Question: Use the WORKSHEET uploaded for the Mid-Term test on MS Teams to prepare the Adjusted Trial Balance for Jagjeet and Jones Ltd. Question 2 Jagjeet

Use the WORKSHEET uploaded for the Mid-Term test on MS Teams to prepare the Adjusted Trial Balance for Jagjeet and Jones Ltd.

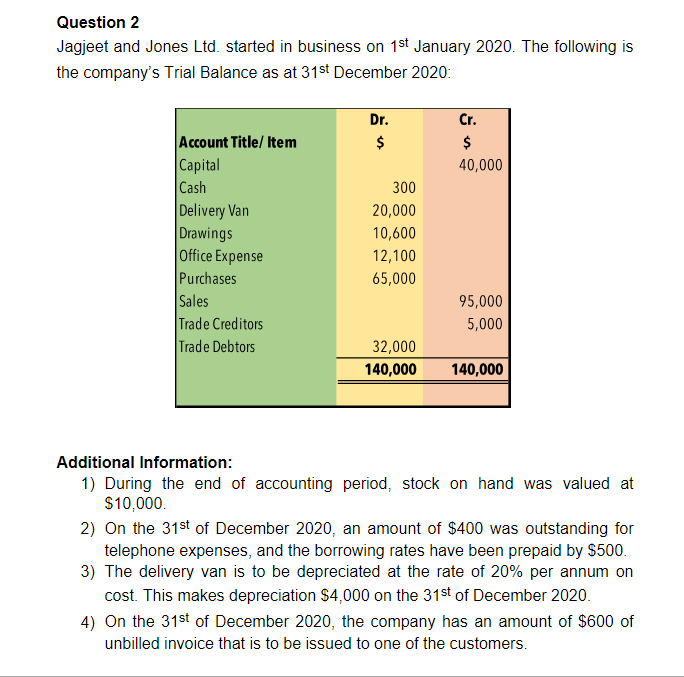

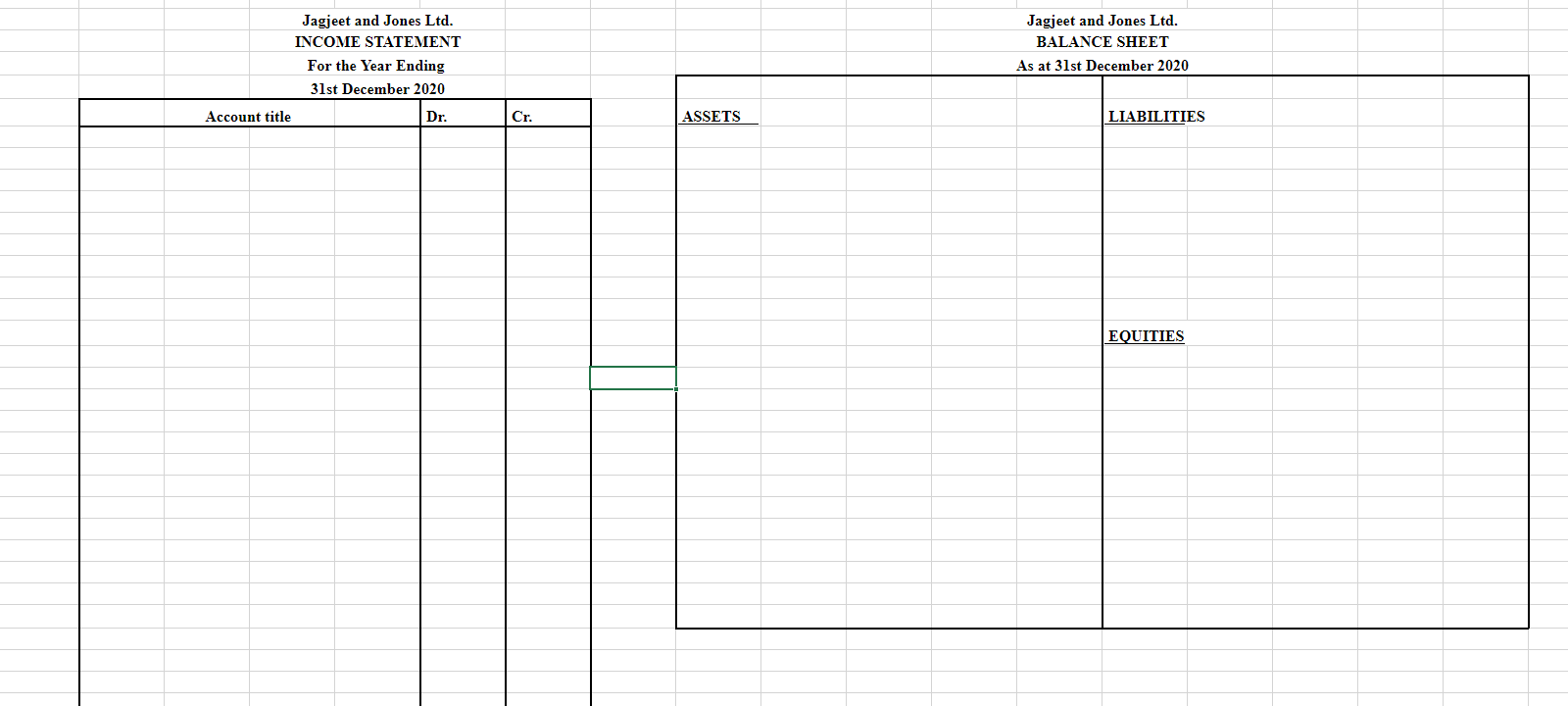

Question 2 Jagjeet and Jones Ltd. started in business on 1st January 2020 . The following is the company's Trial Balance as at 31st December 2020 : Additional Information: 1) During the end of accounting period, stock on hand was valued at $10,000. 2) On the 31st of December 2020 , an amount of $400 was outstanding for telephone expenses, and the borrowing rates have been prepaid by $500. 3) The delivery van is to be depreciated at the rate of 20% per annum on cost. This makes depreciation $4,000 on the 31st of December 2020. 4) On the 31st of December 2020 , the company has an amount of $600 of unbilled invoice that is to be issued to one of the customers. Jagjeet and Jones Ltd. Jagjeet and Jones Ltd. INCOME STATEMENT BALANCE SHEET For the Year Ending As at 31st December 2020 ASSETS LIABILITIES EQUITIES

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts