Question: Use this excel templete as the answer: a) b) a. Prepare journal entries to record credit sales, collections on account, and the transactions and adjustments

Use this excel templete as the answer:

a)

b)

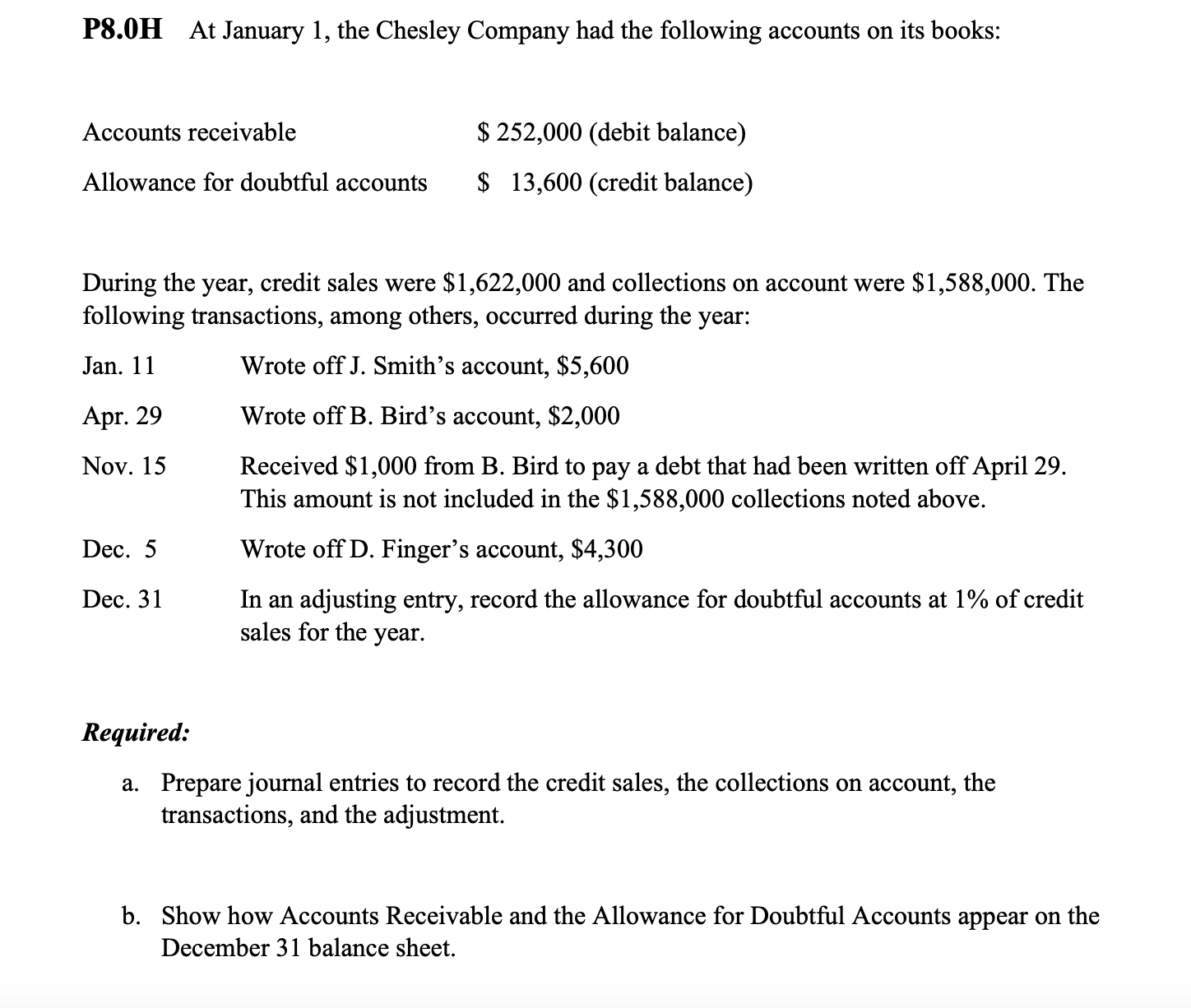

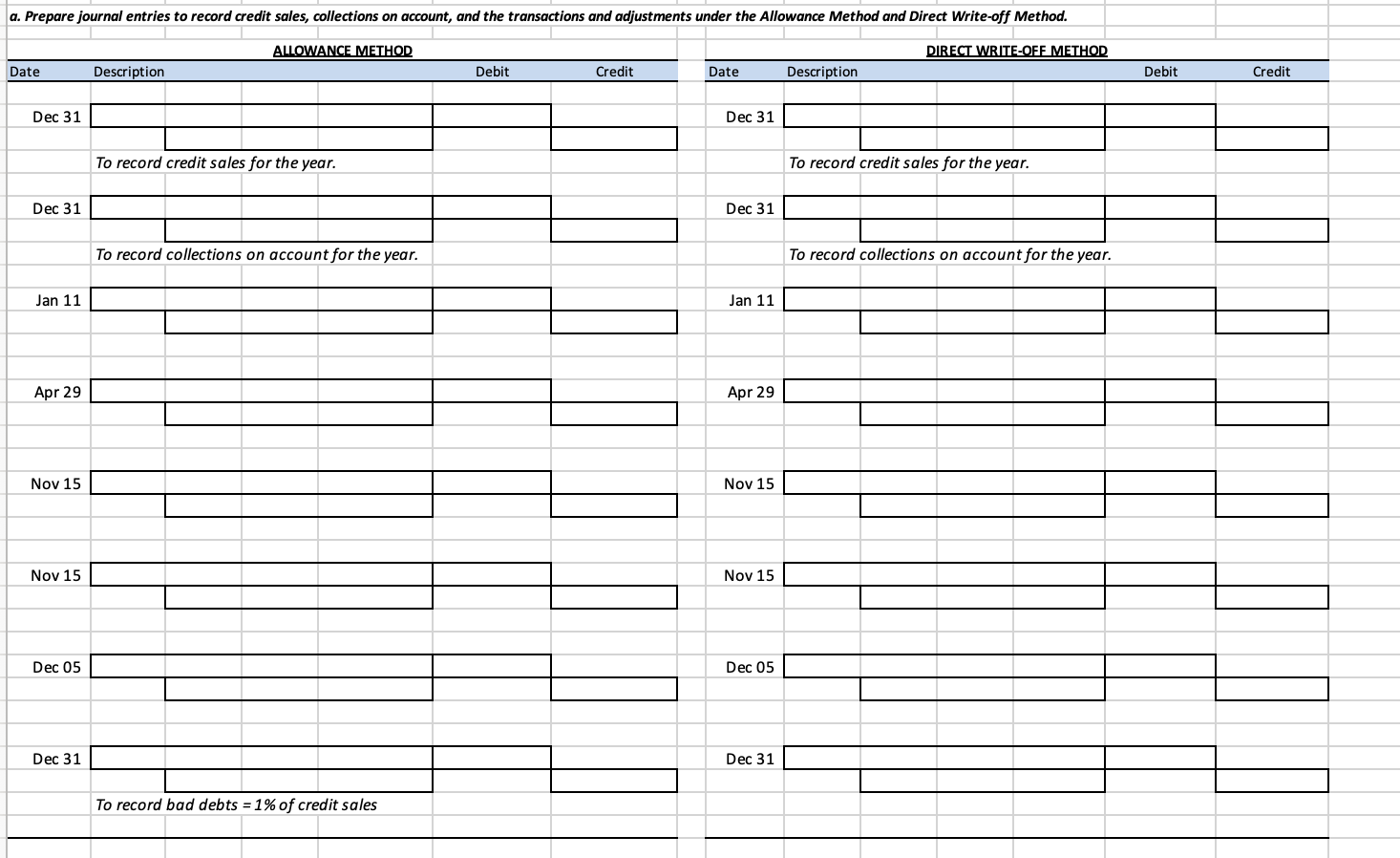

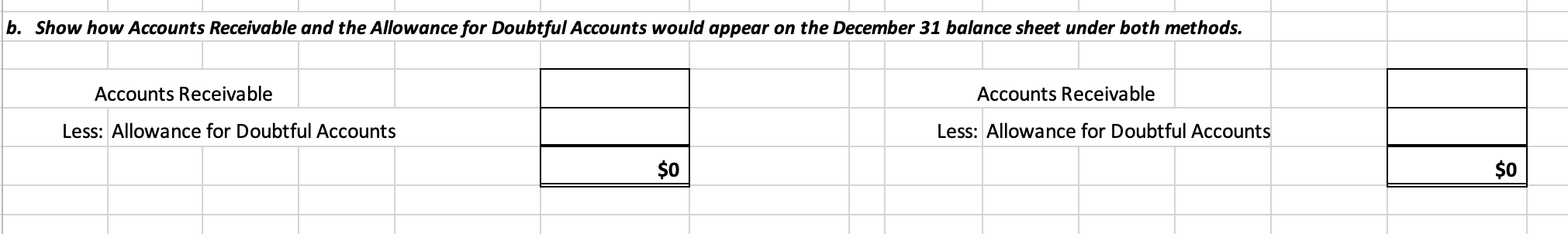

a. Prepare journal entries to record credit sales, collections on account, and the transactions and adjustments under the Allowance Method and Direct Write-off Method. ALLOWANCEMETHOD To record collections on account for the year. Jan 11 \begin{tabular}{|l|l|l|l|l|l|} \hline & & & & \\ \hline & & & & & \\ \cline { 2 - 5 } & & & \end{tabular} Apr 29 \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & & & \\ \cline { 2 - 4 } & & & \end{tabular} Nov 15 Nov 15 Dec 05 Dec 31 DIRECT WRITE-OFF METHOD To record credit sales for the year. Dec 31 To record collections on account for the year. Jan 11 Apr 29 Nov 15 Nov 15 Dec 05 Dec 31 To record bad debts =1% of credit sales P8.0H At January 1, the Chesley Company had the following accounts on its books: During the year, credit sales were $1,622,000 and collections on account were $1,588,000. The following transactions, among others, occurred during the year: Jan. 11 Apr. 29 Nov. 15 Dec. 5 Dec. 31 Wrote off J. Smith's account, $5,600 Wrote off B. Bird's account, $2,000 Received $1,000 from B. Bird to pay a debt that had been written off April 29. This amount is not included in the $1,588,000 collections noted above. Wrote off D. Finger's account, $4,300 In an adjusting entry, record the allowance for doubtful accounts at 1% of credit sales for the year. Required: a. Prepare journal entries to record the credit sales, the collections on account, the transactions, and the adjustment. b. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on the December 31 balance sheet. b. Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear on the December 31 balance sheet under both methods. Accounts Receivable Less: Allowance for Doubtful Accounts \begin{tabular}{|r|} \hline \\ \hline \\ \hline$0 \\ \hline \end{tabular} Accounts Receivable Less: Allowance for Doubtful Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts