.148 \\ \hline Deferred Income Tax Liabilities, Net & 4,826 & 4,284 & 4,091 \\ \hline Other Liabilities. Noncurrent & 9.154 & 11,340 & 9,979 \\ \hline Liabilities & 76.226 & 79.366 & 63,679 \\ \hline \multicolumn{4}{|l|}{ Commitments and contingencies } \\ \hline Common stock, authorized & 3,600 & 3,600 & 3,600 \\ \hline Common stock, issued & 1.383 & 1,380 & 1,391 \\ \hline \multicolumn{4}{|l|}{ PepsiCo Common Shareholders' Equity } \\ \hline \begin{tabular}{l} Common stock, par value 12/3 e per share (authorized 3,600 shares, issued, net of repurchased common \\ stock at par value: 1,380 and 1,391 shares, respectively) \end{tabular} & $23 & $23 & $23 \\ \hline Additional Paid in Capital. Common Stock & 4,001 & 3,910 & $3,886 \\ \hline Retained Earnings (Accumulated Deficit) & 65,165 & 63,443 & 61,946 \\ \hline Accumulated Other Comprehensive Income (Loss). Net of Tax & 5(14,898) & $(15,476) & $(14,300) \\ \hline Repurchased common stock, shares & 484 & 487 & 476 \\ \hline Treasury Stock, Value & $(38.248) & 5(38,446) & (36,769) \\ \hline Stockholders' Equity Attributable to Parent & 16.043 & 13.454 & $14,786 \\ \hline Stockholders' Equity Attributable to Noncontrolling Interest & 108 & 98 & 82 \\ \hline Total Equity & 16,151 & 13,552 & 14,868 \\ \hline Liabilities and Equity & $92,377 & 592,918 & 578,547 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline COCA-COLA & & of the end & \\ \hline CONSOLIDATED BALANCE SHEETS - USD (S) S in Millions & 2021 & 2020 & 2019 \\ \hline CURRENT ASSETS & & & \\ \hline Cash and cash equivalents & $9,684 & $6,795 & $6,480 \\ \hline Short-term investments & 1,242 & 1,771 & 1,467 \\ \hline Total Cash, Cash Equivalents and Short-Term Investments & 10,926 & 8,566 & 7,947 \\ \hline Marketable securities & 1,699 & 2,348 & 3,228 \\ \hline \begin{tabular}{l} Trade accounts receivable, less allowances of \$\$16 and \$526, \\ respectively \end{tabular} & 3,512 & 3,144 & 3,971 \\ \hline Inventories & 3,414 & 3,266 & 3,379 \\ \hline Prepaid expenses and other current assets & 2,994 & 1,916 & 1,886 \\ \hline Total Current Assets & 22,545 & 19,240 & 20,411 \\ \hline Equity method investments & 17,598 & 19,273 & 19,025 \\ \hline Other investments & 818 & 812 & 854 \\ \hline Other noncurrent assets & 6,731 & 6,184 & 6,075 \\ \hline Deferred income tax assets & 2,129 & 2,460 & 2,412 \\ \hline Property, plant and equipment - net & 9,920 & 10,777 & 10,838 \\ \hline Trademarks with indefinite lives & 14,465 & 10,395 & 9,266 \\ \hline Goodwill & 19,363 & 17,506 & 16,764 \\ \hline Other intangible assets & 785 & 649 & 736 \\ \hline Total Assets & 94,354 & 87,296 & 86,381 \\ \hline CURRENT LIABILITIES & & & \\ \hline Accounts payable and accrued expenses & 14,619 & 11,145 & 11,312 \\ \hline Loans and notes payable & 3,307 & 2,183 & 10,994 \\ \hline Current maturities of long-term debt & 1,338 & 485 & 4,253 \\ \hline Accrued income taxes & 686 & 788 & 414 \\ \hline Total Current Liabilities & 19,950 & 14,601 & 26,973 \\ \hline Long-term debt & 38,116 & 40,125 & 27,516 \\ \hline Other noncurrent liabilities & 8,607 & 9,453 & 8.510 \\ \hline Deferred income tax liabilities & 2,821 & 1.833 & 2,284 \\ \hline Total Liabilities & 69,494 & 66,012 & 65,283 \\ \hline THE COCA-COLA COMPANY SHAREOWNERS' EQUITY & & & \\ \hline \begin{tabular}{l} Common stock, $0.25 par value; authorized 11,200 shares; issued - \\ 7,040 shares \end{tabular} & 1,760 & 1,760 & 1,760 \\ \hline Capital surplus & 18,116 & 17,601 & 17,154 \\ \hline Reinvested earnings & 69,094 & 66,555 & 65,855 \\ \hline Accumulated other comprehensive income (loss) & (14,330) & (14,601) & (13,544) \\ \hline Treasury stock, at cost 2,715 and 2,738 shares, respectively & (51,641) & (52,016) & (52,244) \\ \hline Equity Attributable to Shareowners of The Coca-Cola Company & 22,999 & 19,299 & 18,981 \\ \hline Equity attributable to noncontrolling interests & 1,861 & 1,985 & 2,117 \\ \hline Total Equity & 24,860 & 21,284 & 21,098 \\ \hline Total Liabilities and Equity & 594,354 & $87,296 & 586,381 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} COCA-COLA \\ CONSOLIDATED STATEMENTS OF INCOME - USD ( $ ) shares in Millions, $ in Millions \end{tabular}} & \multicolumn{3}{|c|}{12 Months Ended } \\ \hline & 2021 & 2020 & 2019 \\ \hline Net Operating Revenues & $38,655 & $33,014 & $37,266 \\ \hline Cost of goods sold & 15,357 & 13,433 & 14,619 \\ \hline Gross Profit & 23,298 & 19,581 & 22,647 \\ \hline Selling, general and administrative expenses & 12,144 & 9,731 & 12,103 \\ \hline Other operating charges & 846 & 853 & 458 \\ \hline Operating Income & 10,308 & 8,997 & 10,086 \\ \hline Interest income & 276 & 370 & 563 \\ \hline Interest expense & 1,597 & 1,437 & 946 \\ \hline Equity income (loss) - net & 1,438 & 978 & 1,049 \\ \hline Other income (loss) - net & 2,000 & 841 & 34 \\ \hline Income Before Income Taxes & 12,425 & 9,749 & 10,786 \\ \hline Income taxes & 2,621 & 1,981 & 1,801 \\ \hline Consolidated Net Income & 9,804 & 7,768 & 8,985 \\ \hline Less: Net income (loss) attributable to noncontrolling interests & 33 & 21 & 65 \\ \hline Net Income Attributable to Shareowners of The Coca-Cola Company & $9,771 & $7,747 & 58,920 \\ \hline Basic Net Income Per Sharel & $2.26 & $1.80 & $2.09 \\ \hline Diluted Net Income Per Sharel & $2.25 & $1.79 & $2.07 \\ \hline Average Shares Outstanding - Basic & 4,315 & 4,295 & 4,276 \\ \hline Effect of dilutive securities & 25 & 28 & 38 \\ \hline Average Shares Outstanding - Diluted & 4,340 & 4,323 & 4,314 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts