Question: Use the US Yield Curve from the attached spreadsheet. Consider a portfolio that is long 10m USD in one 5-year zero-coupon bond and short 7.5m

Use the US Yield Curve from the attached spreadsheet. Consider a portfolio that is long 10m USD in one 5-year zero-coupon bond and short 7.5m USD in another 5-year zero-coupon bond. If the 5-year zero rate falls from 3.16% to 3%, by how much does the value of the portfolio increase? Hint: Assets = 10m, Liabilities = 7.5m, Equity = 2.5m. You do not need to post margin.

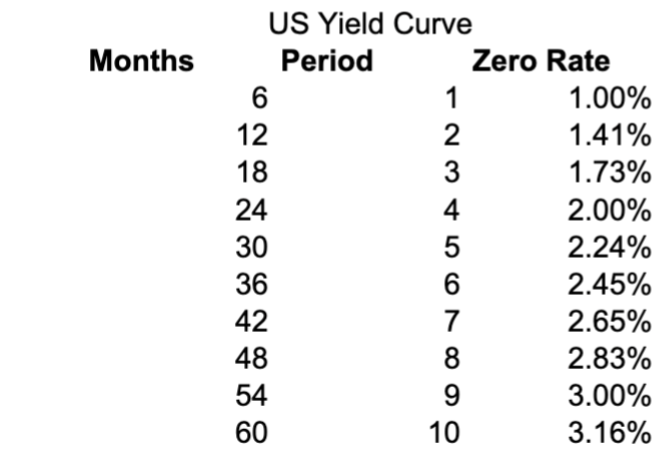

Months US Yield Curve Period Zero Rate 6 1 1.00% 12 2 1.41% 18 3 1.73% 24 4 2.00% 30 5 2.24% 36 6 2.45% 42 7 2.65% 48 8 2.83% 54 9 3.00% 60 10 3.16%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts