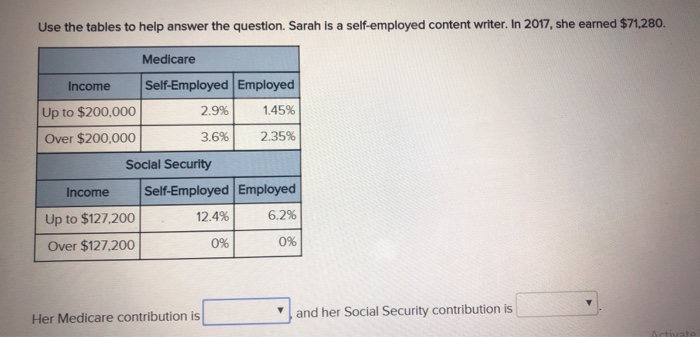

Question: Use the tables to help answer the question. Sarah is a self-employed content writer. In 2017, she earned $71,280. Medicare Income Self-Employed Employed Up to

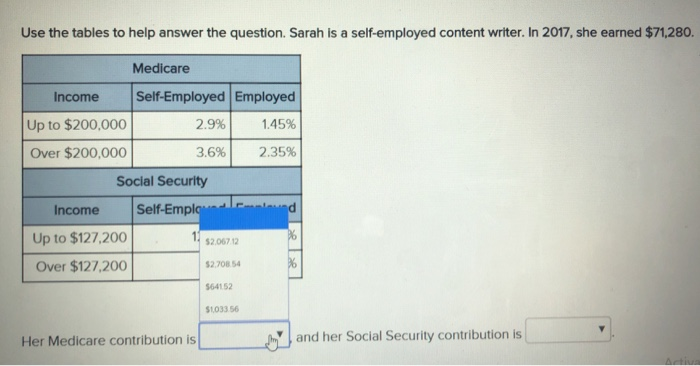

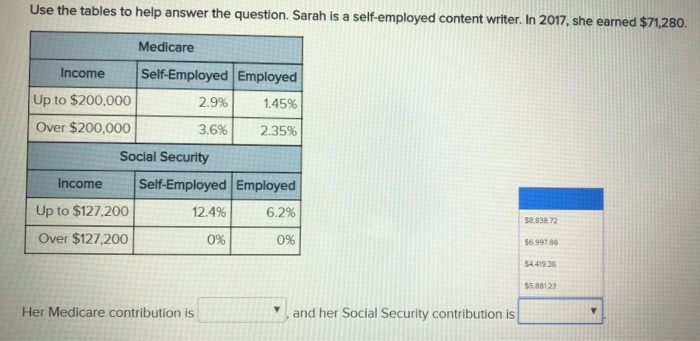

Use the tables to help answer the question. Sarah is a self-employed content writer. In 2017, she earned $71,280. Medicare Income Self-Employed Employed Up to $200,000 2.9% 1.45% Over $200,000 3.6% 2.35% Social Security Income Self-Employed Employed Up to $127,200 12.4% 6.2% Over $127,200 0% 0% Her Medicare contribution is and her Social Security contribution is Activate Use the tables to help answer the question. Sarah is a self-employed content writer. In 2017, she earned $71,280. Medicare Income Self-Employed Employed Up to $200,000 2.9% 1.45% Over $200,000 3.6% 2.35% Social Security Income Self-Emplo mund Up to $127,200 Over $127,200 5206712 $2,708 54 564152 S103356 Her Medicare contribution is by and her Social Security contribution is Use the tables to help answer the question. Sarah is a self-employed content writer. In 2017, she earned $71,280. Medicare Income Self-Employed Employed Up to $200,000 2.9% 1.45% Over $200,000 3.6% 2.35% Social Security Income Self-Employed Employed Up to $127,200 12.4% 6.2% Over $127,200 0% 0% 58,838.72 $6,99786 54.419.36 $5,88123 Her Medicare contribution is and her Social Security contribution is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts