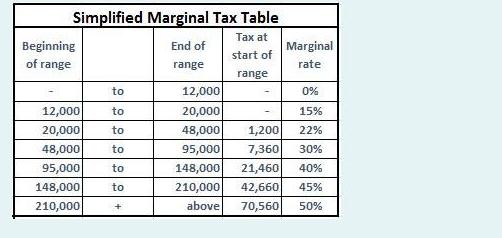

Question: Use the the marginal tax information in the table below to calculate the annual after tax income Greg should expect in his retirement. Greg expects

Use the the marginal tax information in the table below to calculate the annual after tax income Greg should expect in his retirement.

Greg expects

$11201 annually from CPP,

$6467 annually from OAS,

$99,000 from his RRIF.

Assume that his OAS will be clawed back on any income above $76,000.

Simplified Marginal Tax Table Tax at start of range Beginning of range 12,000 20,000 48,000 95,000 148,000 210,000 to to to to to to + End of range 12,000 20,000 48,000 1,200 95,000 7,360 148,000 21,460 210,000 42,660 above 70,560 Marginal rate 0% 15% 22% 30% 40% 45% 50%

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

To calculate Gregs annual aftertax income in his retirement we need to consider the marginal tax rates and the OAS clawback threshold Lets calculate i... View full answer

Get step-by-step solutions from verified subject matter experts