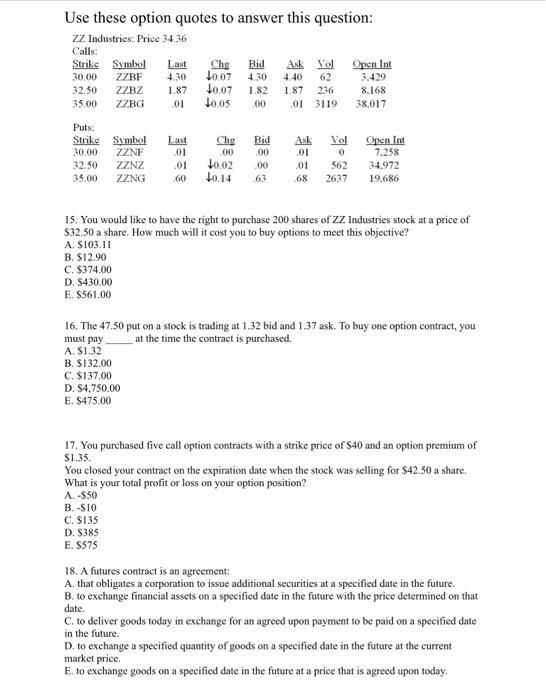

Question: Use these option quotes to answer this question: ZZ Industries: Price 34.36 Calls: Strike Symbol ZZBF 30.00 Last 4.30 Chg 40.07 4o.07 4o.05 Ask

Use these option quotes to answer this question: ZZ Industries: Price 34.36 Calls: Strike Symbol ZZBF 30.00 Last 4.30 Chg 40.07 4o.07 4o.05 Ask Vol 4.40 Open Int 3.429 8,168 Bid 4.30 62 32.50 ZZBZ 1.87 1.82 1.87 236 35.00 ZZBG 01 00 01 3119 38,017 Puts: Strike Symbol 30.00 ZZNF Open Int 7.258 Last Chg Bid Ask 01 Vol 01 .00 .00 to.02 to.14 32.50 ZZNZ .01 .00 .01 562 34.972 35.00 ZZNG 60 63 68 2637 19,686 15. You would like to have the right to purchase 200 shares of ZZ Industries stock at a price of S32.50 a share. How much will it cost you to buy options to meet this objective? A. SI03.11 B. $12.90 C. $374.00 D. S430.00 E. $561.00 16. The 47.50 put on a stock is trading at 1.32 bid and 1.37 ask. To buy one option contract, you must pay A. SI.32 B. S132.00 C. $137.00 D. S4,750.00 E. $475.00 at the time the contract is purchased. 17. You purchased five call option contracts with a strike price of S40 and an option premium of S1.35. You closed your contract on the expiration date when the stock was selling for $42.50 a share. What is your total profit or loss on your option position? A. -S50 B. -S10 C. S135 D. S385 E. S575 18. A futures contract is an agreement: A. that obligates a corporation to issue additional securities at a specified date in the future. B. to exchange financial assets on a specified date in the future with the price determined on that date. C. to deliver goods today in exchange for an agreed upon payment to be paid on a specified date in the future. D. to exchange a specified quantity of goods on a specified date in the future at the current market price. E. to exchange goods on a specified date in the future at a price that is agreed upon today.

Step by Step Solution

3.54 Rating (144 Votes )

There are 3 Steps involved in it

15 Buying a call option gives the right to purchase shares Strike price of call option 3250 Ask pr... View full answer

Get step-by-step solutions from verified subject matter experts