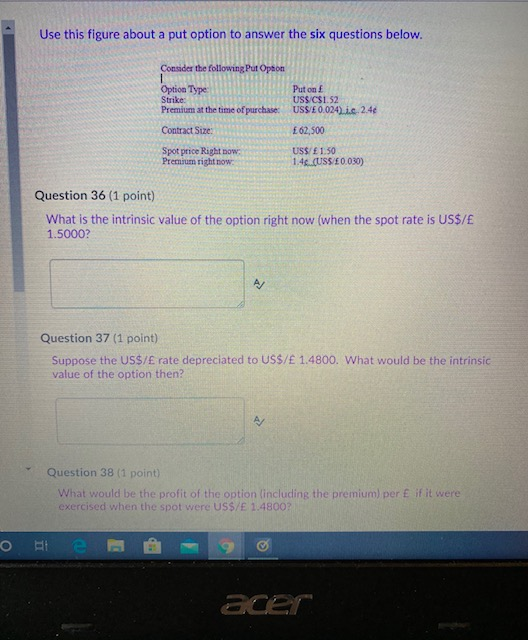

Question: Use this figure about a put option to answer the six questions below. Consider the following Put Ophon Option Type: Strike Premium at the time

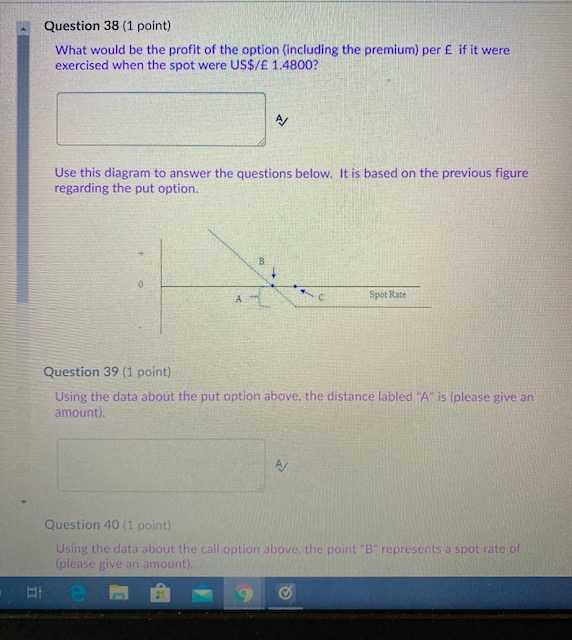

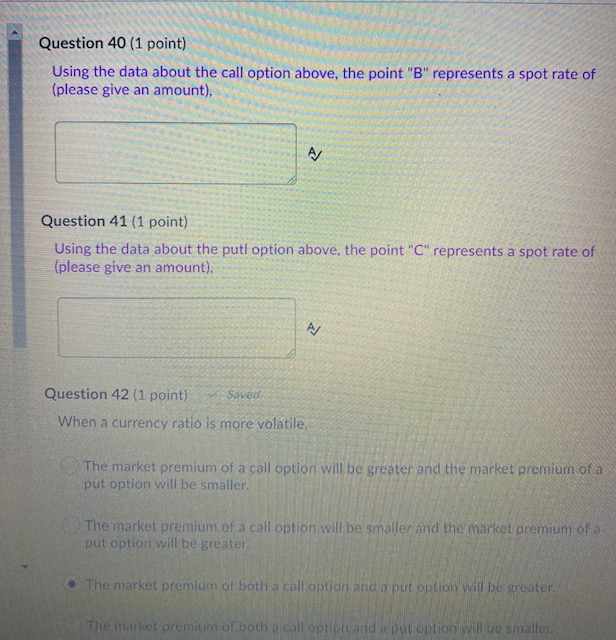

Use this figure about a put option to answer the six questions below. Consider the following Put Ophon Option Type: Strike Premium at the time of purchase Put on US$C$1.52 USSE 0.024).i.c.2.4 62,500 Contract Size: Spot price Right now Premium right now US$ 1.30 1.4.CUSS 0.030) Question 36 (1 point) What is the intrinsic value of the option right now (when the spot rate is US$/ 1.5000? Question 37 (1 point) Suppose the US$/rate depreciated to US$/ 1.4800. What would be the intrinsic value of the option then? Question 38 (1 point) What would be the profit of the option including the premium) per if it were exercised when the spot were US$/E 1.4800? acer Question 38 (1 point) What would be the profit of the option (including the premium) per if it were exercised when the spot were US$/ 1.4800? Use this diagram to answer the questions below. It is based on the previous figure regarding the put option. Spot Rate Question 39 (1 point) Using the data about the put option above, the distance labled "A" is (please give an amount) Question 40 (1 point) Using the data about the call option above, the point "B"represents a spot rate of (please give an amount). Question 40 (1 point) Using the data about the call option above, the point "B" represents a spot rate of (please give an amount), Question 41 (1 point) Using the data about the puti option above, the point "C" represents a spot rate of (please give an amount), Question 42 (1 point) Saved When a currency ratio is more volatile, The market premium of a call option will be greater and the market premium of a put option will be smaller The market premium of a call option will be smaller and the market premium of put option will be greater The market premium of both a call option and put optioly will be greater The market premium of both a call option and a put option will be smaller Use this figure about a put option to answer the six questions below. Consider the following Put Ophon Option Type: Strike Premium at the time of purchase Put on US$C$1.52 USSE 0.024).i.c.2.4 62,500 Contract Size: Spot price Right now Premium right now US$ 1.30 1.4.CUSS 0.030) Question 36 (1 point) What is the intrinsic value of the option right now (when the spot rate is US$/ 1.5000? Question 37 (1 point) Suppose the US$/rate depreciated to US$/ 1.4800. What would be the intrinsic value of the option then? Question 38 (1 point) What would be the profit of the option including the premium) per if it were exercised when the spot were US$/E 1.4800? acer Question 38 (1 point) What would be the profit of the option (including the premium) per if it were exercised when the spot were US$/ 1.4800? Use this diagram to answer the questions below. It is based on the previous figure regarding the put option. Spot Rate Question 39 (1 point) Using the data about the put option above, the distance labled "A" is (please give an amount) Question 40 (1 point) Using the data about the call option above, the point "B"represents a spot rate of (please give an amount). Question 40 (1 point) Using the data about the call option above, the point "B" represents a spot rate of (please give an amount), Question 41 (1 point) Using the data about the puti option above, the point "C" represents a spot rate of (please give an amount), Question 42 (1 point) Saved When a currency ratio is more volatile, The market premium of a call option will be greater and the market premium of a put option will be smaller The market premium of a call option will be smaller and the market premium of put option will be greater The market premium of both a call option and put optioly will be greater The market premium of both a call option and a put option will be smaller

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts