Question: Use the return data for Coca-Cola (KO) to estimate a four-factor (Carhart) pricing model. a. Write down the appropriate four-factor pricing model, i.e., one that

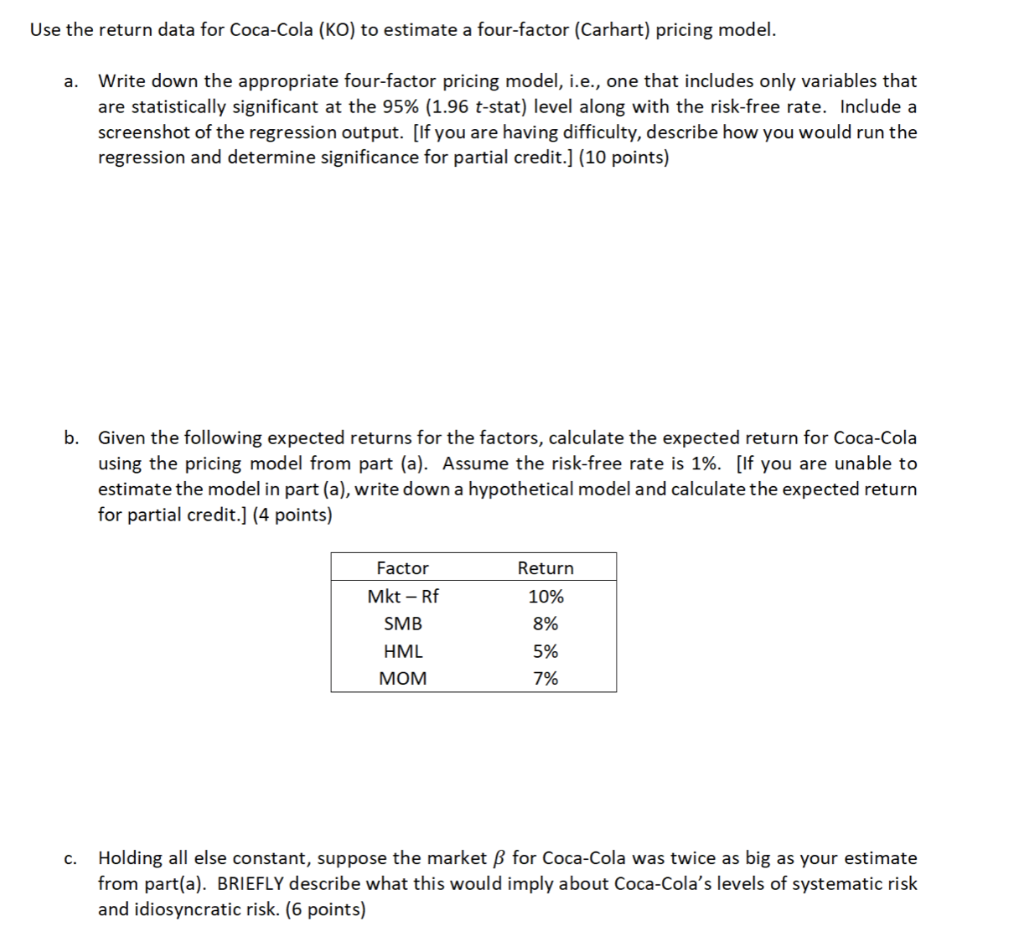

Use the return data for Coca-Cola (KO) to estimate a four-factor (Carhart) pricing model. a. Write down the appropriate four-factor pricing model, i.e., one that includes only variables that are statistically significant at the 95% (1.96 t-stat) level along with the risk-free rate. Include a screenshot of the regression output. [If you are having difficulty, describe how you would run the regression and determine significance for partial credit.) (10 points) b. Given the following expected returns for the factors, calculate the expected return for Coca-Cola using the pricing model from part (a). Assume the risk-free rate is 1%. [If you are to estimate the model in part (a), write down a hypothetical model and calculate the expected return for partial credit.) (4 points) Factor Mkt - Rf SMB HML Return 10% 8% 5% 7% MOM c. Holding all else constant, suppose the market for Coca-Cola was twice as big as your estimate from part(a). BRIEFLY describe what this would imply about Coca-Cola's levels of systematic risk and idiosyncratic risk. (6 points) Use the return data for Coca-Cola (KO) to estimate a four-factor (Carhart) pricing model. a. Write down the appropriate four-factor pricing model, i.e., one that includes only variables that are statistically significant at the 95% (1.96 t-stat) level along with the risk-free rate. Include a screenshot of the regression output. [If you are having difficulty, describe how you would run the regression and determine significance for partial credit.) (10 points) b. Given the following expected returns for the factors, calculate the expected return for Coca-Cola using the pricing model from part (a). Assume the risk-free rate is 1%. [If you are to estimate the model in part (a), write down a hypothetical model and calculate the expected return for partial credit.) (4 points) Factor Mkt - Rf SMB HML Return 10% 8% 5% 7% MOM c. Holding all else constant, suppose the market for Coca-Cola was twice as big as your estimate from part(a). BRIEFLY describe what this would imply about Coca-Cola's levels of systematic risk and idiosyncratic risk. (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts