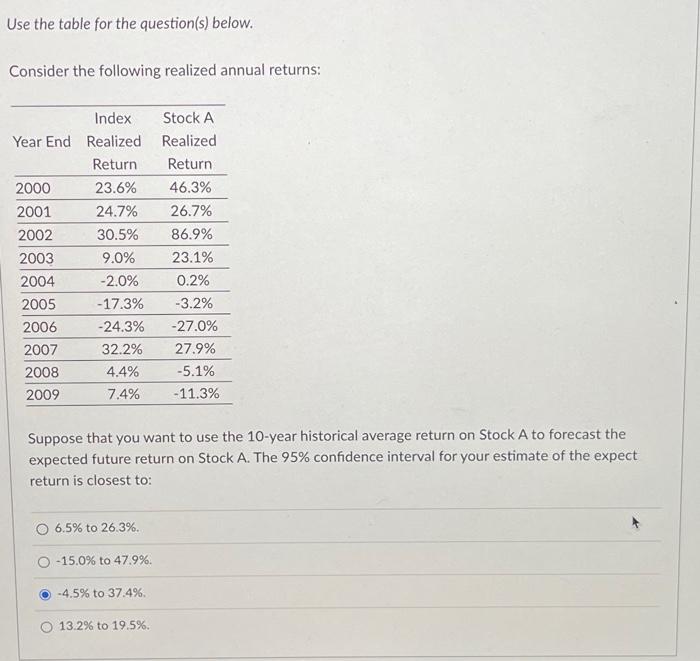

Question: Use the table for the question(s) below. Consider the following realized annual returns: Index Stock A Year End Realized Realized Return Return 23.6% 46.3% 24.7%

Use the table for the question(s) below. Consider the following realized annual returns: Index Stock A Year End Realized Realized Return Return 23.6% 46.3% 24.7% 26.7% 30.5% 86.9% 9.0% 23.1% -2.0% 0.2% -17.3% -3.2% -24.3% -27.0% 32.2% 27.9% 4.4% -5.1% 7.4% -11.3% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Suppose that you want to use the 10-year historical average return on Stock A to forecast the expected future return on Stock A. The 95% confidence interval for your estimate of the expect return is closest to: 6.5% to 26.3%. -15.0% to 47.9%. -4.5% to 37.4%. 13.2% to 19.5%.

Use the table for the question(s) below. Consider the following realized annual returns: Suppose that you want to use the 10 -year historical average return on Stock A to forecast the expected future return on Stock A. The 95% confidence interval for your estimate of the expect return is closest to: 6.5% to 26.3%. 15.0% to 47.9%. 4.5% to 37.4%. 13.2% to 19.5%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock