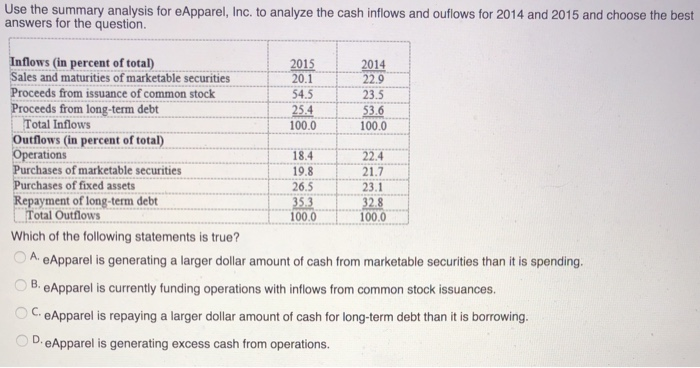

Question: Use the summary analysis for eApparel, Inc. to analyze the cash inflows and ouflows for 2014 and 2015 and choose the best answers for the

Use the summary analysis for eApparel, Inc. to analyze the cash inflows and ouflows for 2014 and 2015 and choose the best answers for the question. 100 Inflows (in percent of total) 2015 2014 Sales and maturities of marketable securities 20.1 220 Proceeds from issuance of common stock Proceeds from long-term debt Total Inflows Outflows (in percent of total) Operations Purchases of marketable securities 19.8 Purchases of fixed assets 26.5 Repayment of long-term debt 35.3 32.8 Total Outflows 100.0 100.0 Which of the following statements is true? A. e Apparel is generating a larger dollar amount of cash from marketable securities than it is spending. BeApparel is currently funding operations with inflows from common stock issuances. eApparel is repaying a larger dollar amount of cash for long-term debt than it is borrowing. D. eApparel is generating excess cash from operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts