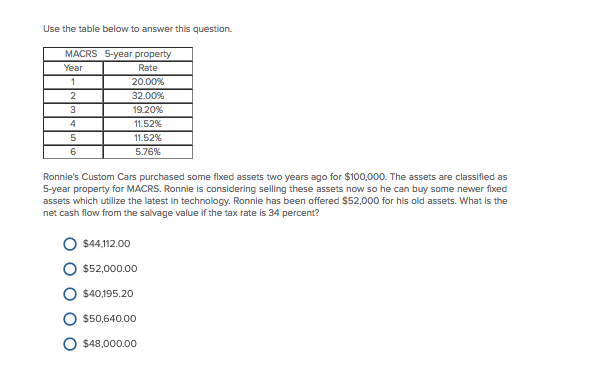

Question: Use the table below to answer this question. MACRS 5-year property Year Rate 1 20.00% 2 32.00% 3 19.20% 4 11.52% 5 11.52% 6 5.76%

Use the table below to answer this question. MACRS 5-year property Year Rate 1 20.00% 2 32.00% 3 19.20% 4 11.52% 5 11.52% 6 5.76% Ronnie's Custom Cars purchased some fixed assets two years ago for $100,000. The assets are classified as 5-year property for MACRS. Ronnie is considering selling these assets now so he can buy some newer fixed assets which utilize the latest in technology. Ronnie has been offered $52,000 for his old assets. What is the net cash flow from the salvage value if the tax rate is 34 percent? $44,112.00 $52,000.00 $40,195.20 $50,640.00 $48,000.00

Use the table below to answer this question MACRS 5-year property Year Rate 20.00% 32.00% 19.20% 1.52% 1.52% 5.76% Ronnie's Custom Cars purchased some fixed assets two years ago for $100,000. The assets are classified as S-year property for MACRS. Ronnie is considering selling these assets now so he can buy some newer fixed assets which utilize the latest in technology. Ronnie has been offered S52,000 for his old assets. What is the net cash flow from the salvage value if the tax rate is 34 percent? O $44,112.00 O $52.000.00 $40195.20 $50,640.00 O $48,00000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts