Question: Use this format to answer the question Item # Account involved Carrying value Tax Base temporary Difference DTA or DTL? For each of the following

Use this format to answer the question

| Item # | Account involved | Carrying value | Tax Base | temporary Difference | DTA or DTL? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

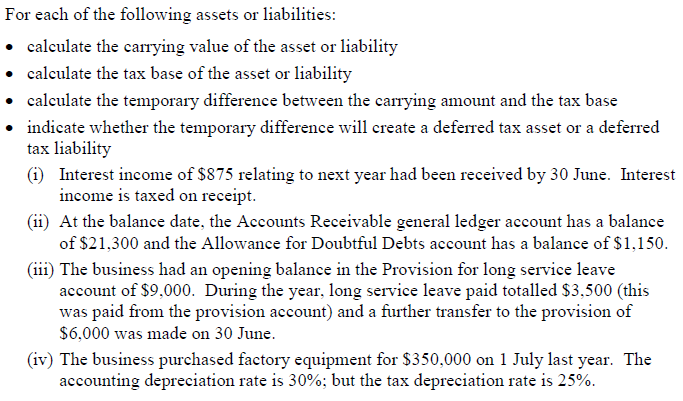

For each of the following assets or liabilities calculate the carrying value of the asset or liability calculate the tax base of the asset or liability calculate the temporary difference between the carrying amount and the tax base indicate whether the temporary difference will create a deferred tax asset or a deferred tax liability (i) Interest income of $875 relating to next year had been received by 30 June. Interest income is taxed on receipt. (i) At the balance date, the Accounts Receivable general ledger account has a balance of $21,300 and the Allowance for Doubtful Debts account has a balance of $1,150. (iii) The business had an opening balance in the Provision for long service leave account of $9,000. During the year, long service leave paid totalled S3,500 (this was paid from the provision account) and a further transfer to the provision of $6,000 was made on 30 June. iv) The business purchased factory equipment for $350,000 on 1 July last year. The accounting depreciation rate is 30%: but the tax depreciation rate is 25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts