Question: Use the simple interest formula method to find the future value of an annuity due of $2,800 paid annually after three years at 2.7% annual

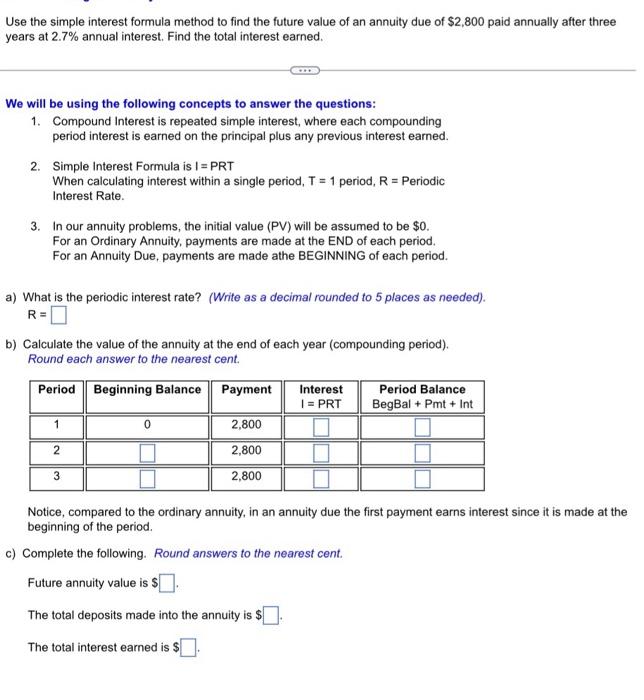

Use the simple interest formula method to find the future value of an annuity due of $2,800 paid annually after three years at 2.7% annual interest. Find the total interest earned. We will be using the following concepts to answer the questions: 1. Compound Interest is repeated simple interest, where each compounding period interest is earned on the principal plus any previous interest earned. 2. Simple Interest Formula is =PRT When calculating interest within a single period, T=1 period, R= Periodic Interest Rate. 3. In our annuity problems, the initial value (PV) will be assumed to be $0. For an Ordinary Annuity, payments are made at the END of each period. For an Annuity Due, payments are made athe BEGINNING of each period. a) What is the periodic interest rate? (Write as a decimal rounded to 5 places as needed). R= b) Calculate the value of the annuity at the end of each year (compounding period). Round each answer to the nearest cent. Notice, compared to the ordinary annuity, in an annuity due the first payment earns interest since it is made at the beginning of the period. c) Complete the following. Round answers to the nearest cent. Future annuity value is $ The total deposits made into the annuity is $ The total interest earned is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts