Question: Use the table and the Single-Index Model for problems 14-17 to calculate the requested values for an equally weighted portfolio made up of the four

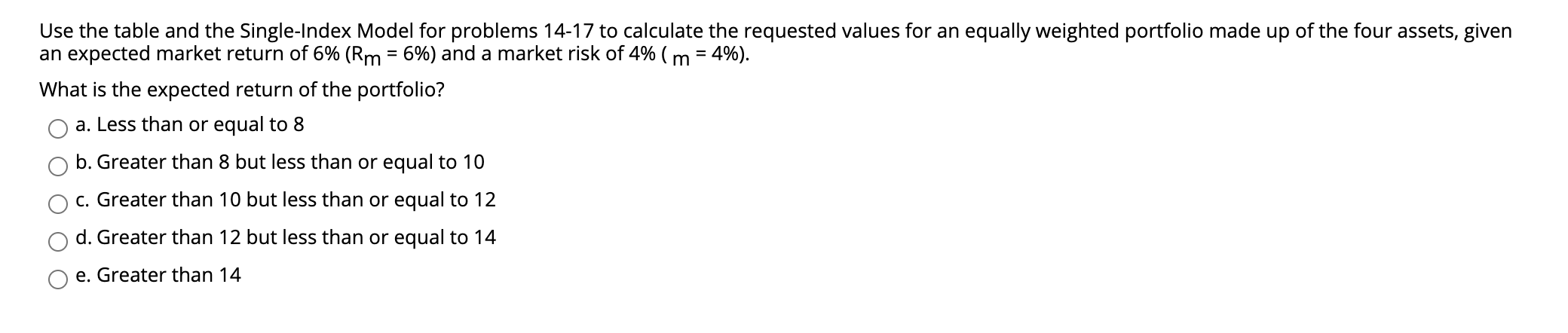

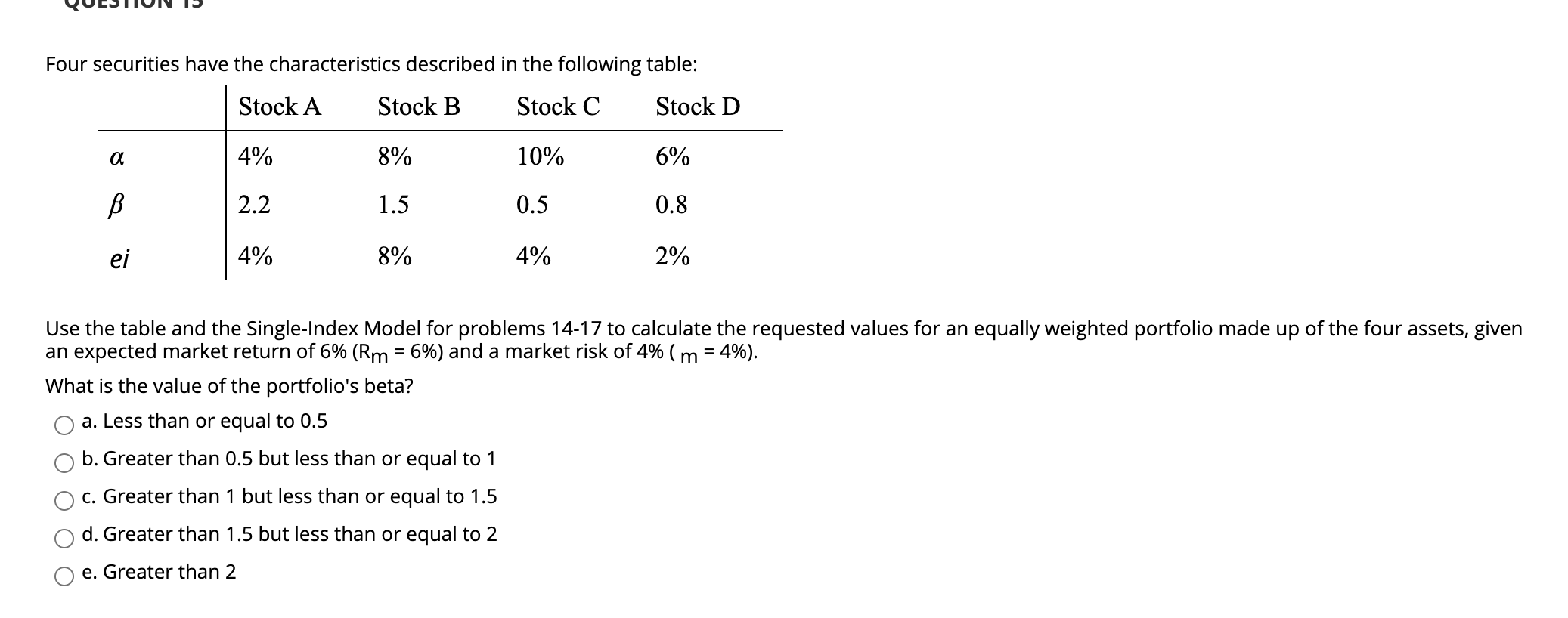

Use the table and the Single-Index Model for problems 14-17 to calculate the requested values for an equally weighted portfolio made up of the four assets, given an expected market return of 6% (Rm = 6%) and a market risk of 4% ( m = 4%). What is the expected return of the portfolio? a. Less than or equal to 8 b. Greater than 8 but less than or equal to 10 C. Greater than 10 but less than or equal to 12 d. Greater than 12 but less than or equal to 14 e. Greater than 14 Four securities have the characteristics described in the following table: Stock A Stock B Stock C Stock D a 4% 8% 10% 6% B 2.2 1.5 0.5 0.8 ei 4% 8% 4% 2% Use the table and the Single-Index Model for problems 14-17 to calculate the requested values for an equally weighted portfolio made up of the four assets, given an expected market return of 6% (Rm = 6%) and a market risk of 4% (m = 4%). What is the value of the portfolio's beta? a. Less than or equal to 0.5 b. Greater than 0.5 but less than or equal to 1 C. Greater than 1 but less than or equal to 1.5 d. Greater than 1.5 but less than or equal to 2 e. Greater than 2 Use the table and the Single-Index Model for problems 14-17 to calculate the requested values for an equally weighted portfolio made up of the four assets, given an expected market return of 6% (Rm = 6%) and a market risk of 4% ( m = 4%). What is the expected return of the portfolio? a. Less than or equal to 8 b. Greater than 8 but less than or equal to 10 C. Greater than 10 but less than or equal to 12 d. Greater than 12 but less than or equal to 14 e. Greater than 14 Four securities have the characteristics described in the following table: Stock A Stock B Stock C Stock D a 4% 8% 10% 6% B 2.2 1.5 0.5 0.8 ei 4% 8% 4% 2% Use the table and the Single-Index Model for problems 14-17 to calculate the requested values for an equally weighted portfolio made up of the four assets, given an expected market return of 6% (Rm = 6%) and a market risk of 4% (m = 4%). What is the value of the portfolio's beta? a. Less than or equal to 0.5 b. Greater than 0.5 but less than or equal to 1 C. Greater than 1 but less than or equal to 1.5 d. Greater than 1.5 but less than or equal to 2 e. Greater than 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts