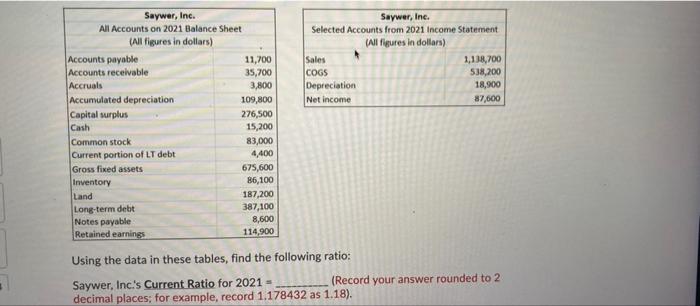

Question: use the same table for all the question Saywer, Inc. Selected Accounts from 2021 Income Statement (All figures in dollars) Sales 1,138,700 COGS 538,200 Depreciation

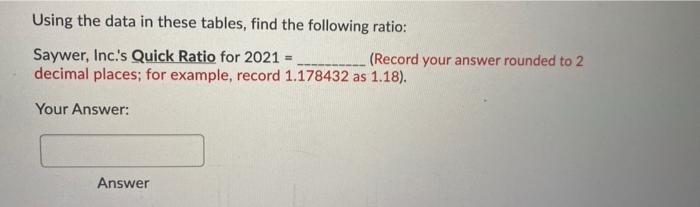

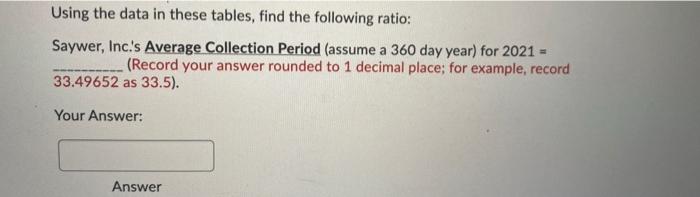

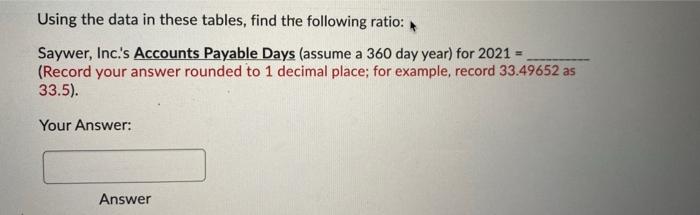

Saywer, Inc. Selected Accounts from 2021 Income Statement (All figures in dollars) Sales 1,138,700 COGS 538,200 Depreciation 18,900 Net income 87,600 Saywer, Inc. All Accounts on 2021 Balance Sheet (All figures in dollars) Accounts payable 11,700 Accounts receivable 35,700 Accruals 3,800 Accumulated depreciation 109,800 Capital surplus 276,500 Cash 15,200 Common stock 83,000 Current portion of LT debt 4,400 Gross fixed assets 675,600 Inventory 86,100 Land 187,200 Long-term debt 387,100 Notes payable 8,600 Retained earnings 114,900 Using the data in these tables, find the following ratio: Saywer, Inc.'s Current Ratio for 2021 - (Record your answer rounded to 2 decimal places; for example, record 1.178432 as 1.18). Using the data in these tables, find the following ratio: Saywer, Inc.'s Quick Ratio for 2021 (Record your answer rounded to 2 decimal places; for example, record 1.178432 as 1.18). Your Answer: Answer Using the data in these tables, find the following ratio: Saywer, Inc.'s Average Collection Period (assume a 360 day year) for 2021 - (Record your answer rounded to 1 decimal place; for example, record 33.49652 as 33.5). Your Answer: Answer Using the data in these tables, find the following ratio: Saywer, Inc.'s Accounts Payable Days (assume a 360 day year) for 2021 = (Record your answer rounded to 1 decimal place; for example, record 33.49652 as 33.5). Your Answer: Answer Using the data in these tables, find the following ratio: Saywer, Inc.'s Inventory Turnover Ratio for 2021 - (Record your answer rounded to 1 decimal place; for example, record 33.49652 as 33.5). Your Answer: Answer Using the data in these tables, find the following ratio: Saywer, Inc.'s Total Asset Turnover Ratio for 2021 (Record your answer rounded to 2 decimal places, for example, record 2.179621 as 2.18). Your Answer: Answer Using the data in these tables, find the following ratio: Saywer, Inc.'s Debt Ratio for 2021 (Record your answer as a percent rounded to 1 decimal place, but do not include the percent sign with your answer: for example, record 0.348956 = 34.8956% as 34.9). Your Answer: Answer Using the data in these tables, find the following ratio: Saywer, Inc.'s Return on Assets for 2021 - (Record your answer as a percent rounded to 1 decimal place, but do not include the percent sign with your answer, for example, record 0.348956 - 34.8956% as 34.9). Your Answer: Answer Using the data in these tables, find the following ratio: Saywer, Inc.s Return on Equity for 2021 = (ecord your answer as a percent rounded to 1 decimal place, but do not include the percent sign with your answer; for example, record 0,348956 = 34.8956% as 34.9). Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts