Question: What inventory flow assumption did Tootsie Roll use to value most of its inventory? Why do you think they chose that assumption? Find or

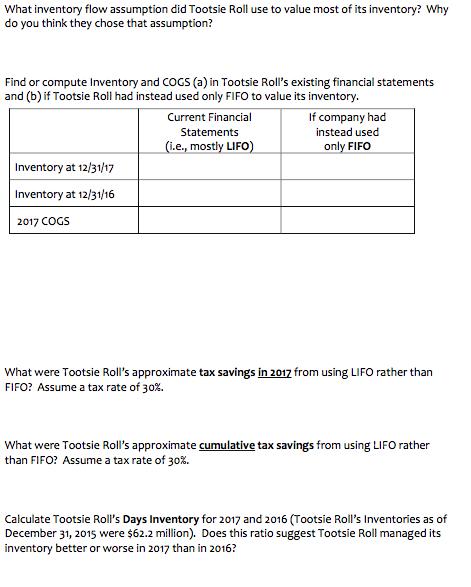

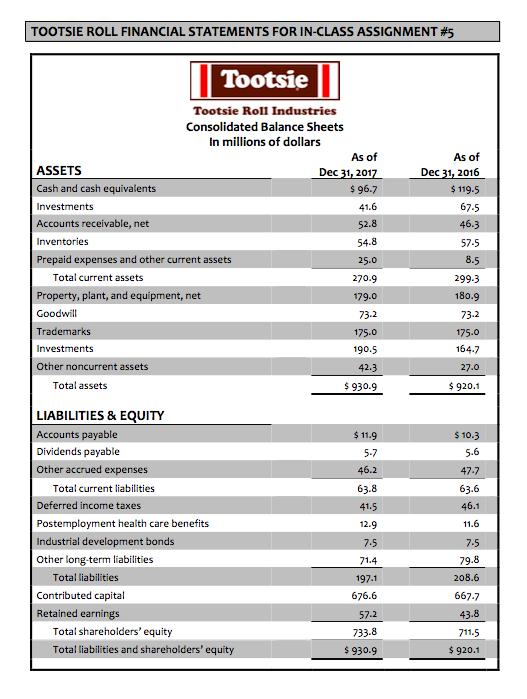

What inventory flow assumption did Tootsie Roll use to value most of its inventory? Why do you think they chose that assumption? Find or compute Inventory and COGS (a) in Tootsie Roll's existing financial statements and (b) if Tootsie Roll had instead used only FIFO to value its inventory. Current Financial If company had Statements instead used (i.e., mostly LIFO) only FIFO Inventory at 12/31/17 Inventory at 12/31/16 2017 COGS What were Tootsie Roll's approximate tax savings in 2017 from using LIFO rather than FIFO? Assume a tax rate of 30%. What were Tootsie Roll's approximate cumulative tax savings from using LIFO rather than FIFO? Assume a tax rate of 30%. Calculate Tootsie Roll's Days Inventory for 2017 and 2016 (Tootsie Roll's Inventories as of December 31, 2015 were $62.2 million). Does this ratio suggest Tootsie Roll managed its inventory better or worse in 2017 than in 2016? TOOTSIE ROLL FINANCIAL STATEMENTS FOR IN-CLASS ASSIGNMENT #5 Tootsie Tootsie Roll Industries Consolidated Balance Sheets In millions of dollars As of As of ASSETS Cash and cash equivalents Dec 31, 2017 $ 96.7 Dec 31, 2016 $ 119-5 Investments 41.6 67.5 Accounts receivable, net 52.8 46.3 Inventories 54.8 57-5 Prepaid expenses and other current assets 25.0 8.5 Total current assets 270.9 299.3 Property, plant, and equipment, net 180.9 179.0 Goodwill 73.2 73.2 Trademarks 175.0 175.0 Investments 190.5 164.7 Other noncurrent assets 42.3 27.0 Total assets $ 930.9 $ 920.1 LIABILITIES & EQUITY Accounts payable $ 11.9 $ 10.3 Dividends payable 5-7 5.6 Other accrued expenses 46.2 47-7 Total current liabilities 63.8 63.6 Deferred income taxes 41.5 46.1 Postemployment health care benefits Industrial development bonds 12.9 11.6 7.5 7.5 Other long-term liabilities 71.4 79.8 Total liabilities 197.1 208.6 Contributed capital 676.6 667.7 Retained earnings 57.2 43.8 Total shareholders' equity 733.8 711.5 Total liabilities and shareholders' equity $ 930.9 $ 920.1 Tootsie Tootsie Roll Industries Consolidated Income Statements In millions of dollars, except per share amounts Year ended Year ended Year ended Dec 31, 2017 $ 519.3 Dec 31, 2016 Dec 31, 2015 Net sales $ 521.1 $540.1 Cost of goods sold 326.9 321.3 340.9 Gross margin 192.4 199.8 199.2 Seling, marketing and administrative expenses 121.0 107.4 108.1 Income from operations 71.4 92.4 91.1 Other income, net 13.2 5.5 1.5 Income before income taxes 84.6 97.9 92.6 Income tax expense 3-7 30.6 26.5 Net income $ 80.9 $ 67.3 $ 66.1 Earnings per share $ 1.28 $ 1.08 $ 1.04 Notes to Consolidated Financial Statements (partial) FOOTNOTE 1. SIGNIFICANT ACCOUNTING POLICIES BUSINESS Tootsie Roll Industries, Inc. and its consolidated subsidiaries have been engaged in the manufacture and sale of confectionery products for over 100 years. This is the only industry segment in which the Company operates and is its only line of business. The majority of the Company's products are sold under the Charms Mini-Pops, Cella's, Dots, Junior Mints, Charleston Chew, Sugar Daddy, Sugar Babies, Andes, Fluffy Stuff, Dubble Bubble, Razzles, Cry Baby, Nik-L-Nip, and Tutsi Pop (Mexico). INVENTORIES Inventories are stated at cost, not to exceed market. The cost of substantially all of the Company's inventories has been determined by the last-in, first-out (LIFO) method. The excess of current cost over LIFO cost of inventories approximates $18.8 million and $17.6 million at December 31, 2017 and 2016, respectively. The cost of certain foreign inventories has been determined by the first-in, first-out (FIFO) method.

Step by Step Solution

3.55 Rating (165 Votes )

There are 3 Steps involved in it

Answer a Tootsie Roll has used LIFO to value most of its inventory as mentioned in the ... View full answer

Get step-by-step solutions from verified subject matter experts