Question: Use this chart to answer these questions. 1.Compare the ratios for the 2-year period and determine if the the company is sufficiently liquid? How? 2.

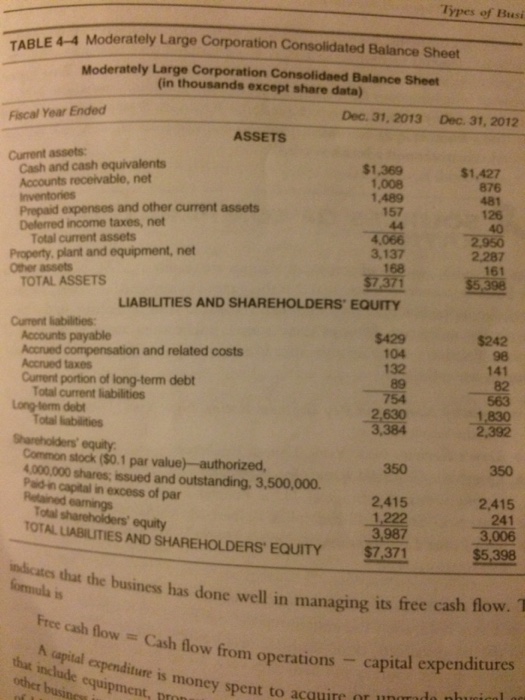

Types of Busi TABLE 4-4 Moderately Large Corporation Consolidated Balance Sheet Moderately Large Corporation Consolidaed Balance Sheet (in thousands except share data) Fiscal Year Ended Dec. 31, 2013 Dec. 31, 2012 Current assets: Cash and cash equivalents $1.369 $1.427 Accounts receivable, net 1.008 Prepaid expenses and other current assets 157 Deferred income taxes, net Total current assets Property, plant and equipment, net 3,137 Other assets 161 TOTAL ASSETS 371 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable $242 Accrued compensation and related costs Accrued taxes 132 141 Current portion of long-term debt Total current liabilities 2,630 Shareholders' equity. Common stock ($0.1 par value) authorized. 4000000 shares issued and outstanding, 3,500,000. capital in excess of par Retained earnings 2,415 2,415 Total shareholders' equity AND SHAREHOLDERS' EQUITY 1,222 241 $7,371 formula that the business has done well in managing its free cash flow T is that Free cash flow Cash flow from operations capital expenditures include expenditure money spent to acquire or unm do n other is businew prn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts