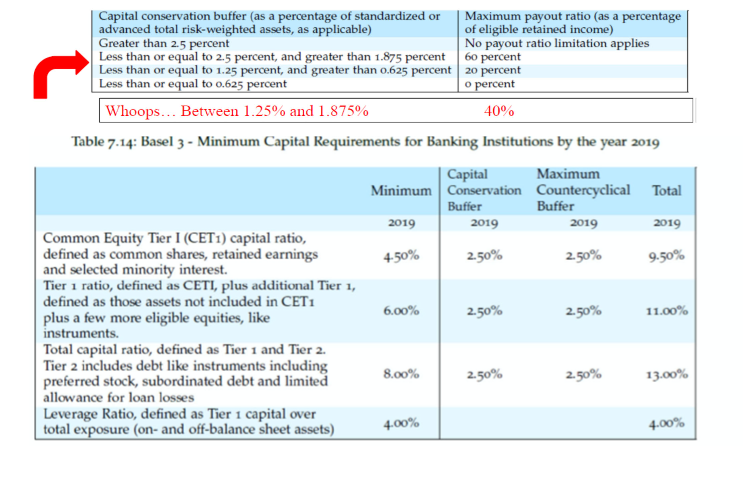

Question: Use the Table at the top for Questions 34 & 35. Question 33 can be done without any extra help. Capital conservation buffer (as a

Use the Table at the top for Questions 34 & 35. Question 33 can be done without any extra help.

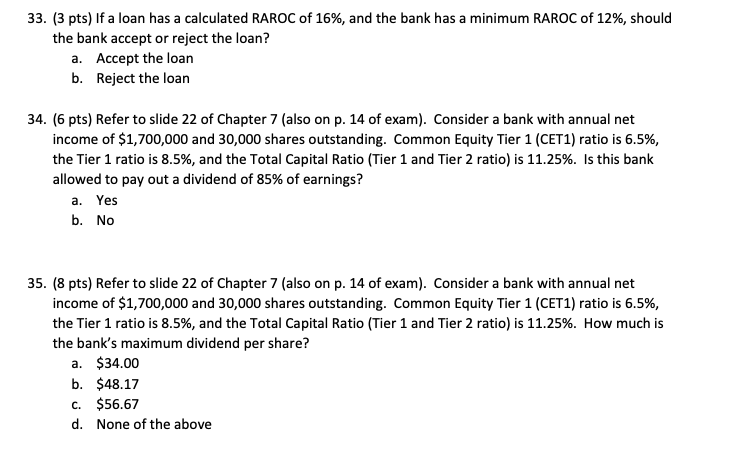

Capital conservation buffer (as a percentage of standardized or Maximum payout ratio (as a percentage advanced total risk-weighted assets, as applicable) of eligible retained income) Greater than 2.5 percent No payout ratio limitation applies Less than or equal to 2.5 percent, and greater than 1.875 percent 60 percent Less than or equal to 1.25 percent, and greater than 0.625 percent 20 percent Less than or equal to 0.625 percent o percent Whoops... Between 1.25% and 1.875% 40% Table 7.14: Basel 3 - Minimum Capital Requirements for Banking Institutions by the year 2019 Capital Maximum Minimum Conservation Countercyclical Total Buffer Buffer 2019 2019 2019 2019 Common Equity Tier I (CET1) capital ratio, defined as common shares, retained earnings 2.50% and selected minority interest Tier 1 ratio, defined as CETI, plus additional Tier 1, defined as those assets not included in CET1 6.00% plus a few more eligible equities, like 2.50% 11.00% instruments. Total capital ratio, defined as Tier 1 and Tier 2. Tier 2 includes debt like instruments including preferred stock, subordinated debt and limited 8.00% 2.50% 13.00% allowance for loan losses Leverage Ratio, defined as Tier 1 capital over total exposure (on- and off-balance sheet assets) 4.50% 2.50% 9.50% 2.50% 2.50% 4.00% 4.00% 33. (3 pts) If a loan has a calculated RAROC of 16%, and the bank has a minimum RAROC of 12%, should the bank accept or reject the loan? a. Accept the loan b. Reject the loan 34. (6 pts) Refer to slide 22 of Chapter 7 (also on p. 14 of exam). Consider a bank with annual net income of $1,700,000 and 30,000 shares outstanding. Common Equity Tier 1 (CET1) ratio is 6.5%, the Tier 1 ratio is 8.5%, and the Total Capital Ratio (Tier 1 and Tier 2 ratio) is 11.25%. Is this bank allowed to pay out a dividend of 85% of earnings? a. Yes b. No 35. (8 pts) Refer to slide 22 of Chapter 7 (also on p. 14 of exam). Consider a bank with annual net income of $1,700,000 and 30,000 shares outstanding. Common Equity Tier 1 (CET1) ratio is 6.5%, the Tier 1 ratio is 8.5%, and the Total Capital Ratio (Tier 1 and Tier 2 ratio) is 11.25%. How much is the bank's maximum dividend per share? a. $34.00 b. $48.17 C. $56.67 d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts