Question: Use the Table for Q 8 and 9 Table 1: Present Value of $1.00 1% 2% 3% 5% 6% 7% 8% 9% 11% Period 1

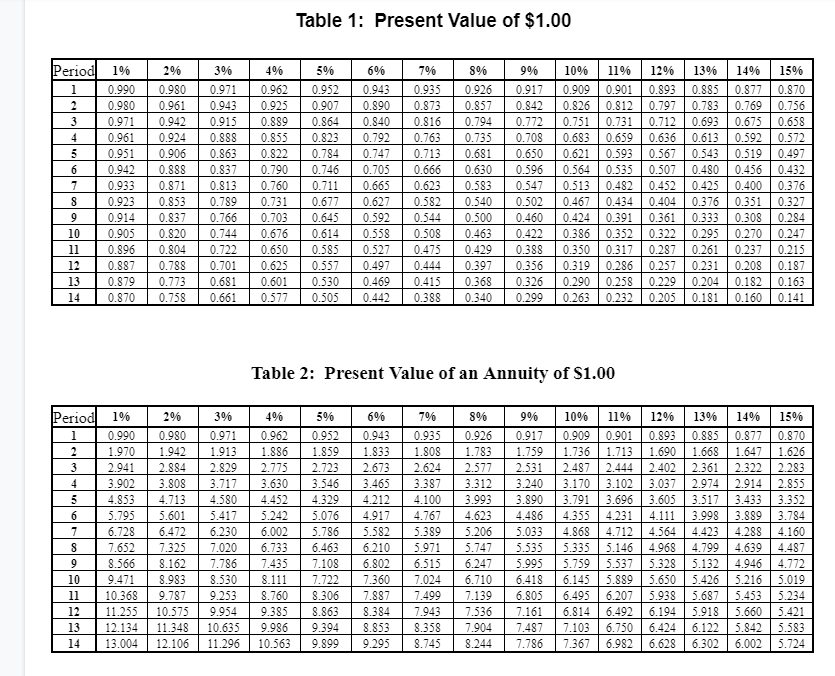

Use the Table for Q 8 and 9

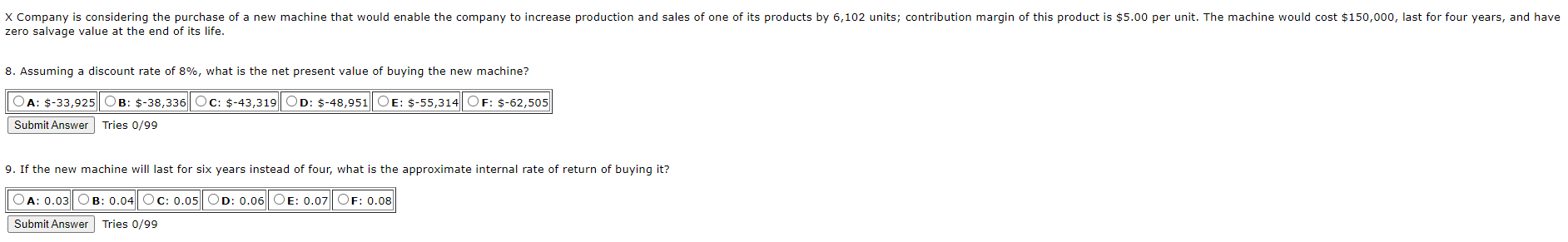

Table 1: Present Value of $1.00 1% 2% 3% 5% 6% 7% 8% 9% 11% Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 13% 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 Table 2: Present Value of an Annuity of $1.00 1% 2% 4% 5% 6% 7% 8% 9% Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 3% 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10. 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 .899 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.7 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 12% 13% 14% 15% 0.893 0.885 0.877 0.870 1.690 1.668 1.647 1.626 2.402 2.361 2.322 2.283 3.037 2.9742.914 2.855 3.605 3.517 3.433 3.352 4.111 3.998 3.889 3.784 4.564 4.423 4.288 4.160 4.968 4.799 4.639 4.487 5.328 5.132 4.946 4.772 5.650 5.426 5.216 5.019 5.938 5.687 5.453 5.234 6.194 5.918 5.660 5.421 6.424 6.122 5.842 5.583 6.628 302 6.002 5.724 LT X Company is considering the purchase of a new machine that would enable the company to increase production and sales of one of its products by 6,102 units; contribution margin of this product is $5.00 per unit. The machine would cost $150,000, last for four years, and have zero salvage value at the end of its life. 8. Assuming a discount rate of 8%, what is the net present value of buying the new machine? OA: $-33,925 | OB: $-38,336 Oc: $-43,319 OD: $-48,951 OE: $-55,314| OF: $-62,505|| Submit Answer Tries 0/99 9. If the new machine will last for six years instead of four, what is the approximate internal rate of return of buying it? OA: 0.03|OB: 0.04 Oc: 0.05 OD: 0.06 OE: 0.07| OF: 0.08 Submit Answer Tries 0/99

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts