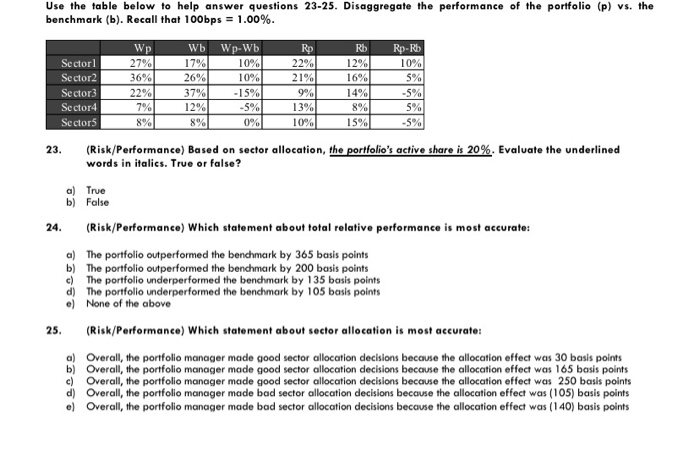

Question: Use the table below to help answer questions 23-25. Disaggregate the performance of the portfolio (p) vs. the benchmark (b). Recall that 100bps = 1.00%.

Use the table below to help answer questions 23-25. Disaggregate the performance of the portfolio (p) vs. the benchmark (b). Recall that 100bps = 1.00%. Sectorl Sector2 Sector3 Sector4 Sectors WpWb Wp- W 27% 27% 17% 10% 3 6 26% 10% 22% 37% -15% 7 % 12% -5% 8% RpRb Rp-Rb 22% 12% 10% 21% 16% 5% 9% 14% -5% 13% 8% 5% 15% 23. (Risk/Performance) Based on sector allocation, the portfolio's active share is 20%. Evaluate the underlined words in italics. True or false? a) True b) False 24. (Risk/Performance) Which statement about total relative performance is most accurate: a) The portfolio outperformed the benchmark by 365 basis points b) The portfolio outperformed the benchmark by 200 basis points c) The portfolio underperformed the benchmark by 135 basis points d) The portfolio underperformed the benchmark by 105 basis points e) None of the above 25. (Risk/Performance) Which statement about sector allocation is most accurate a) Overall, the portfolio manager made good sector allocation decisions because the allocation effect was 30 basis points b) Overall, the portfolio manager made good sector allocation decisions because the allocation effect was 165 basis points c) Overall, the portfolio manager made good sector allocation decisions because the allocation effect was 250 basis points d) Overall, the portfolio manager made bad sector allocation decisions because the allocation effect was (105) basis points e) Overall, the portfolio manager made bad sector allocation decisions because the allocation effect was (140) basis points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts