Question: Use the template for this question (attached) in Excel to value XYZ Corp's stock. Assumptions for growth rate of Free Cash Flows and Terminal Value

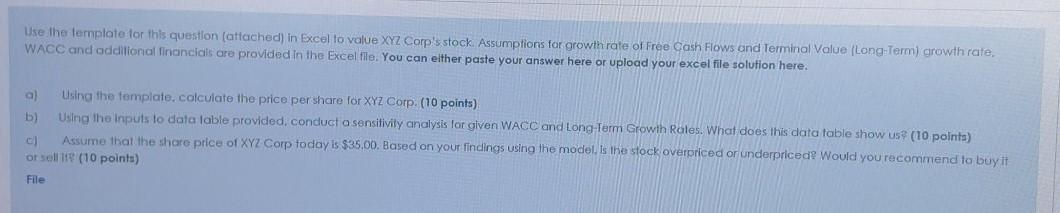

Use the template for this question (attached) in Excel to value XYZ Corp's stock. Assumptions for growth rate of Free Cash Flows and Terminal Value Long-Term) growth rate, WACC and additional financials are provided in the Excel file. You can either paste your answer here or upload your excel file solution here. al Using the fomplate, calculate the price per share for XYZ Corp. (10 points) b) Using the inputs to data lable provided. conduct a sensitivity analysis for given WACC and Long-Term Growth Rales. What does this data table show us (10 points) c) Assume that the share price of XYZ Corp today is $35.00. Based on your findings using the model is the stock overpriced or underpriced? Would you recommend to buy it or sollte (10 points) File Use the template for this question (attached) in Excel to value XYZ Corp's stock. Assumptions for growth rate of Free Cash Flows and Terminal Value Long-Term) growth rate, WACC and additional financials are provided in the Excel file. You can either paste your answer here or upload your excel file solution here. al Using the fomplate, calculate the price per share for XYZ Corp. (10 points) b) Using the inputs to data lable provided. conduct a sensitivity analysis for given WACC and Long-Term Growth Rales. What does this data table show us (10 points) c) Assume that the share price of XYZ Corp today is $35.00. Based on your findings using the model is the stock overpriced or underpriced? Would you recommend to buy it or sollte (10 points) File

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts