Question: Use the table to answer the questions below: On December 31, 2018, Yard Art Landscaping leased a delivery truck from Branch Motors. Branch paid $36,000

Use the table to answer the questions below:

On December 31, 2018, Yard Art Landscaping leased a delivery truck from Branch Motors. Branch paid $36,000 for the truck. Its retail value is $70,297. The lease agreement specified annual payments of $21,500 beginning December 31, 2018, the beginning of the lease, and at each December 31 through 2021. Branch Motors interest rate for determining payments was 11%. At the end of the four-year lease term (December 31, 2022) the truck was expected to be worth $10,000. The estimated useful life of the truck is five years with no salvage value. Both companies use straight-line amortization or depreciation. Yard Art guaranteed a residual value of $6,000. Yard Arts incremental borrowing rate is 9% and is unaware of Branchs implicit rate. A $3,000 per year maintenance agreement was arranged for the truck with an outside service firm. As an expedient, Branch Motors agreed to pay this fee. It is, however, reflected in the $21,500 lease payments.

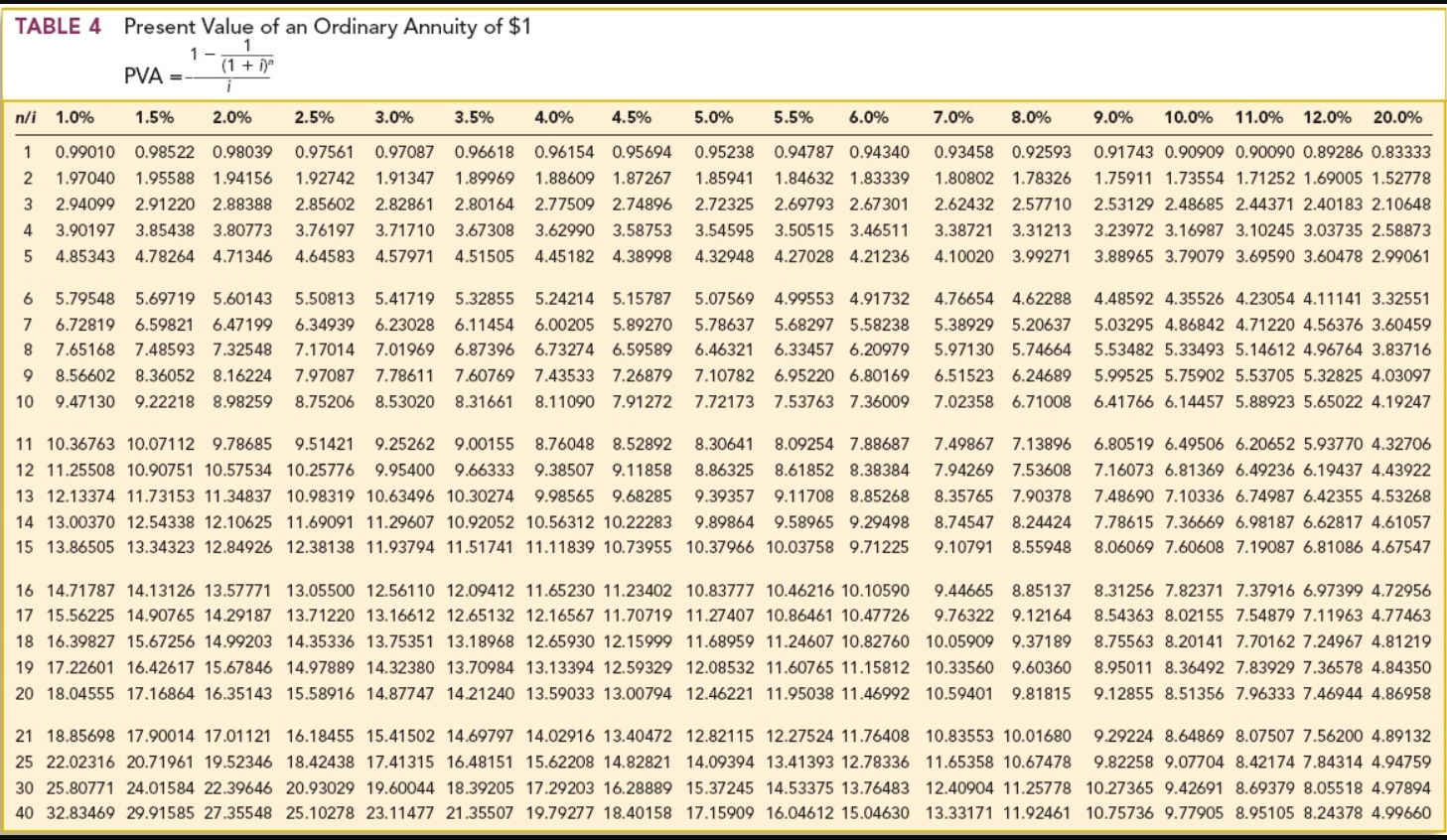

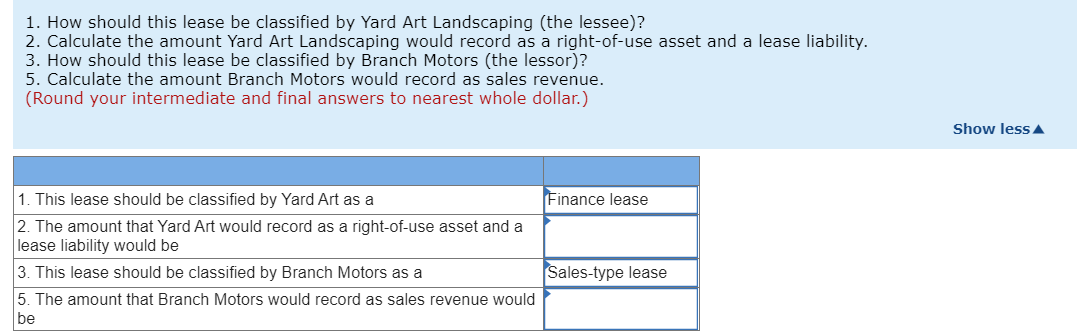

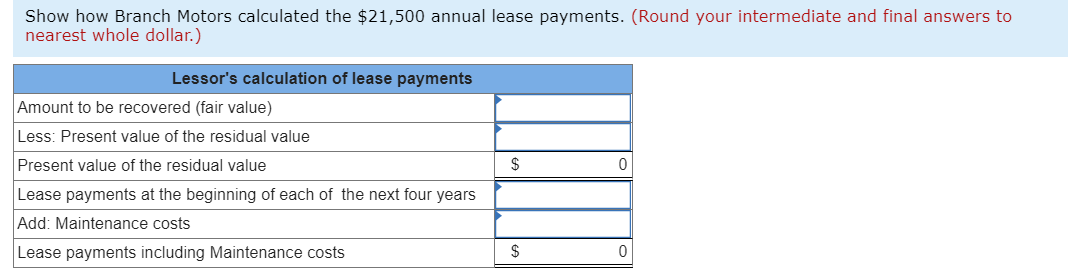

TABLE 4 Present Value of an Ordinary Annuity of $1 1-1 + 119 PVA =- n/i 1 2 3 4 5 1.0% 1.5% 2.0% 0.99010 0.98522 0.98039 1.97040 1.95588 1.94156 2.940992.91220 2.88388 3.90197 3.85438 3.80773 4.85343 4.78264 4.71346 2.5% 0.97561 1.92742 2.85602 3.76197 4.64583 3.0% 0.97087 1.91347 2.82861 3.71710 4.57971 3.5% 0.96618 1.89969 2.80164 3.67308 4.51505 4.0% 0.96154 1.88609 2.77509 3.62990 4.45182 4.5% 0.95694 1.87267 2.74896 3.58753 4.38998 5.0% 0.95238 1.85941 2.72325 3.54595 4.32948 5.5% 6.0% 0.94787 0.94340 1.84632 1.83339 2.69793 2.67301 3.50515 3.46511 4.27028 4.21236 7.0% 8.0% 0.93458 0.92593 1.80802 1.78326 2.62432 2.57710 3.38721 3.31213 4.10020 3.99271 0.0% 0.0% 11.0% 12.0% 20.0% 0.91743 0.90909 0.90090 0.89286 0.83333 1.75911 1.73554 1.71252 1.69005 1.52778 2.53129 2.48685 2.44371 2.40183 2.10648 3.23972 3.16987 3.10245 3.03735 2.58873 3.88965 3.79079 3.69590 3.60478 2.99061 6 7 8 9 10 5.79548 5.69719 5.60143 6.72819 6.59821 6.47199 7.65168 7.48593 7.32548 8.56602 8.36052 8.16224 9.47130 9.22218 8.98259 5.50813 5.41719 5.32855 5.24214 5.15787 6.34939 6.23028 6.11454 6.00205 5.89270 7.17014 7.01969 6.87396 6.73274 6.59589 7.97087 7.78611 7.60769 7.435337.26879 8.75206 8.53020 8.31661 8.11090 7.91272 5.07569 4.99553 4.91732 4.76654 4.62288 5.78637 5.68297 5.58238 5.38929 5.20637 6.46321 6.33457 6.20979 5.97130 5.74664 7.10782 6.95220 6.80169 6.51523 6.24689 7.72173 7.53763 7.360097.02358 6.71008 4.48592 4.35526 4.23054 4.11141 3.32551 5.03295 4.86842 4.71220 4.56376 3.60459 5.53482 5.33493 5.14612 4.96764 3.83716 5.99525 5.75902 5.53705 5.32825 4.03097 6.41766 6.14457 5.88923 5.65022 4.19247 11 10.36763 10.07112 9.78685 9.51421 9.25262 9.00155 8.76048 8.52892 8.30641 8.09254 7.88687 7.49867 7.13896 12 11.25508 10.90751 10.57534 10.25776 9.95400 9.66333 9.38507 9.11858 8.86325 8.61852 8.38384 7.94269 7.53608 13 12.13374 11.73153 11.34837 10.98319 10.63496 10.30274 9.98565 9.68285 9.39357 9.11708 8.85268 8.35765 7.90378 14 13.00370 12.54338 12.10625 11.69091 11.29607 10.92052 10.56312 10.22283 9.89864 9.58965 9.294988.74547 8.24424 15 13.86505 13.34323 12.84926 12.38138 11.93794 11.51741 11.11839 10.73955 10.37966 10.03758 9.71225 9.10791 8.55948 6.80519 6.49506 6.20652 5.93770 4.32706 7.16073 6.81369 6.49236 6.19437 4.43922 7.48690 7.10336 6.74987 6.42355 4.53268 7.78615 7.36669 6.98187 6.62817 4.61057 8.06069 7.60608 7.19087 6.81086 4.67547 16 14.71787 14.13126 13.57771 13.05500 12.56110 12.09412 11.65230 11.23402 10.83777 10.46216 10.10590 9.44665 8.85137 17 15.56225 14.90765 14.29187 13.71220 13.16612 12.65132 12.16567 11.70719 11.27407 10.86461 10.47726 9.76322 9.12164 18 16.39827 15.67256 14.99203 14.35336 13.75351 13.18968 12.65930 12.15999 11.68959 11.24607 10.82760 10.05909 9.37189 19 17.22601 16.42617 15.67846 14.97889 14.32380 13.70984 13.13394 12.59329 12.08532 11.60765 11.15812 10.33560 9.60360 20 18.04555 17.16864 16.35143 15.58916 14.87747 14.21240 13.59033 13.00794 12.46221 11.95038 11.46992 10.59401 9.81815 8.31256 7.82371 7.37916 6.97399 4.72956 8.54363 8.02155 7.54879 7.11963 4.77463 8.75563 8.20141 7.70162 7.24967 4.81219 8.95011 8.36492 7.83929 7.36578 4.84350 9.12855 8.51356 7.96333 7.46944 4.86958 21 18.85698 17.90014 17.01121 16.18455 15.41502 14.69797 14.02916 13.40472 12.82115 12.27524 11.76408 10.83553 10.01680 9.29224 8.64869 8.07507 7.56200 4.89132 25 22.02316 20.71961 19.52346 18.42438 17.41315 16.48151 15.62208 14.82821 14.09394 13.41393 12.78336 11.65358 10.67478 9.82258 9.07704 8.42174 7.84314 4.94759 30 25.80771 24.01584 22.39646 20.93029 19.60044 18.39205 17.29203 16.28889 15.37245 14.53375 13.76483 12.40904 11.25778 10.27365 9.42691 8.69379 8.05518 4.97894 40 32.83469 29.91585 27.35548 25.10278 23.11477 21.35507 19.79277 18.40158 17.15909 16.04612 15.04630 13.33171 11.92461 10.75736 9.77905 8.95105 8.24378 4.99660 1. How should this lease be classified by Yard Art Landscaping (the lessee)? 2. Calculate the amount Yard Art Landscaping would record as a right-of-use asset and a lease liability. 3. How should this lease be classified by Branch Motors (the lessor)? 5. Calculate the amount Branch Motors would record as sales revenue. (Round your intermediate and final answers to nearest whole dollar.) Show less Finance lease 1. This lease should be classified by Yard Art as a 2. The amount that Yard Art would record as a right-of-use asset and a lease liability would be 3. This lease should be classified by Branch Motors as a 5. The amount that Branch Motors would record as sales revenue would be Sales-type lease Show how Branch Motors calculated the $21,500 annual lease payments. (Round your intermediate and final answers to nearest whole dollar.) Lessor's calculation of lease payments Amount to be recovered (fair value) Less: Present value of the residual value Present value of the residual value Lease payments at the beginning of each of the next four years Add: Maintenance costs Lease payments including Maintenance costs $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts