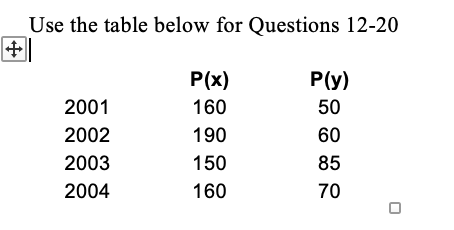

Question: Use the table below for Questions 12-20 12. (5 points) Given the prices of stock X and stock Y, find the expected return on stock

Use the table below for Questions 12-20

12. (5 points) Given the prices of stock X and stock Y, find the expected return on stock X for the period 2002-2004

A. 4.44%

B. 3.10%

C. 1.45%

D. 2.10%

13. (5 points) Find the expected return on stock Y for the period 2002-2004

A. 10.56%

B. 11.97%

C. 14.67%

D. 13.22%

14. (5 points) Find the standard deviation of returns on stock X for the period 2002-2004

A. 13.04%

B. 18.22%

C. 15.55%

D. 20.41%

15. (5 points) Find the standard deviation of returns on stock Y for the period 2002-2004

A. 27.02%

B. 17.88%

C. 22.36%

D. 30.01%

16. (5 points) Find the correlation of returns on stock X and Y for the period 2002-2004

A. 0.672

B. 0.585

C. 0.472

D. 0.558

17. (5 points) Find the optimal portfolio weights that maximize the risk-adjusted return (e.g., the Sharpe ratio)

A. w(x)=0.6608, w(y)=0.3392

B. w(x)=0.8862, w(y)=0.1138

C. w(x)=0.4892, w(y)=0.5108

D. w(x)=0.7035, w(y)=0.2965

18. (5 points) Find the expected return of the optimal portfolio

A. 10.04%

B. 9.11%

C. 8.21%

D. 11.66%

19. (5 points) Find the standard deviation of the optimal portfolio

A. 12.80%

B. 13.62%

C. 14.97%

D. 11.89%

20. (5 points) Find the maximum risk-adjusted return (i.e., the Sharpe ratio, assuming zero risk free rate)

A. 0.6383

B. 0.5890

C. 0.6412

D. 0.7821

Use the table below for Questions 1220

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts