Question: Use the Table for the two questions below Table 1: Present Value of $1.00 1% 2% 3% 4% 6% 8% Period 1 2 3 4

Use the Table for the two questions below

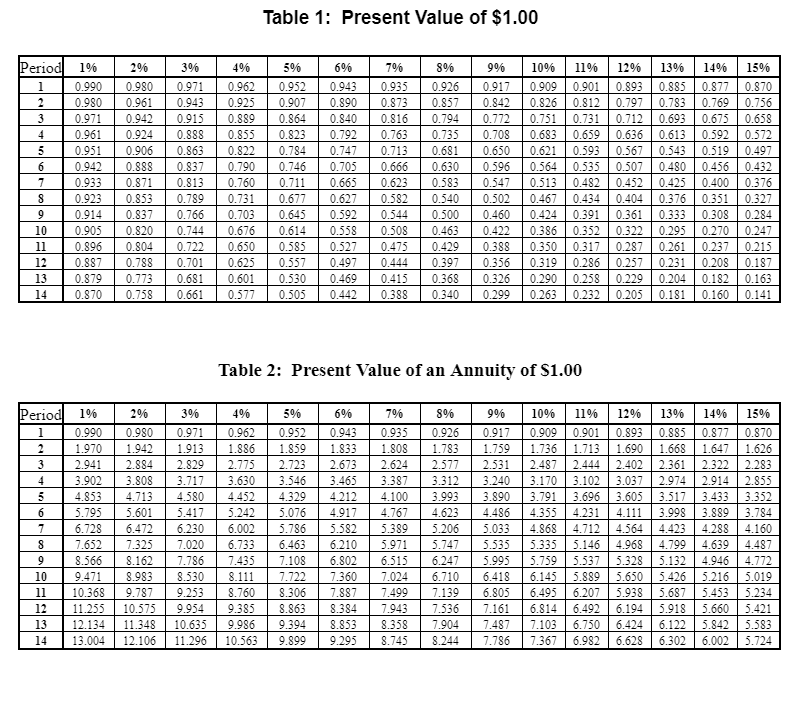

Table 1: Present Value of $1.00 1% 2% 3% 4% 6% 8% Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 10% 11% 12% 13% 14% 15% 0.909 0.901 0.893 0.885 0.877 0.870 0.826 0.812 0.797 0.783 0.769 0.756 0.751 0.731 0.712 0.693 0.675 0.658 0.683 0.659 0.636 0.613 0.592 0.572 0.621 0.593 0.567 0.543 0.519 0.497 0.564 0.535 0.507 0.480 0.456 0.432 0.513 0.482 0.452 0.425 0.400 0.376 0.467 0.434 0.404 0.376 0.351 0.327 0.424 0.391 0.361 0.333 0.308 0.284 0.386 0.352 0.322 0.295 0.270 0.247 0.350 0.317 0.2870.261 0.237 0.215 0.319 0.286 0.257 0.231 0.208 0.187 0.290 0.258 0.229 0.204 0.182 0.163 0.263 0.232 0.205 0.181 0.160 0.141 Table 2: Present Value of an Annuity of S1.00 2% 3% 4% 5% 7% 8% 15% Period 1% 1 0.990 2 1.970 3 2.941 4 3.902 5 4.853 6 5.795 7 6.728 8 7.652 9 8.566 10 9.471 11 10.368 12 11.255 13 12.134 14 13.004 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 10% 11% 12% 0.909 0.901 0.893 1.736 1.713 1.690 2.487 2.444 2.402 3.170 3.102 3.037 3.791 3.696 3.605 4.355 4.231 4.111 4.868 4.712 4.564 5.335 5.146 4.968 5.759 5.537 5.328 6.145 5.889 5.650 6.495 6.207 5.938 6.814 6.492 6.194 7.103 6.750 6.424 7.367 6.982 6.628 13% 14% 0.885 0.877 1.668 1.647 2.361 2.322 2.974 2.914 3.517 3.433 3.998 3.889 4.423 4.288 4.799 4.639 5.132 4.946 5.426 5.216 5.687 5.453 5.9185.660 6.122 5.842 6.302 6.002 0.870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 X Company is considering the purchase of a new machine. The machine would reduce the amount of part-time labor, at a cost savings of $13,190 per year. In addition, the machine would enable the company to increase production and sales of one of its products by 2,500 units; contribution margin of this product is $5.80 per unit. The machine would cost $150,000, last for four years, and have zero salvage value at the end of its life. 8. Assuming a discount rate of 7%, what is the net present value of buying the new machine? Submit Answer Tries 0/4 9. If the new machine will last for six years instead of four, what is the approximate internal rate of return of buying it? (enter your answer as .XX, so 1% would be .01] Submit Answer Tries 0/4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts