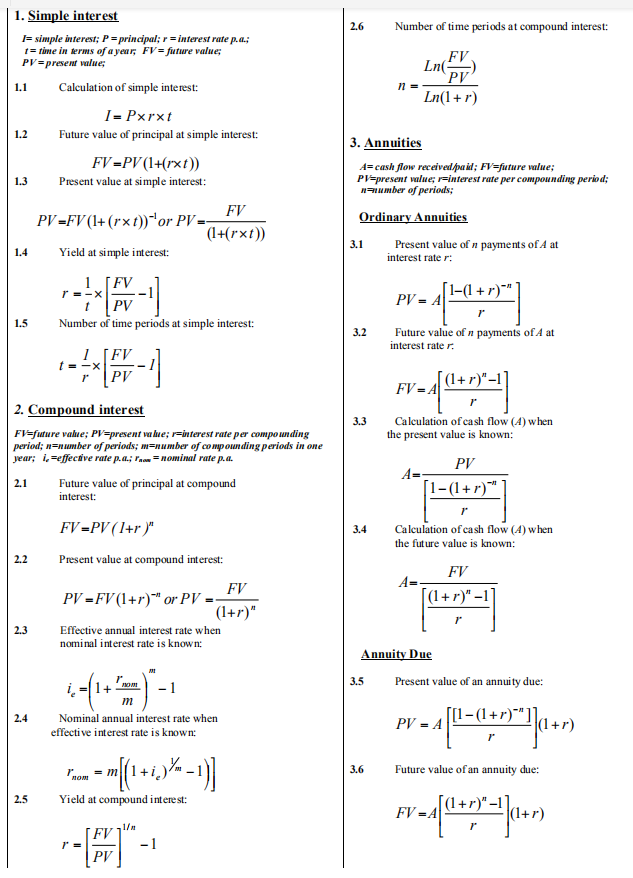

Question: Use these two formula sheets to answer questions James is starting to take his financial future seriously after studying finance at university. He is currently

Use these two formula sheets to answer questions

James is starting to take his financial future seriously after studying finance at university. He is currently 25 years of age and wishes to retire from full-time work at the age of 55 with $2 000 000 in savings.

a)How much will James need to contribute at theendof each month in order to receive$2 000 000 in 30 years' time at a compound interest rate of 7.25% p.a.?

Showformula,variables,calculationand aconcluding statementin your response.

b)How much will James need to contribute at thestartof each month in order to receive $2 000 000 in 30 years' time at a compound interest rate of 7.25% p.a.?

Showformula,variables,calculationand aconcluding statementin your response.

c)Explain why there is a difference between the two amounts determined in partsa)andb)?

1. Simple interest 2.6 I= simple interest; P = principal; r = interest rate p.a.; Number of time periods at compound interest: I = time in terms of a year, FV= future value; PV= present value; Ln- FV 1.1 Calculation of simple interest: 1 = PI In(1 + r) I = Pxrxt 1.2 Future value of principal at simple interest: 3. Annuities FV=PV (1+(rxt)) A= cash flow received/paid; FV future value; 1.3 Present value at simple interest: PV=present value; Finterest rate per compounding period; n=number of periods; PV =FV(1+(rxt)" or PV=- FV Ordinary Annuities (1 +(rxt ) ) 1.4 Yield at simple interest: 3.1 Present value of n payments of A at interest rate r: r = =x PV -1] 1 PV = Al-(+r)-" 15 Number of time periods at simple interest: r 3.2 Future value of n payments of A at interest rate r. FV = A (1+r)"-1] 2. Compound interest 3.3 Calculation of cash flow (A) when FV future value; PV=present value; =interest rate per compounding the present value is known: period; n=number of periods; m=number of compounding periods in one year; i, =effective rate p.a.; Fa. = nominal rate p.a. PV 2.1 Future value of principal at compound A=- interest: 1 - (1 +r )- r FV =PV( ]+r )" 3.4 Calculation of cash flow (A) when the future value is known: 2.2 Present value at compound interest: PV =FV(1+r)-" or PV _ FV A= FV (1+r)" (1+r)" -1 2.3 Effective annual interest rate when nominal interest rate is known: Annuity Due m -1 3.5 Present value of an annuity due: 2.4 Nominal annual interest rate when effective interest rate is known: PV = [-(1+2) (1+7) m[(1+ 1 ) /m - 1 ) ] 3.6 Future value of an annuity due: 2.5 Yield at compound interest: FV =A (1+)"- (1+7) FV PT -13.7 Calculation of cash flow (A) when the present value is known: 4.5 Risk measurement using probabilities: A= PV 4.6 Calculation of cash flow (A) when Return of a portfolio: 3.8 the future value is known: Swr, A= FV To = porfolio return; w, = weight of asset j in the portfolio; =remen of asset 4.7 Beta Coefficient: Perpetuity Bi = Pmkti * Oi Umkt 3.9 Perpetuity - when the constant cash flow (A) is known: 8,=Beta Coefficient; Pad=Correlation between the market and stock i; o =standard deviation (risk) of stock i; God, = PV = 4 standard deviation (risk ) of the marker. 4. Risk and Return 4.8 Beta of a portfolio: Risk and Returns using Historical Data Bp = SW.B, CFup =income for dividend) received during the holding period; PEND =price at the end of holding period; Psecas price at start of holding period; r, = return at time t; n = number of returns; o, =standard B, = portfolio Bera; w, = weight of asset j in the portfolio; B. deviation (risk) of returns; =beta of asset i. 4.1 Historical return with income: CF HP+ (PEND- PBEGIN) 5. Bond Pricing r= PBEGIN 5.1 Present value of a coupon paying bond [PV of coupon payments + PV of face value: Formula 4.2 Expected return using historical returns: 3.1+Formula 2.2] PV = Al-(1+r)-" ] r + FV E(R) =r = (1+r)" n 4.3 Risk measurement using historical returns: 6. Share Valuation value of a share using dividend valuation models: - = 6.1 (Zero Growth) : V = A n - 1 6.2 (Constant Growth): V = DI Risk and Returns using Probabilities k - g n = return for outcome i; Pr, = probability of return i occurring; n = number 4.4 of returns; a,=standard deviation (risk) of returns; Expected return using probabilities: 4annual constant dividend payment; D D. (1+p); A=required rate of return; g =constant rate of growth in dividends. E(R) = r= Yr,Pr