Question: Use the time value tables found in your textbook when required to show your work (use the same method as I did in class). Do

Use the time value tables found in your textbook when required to show your work (use the same method as I did in class). Do NOT use finance calculators, excel formulas, etc. to calculate values. You can round to the nearest dollar.

Complete the four cases using your individually assigned values for the variables. Be very careful to use your individually assigned variables. Your answers will be graded as wrong, if you use the wrong variables.

Use the time value tables found in your textbook when required to show your work (use the same method as I did in class). Do NOT use finance calculators, excel formulas, etc. to calculate values. You can round to the nearest dollar.

Case # 2 ( 40 points)

On January 1, 2020 the Kiner Co. issued three-year bonds with a face value of $17500 and a stated interest rate of 6.5 %. Interest is payable quarterly. The bonds were sold to yield(market rate) of 16%

Calculate the issues price of the bonds. Show your final answer and show all the work to support your answer.

Prepare the bond amortization table using the format covered in class (attached below in the sample answers).

Case # 3 ( 20 points)

On January 1, 2020, ABC Corp. borrowed $93900 by signing an installment loan. The loan will be repaid in 17 equal payments, one at the beginning of each year. The first payment is made on January 1, 2020. The interest rate for the loan is 11 %.

Calculate the annual payment required. Show your final answer and show all the work to support your answer.

Prepare the amortization table for the loan using the format covered in class.

Case # 4 ( 20 points)

Assume the payments will be made at the end of each year (the first payment is made on December 31, 2020.); recalculate your answer for case # 3.

Calculate the annual payment required. Show your final answer and show all the work to support your answer.

Prepare the amortization table for the loan using the format covered in class. use this as sample. the table should look like that but different answersumbers. how do you form this table? Use references ONLY from picture provided. thanks.

use this as sample. the table should look like that but different answersumbers. how do you form this table? Use references ONLY from picture provided. thanks.

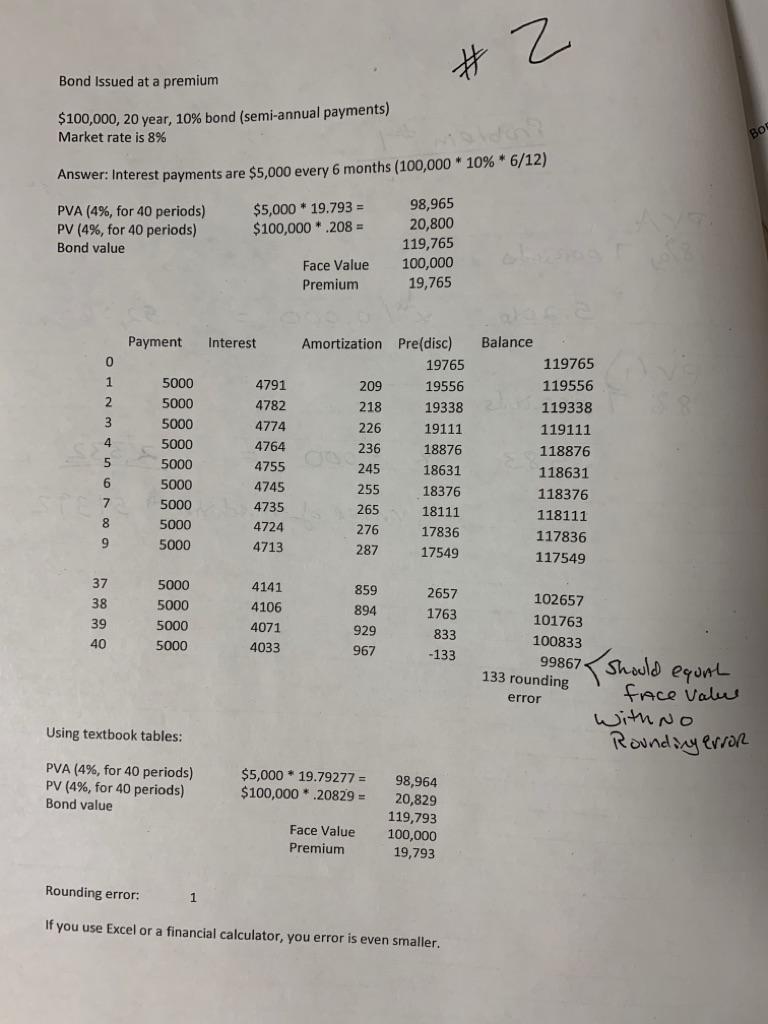

# 2 Bond Issued at a premium $100,000, 20 year, 10% bond (semi-annual payments) Market rate is 8% 50 Answer: Interest payments are $5,000 every 6 months (100,000 * 10% * 6/12) PVA (4%, for 40 periods) PV (4%, for 40 periods) Bond value $5,000 * 19.793 = $100,000 * .208 = 98,965 20,800 119,765 100,000 19,765 Face Value Premium Payment Interest 0 1 2 3 4 5000 5000 5000 5000 5000 5000 5000 5000 5000 Amortization Pre(disc) 19765 209 19556 218 19338 226 19111 236 18876 245 18631 255 265 18111 276 17836 287 17549 4791 4782 4774 4764 4755 4745 4735 4724 4713 5 Balance 119765 119556 119338 119111 118876 118631 118376 118111 117836 117549 6 18376 7 8 9 37 38 39 40 5000 5000 5000 5000 4141 4106 4071 4033 859 894 929 967 2657 1763 833 -133 102657 101763 100833 99867 133 rounding error > should equal face valul With No Rounding error Using textbook tables: PVA (4%, for 40 periods) PV (4%, for 40 periods) Bond value $5,000 * 19.79277 = $100,000 * .20829 = 98,964 20,829 119,793 100,000 19,793 Face Value Premium Rounding error: 1 If you use Excel or a financial calculator, you error is even smaller. Future ure Value of an Ordinary Annuity of 1 FVF-OA = (1+99-1 (n) Periods ON 26 ON88 399 (n) Periods 888 Present Value of an Ordinary Annuity of 1 PVF-OAT ON 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts