Question: Use the template to build two cost models, one for the Plinth and one for compressors, and submit the completed template file. Some hints are

Use the template to build two cost models, one for the Plinth and one for compressors, and submit the completed template file. Some hints are offered below.

Hints for building the plinth cost model:

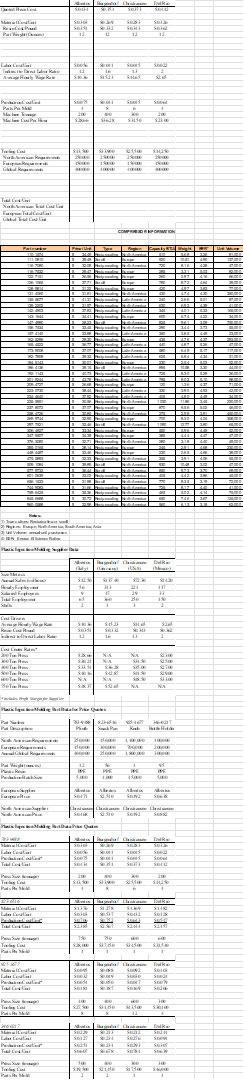

Four suppliers have quoted perpiece costs for the Plinth. Each quote consists of material, labor, and production costs. In addition, each supplier has also quoted the tooling cost which will be a onetime cost paid by Whirlpool. Your goal is to model and understand how such costs come to be so as to obtain insights into each supplier's operational details. Please work on the basis of dollar value per unit. Feel free to make any necessary changes to the spreadsheets.

For the material cost, focus on calculating material wastescrap Given the part weight and unit material cost, you can calculate the shouldbe part material cost should there be no waste. The difference between the shouldbe and the quoted part material costs can be explained by material wastescrap

For the labor cost, focus on calculating the labor productivity parts per labor hour The quoted labor costunit includes both direct and indirect labor costs. An indirectdirect ratio of for example, means that for every $ of direct labor cost, there is $ of indirect labor cost. Using the indirectdirect ratio, you can calculate the direct labor cost per part. You can then calculate the labor productivity with the direct labor cost per part and the hourly wage rate. For example, if the hourly wage is $ and each part contains $ worth of direct labor, you know parts are produced each laborhour. There is no need to consider batching or shifts because they all boil down to the provided labor costunit

For the production cost, focus on calculating the production erroroverhead wasted machine time You have calculated the labor productivity parts per hour Using that and the machine cost $ per hour you can calculate the production cost if there is production erroroverhead For example, if the productivity is parts per hour and the machine cost is $ per hour, you know the production cost should be $ per part. The difference between the shouldbe and the quoted production costs can be explained by production erroroverhead There is no need to consider batching or shifts because they all boil down to the provided production costunit

For the tooling cost, simply divide the total tooling cost by the total production quantity when a supplier meets only North America, only Europe, and both markets' demands.

For the total per unit cost, sum up the quoted total variable cost and the average tooling costs per unit in the three different scenarios from step You may notice that you are not using your calculations in steps

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock