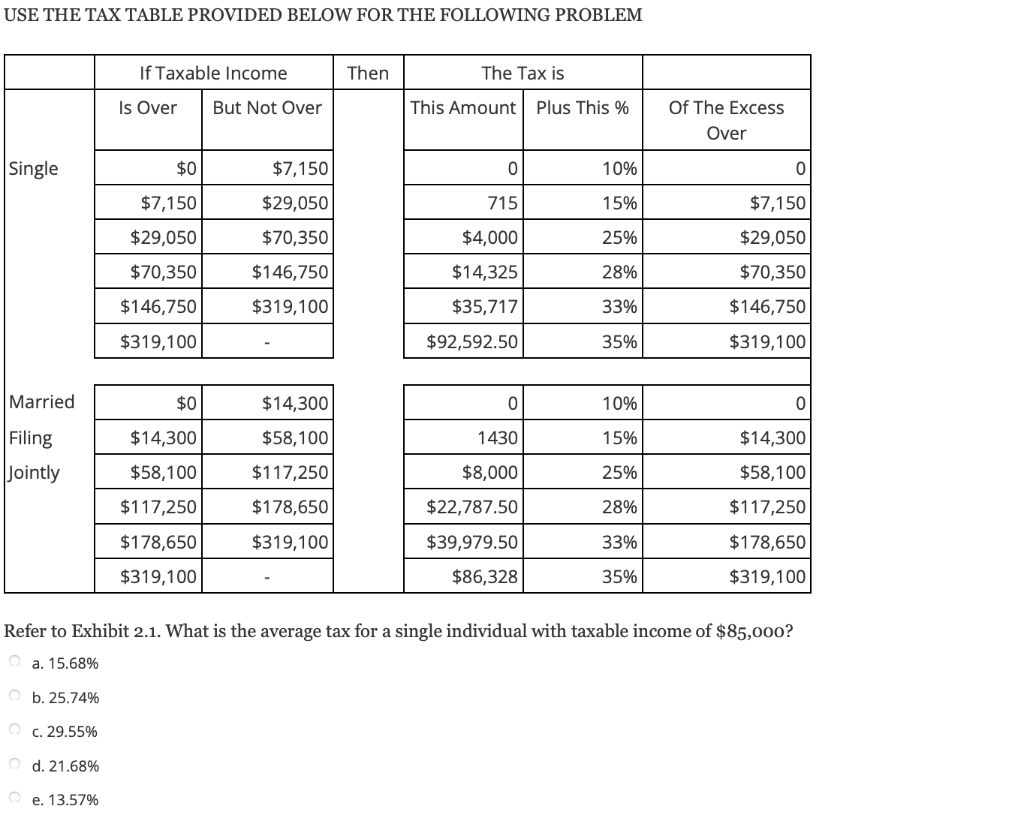

Question: USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM If Taxable income Then The Tax is Is Over But Not Over This Amount Plus

USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM If Taxable income Then The Tax is Is Over But Not Over This Amount Plus This % Of The Excess Over Single $0 0 10% 0 $7,150 $29,050 $7,150 715 15% $7,150 $29,050 25% $70,350 $146,750 $4,000 $14,325 $35,717 $29,050 $70,350 $70,350 28% $146,750 $319,100 33% $146,750 $319,100 $92,592.50 35% $319,100 Married $0 $14,300 0 10% 0 Filing $14,300 $58,100 1430 15% $14,300 Jointly $58,100 $117,250 $8,000 25% $58,100 $117,250 $178,650 $22,787.50 28% $117,250 $178,650 $319,100 $39,979.50 33% $178,650 $319,100 $86,328 35% $319,100 Refer to Exhibit 2.1. What is the average tax for a single individual with taxable income of $85,000? a. 15.68% b. 25.74% c. 29.55% d. 21.68% e. 13.57%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts