Question: Use the table. explain all steps thank you. Class Question (13) - (Capital Allowances) (skip) Myles is considering an investment program which has the following

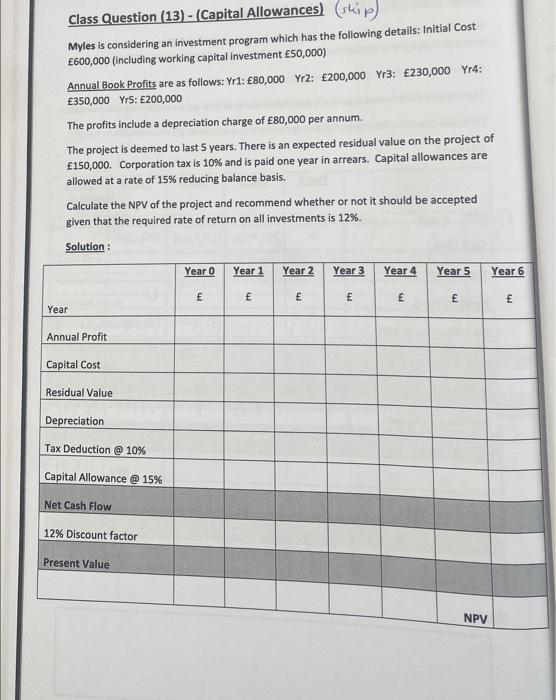

Class Question (13) - (Capital Allowances) (skip) Myles is considering an investment program which has the following details: Initial Cost 600,000 (including working capital investment 50,000 ) Annual Book Profits are as follows: Yr1: 80,000 Yr2: 200,000 Yr3: 230,000 Yr4: 350,000 Yr5: 200,000 The profits include a depreciation charge of 80,000 per annum. The project is deemed to last 5 years. There is an expected residual value on the project of 150,000. Corporation tax is 10% and is paid one year in arrears. Capital allowances are allowed at a rate of 15% reducing balance basis. Calculate the NPV of the project and recommend whether or not it should be accepted given that the required rate of return on all investments is 12%. Solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts