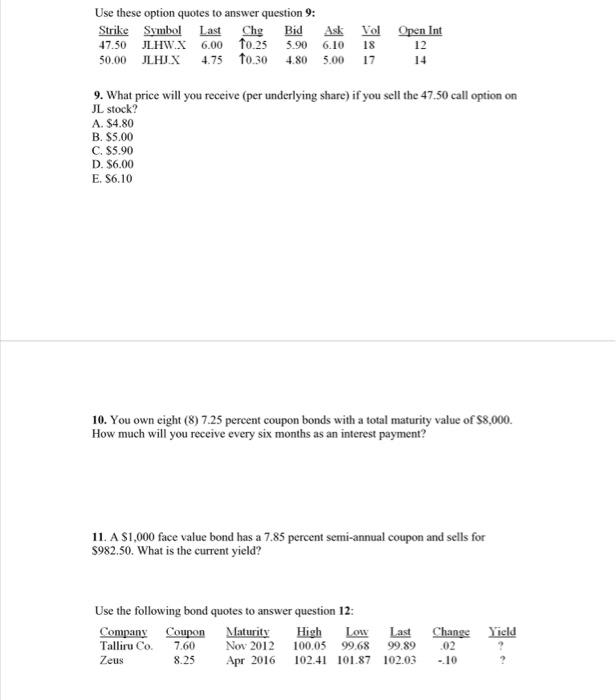

Question: Use these option quotes to answer question 9: Strike Symbol Last Bid Ask Vol Open Int 47.50 JLHW.X 6.00 10.25 5.90 6.10 18 12 50,00

Use these option quotes to answer question 9: Strike Symbol Last Bid Ask Vol Open Int 47.50 JLHW.X 6.00 10.25 5.90 6.10 18 12 50,00 JLHJX 4.75 fo.30 4.80 5.00 17 14 Chg 9. What price will you receive (per underlying share) if you sell the 47.50 call option on JL stock? A. $4.80 B. $5.00 C. $5.90 D. $6.00 E. $6.10 10. You own eight (8) 7.25 percent coupon bonds with a total maturity value of $8,000. How much will you receive every six months as an interest payment? 11 A S1,000 face value bond has a 7.85 percent semi-annual coupon and sells for 8982.50. What is the current yield? Use the following bond quotes to answer question 12: Company Coupon Maturity High Low Last Talliru Co. 7.60 Nov 2012 100.05 99.68 99.89 Zeus 8.25 Apr 2016 102.41 101.87 102.03 Change Yield .02 - 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts