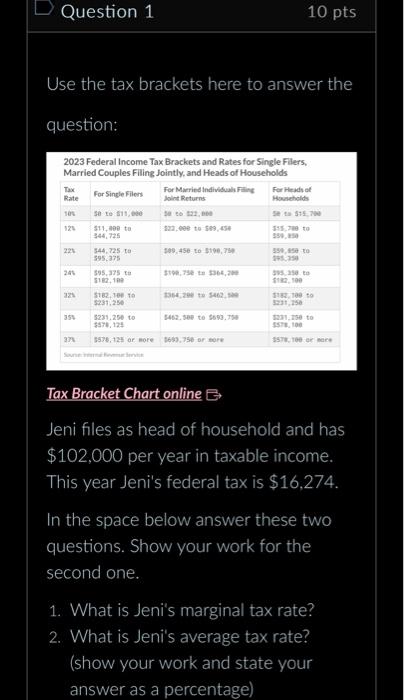

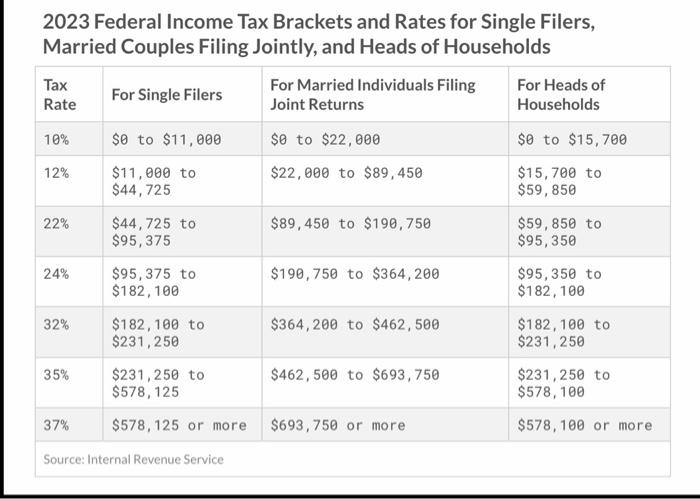

Question: Use the tax brackets here to answer the question: 2023 Federal Income Tax Brackets and Rates for Single Filers. Married Couples Filing Jointly, and Heads

Use the tax brackets here to answer the question: 2023 Federal Income Tax Brackets and Rates for Single Filers. Married Couples Filing Jointly, and Heads of Households Tax Bracket Chart online B Jeni files as head of household and has $102,000 per year in taxable income. This year Jeni's federal tax is $16,274. In the space below answer these two questions. Show your work for the second one. 1. What is Jeni's marginal tax rate? 2. What is Jeni's average tax rate? (show your work and state your answer as a percentage) Use the tax brackets here to answer the question: 2023 Federal Income Tax Brackets and Rates for Single Filers. Married Couples Filing Jointly, and Heads of Households Tax Bracket Chart online B Jeni files as head of household and has $102,000 per year in taxable income. This year Jeni's federal tax is $16,274. In the space below answer these two questions. Show your work for the second one. 1. What is Jeni's marginal tax rate? 2. What is Jeni's average tax rate? (show your work and state your answer as a percentage)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts