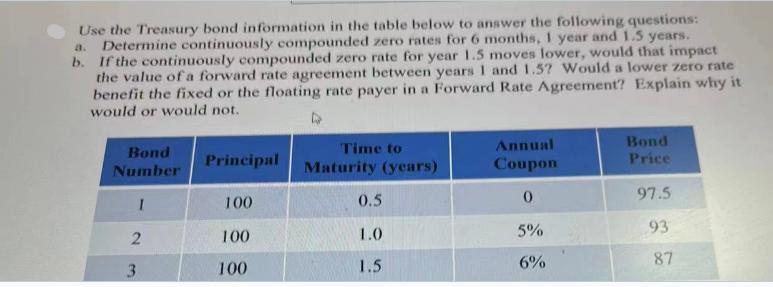

Question: Use the Treasury bond information in the table below to answer the following questions: a. Determine continuously compounded zero rates for 6 months, 1

Use the Treasury bond information in the table below to answer the following questions: a. Determine continuously compounded zero rates for 6 months, 1 year and 1.5 years. b. If the continuously compounded zero rate for year 1.5 moves lower, would that impact the value of a forward rate agreement between years 1 and 1.5? Would a lower zero rate benefit the fixed or the floating rate payer in a Forward Rate Agreement? Explain why it would or would not. Bond Number 2 3 Principal 100 100 100 4 Time to Maturity (years) 0.5 1.0 1.5 Annual Coupon 0 5% 6% Bond Price 97.5 93 87

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

SOLUTION To determine the continuously compounded zero rates for 6 months 1 year and 15 years we can ... View full answer

Get step-by-step solutions from verified subject matter experts