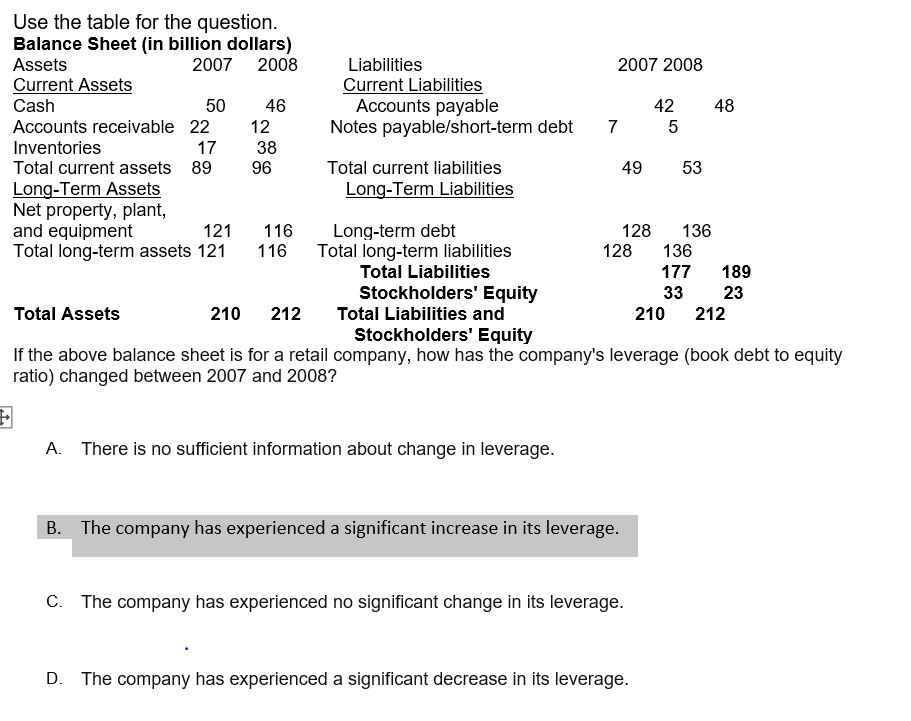

Question: Use the table for the question. Balance Sheet (in billion dollars) Assets 2007 2008 Liabilities 2007 2008 Current Assets Current Liabilities Cash 50 46 Accounts

Use the table for the question. Balance Sheet (in billion dollars) Assets 2007 2008 Liabilities 2007 2008 Current Assets Current Liabilities Cash 50 46 Accounts payable 42 48 Accounts receivable 22 12 Notes payable/short-term debt 7 5 Inventories 17 38 Total current assets 89 96 Total current liabilities 49 53 Long-Term Assets Long-Term Liabilities Net property, plant, and equipment 121 116 Long-term debt 128 136 Total long-term assets 121 116 Total long-term liabilities 128 136 Total Liabilities 177 189 Stockholders' Equity 33 23 Total Assets 210 212 Total Liabilities and 210 212 Stockholders' Equity If the above balance sheet is for a retail company, how has the company's leverage (book debt to equity ratio) changed between 2007 and 2008? A. There is no sufficient information about change in leverage. The company has experienced a significant increase in its leverage. The company has experienced no significant change in its leverage. D. The company has experienced a significant decrease in its leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts