Question: use this formula tell what formula do you use for number 2 and 3 Charlie is 22 years old and has recently completed a Bachelor

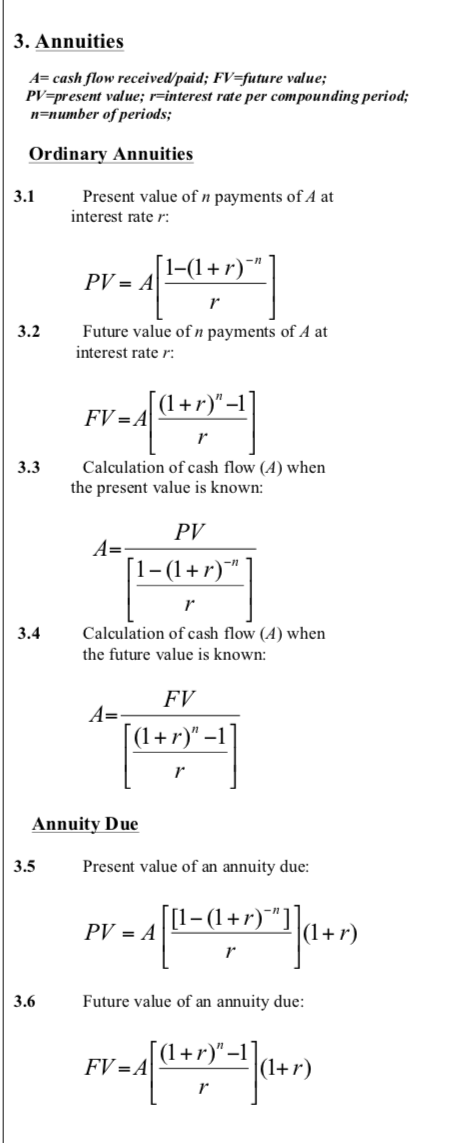

use this formula

tell what formula do you use for number 2 and 3

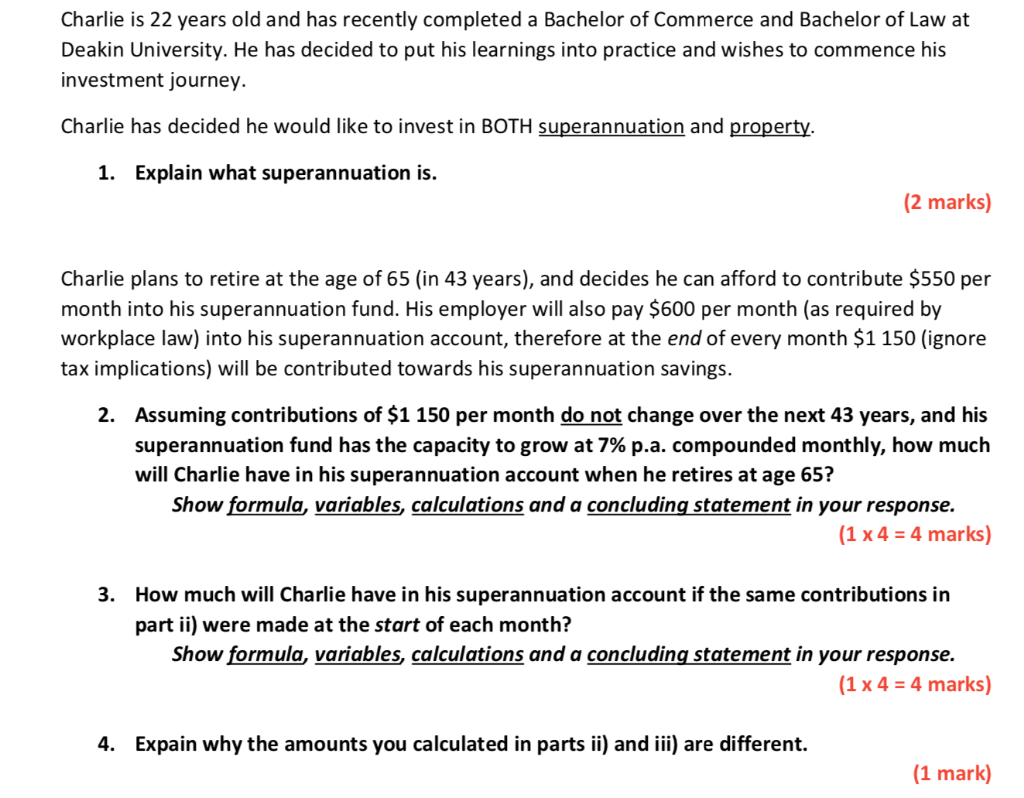

Charlie is 22 years old and has recently completed a Bachelor of Commerce and Bachelor of Law at Deakin University. He has decided to put his learnings into practice and wishes to commence his investment journey. Charlie has decided he would like to invest in BOTH superannuation and property. 1. Explain what superannuation is. (2 marks) Charlie plans to retire at the age of 65 (in 43 years), and decides he can afford to contribute $550 per month into his superannuation fund. His employer will also pay $600 per month (as required by workplace law) into his superannuation account, therefore at the end of every month $1 150 (ignore tax implications) will be contributed towards his superannuation savings. 2. Assuming contributions of $1 150 per month do not change over the next 43 years, and his superannuation fund has the capacity to grow at 7% p.a. compounded monthly, how much will Charlie have in his superannuation account when he retires at age 65? Show formula, variables, calculations and a concluding statement in your response. (1 x 4 = 4 marks) 3. How much will Charlie have in his superannuation account if the same contributions in part ii) were made at the start of each month? Show formula, variables, calculations and a concluding statement in your response. (1 x 4 = 4 marks) 4. Expain why the amounts you calculated in parts ii) and iii) are different. (1 mark) 3. Annuities A= cash flow received paid; FV=future value; PV=present value; r=interest rate per compounding period; n=number of periods, Ordinary Annuities 3.1 Present value of n payments of A at interest rate : [1-(1+r)" PV = A 44-473 3.2 Future value of n payments of A at interest rate : [(1+r)"1 FV = A (+1*1 v 3.3 Calculation of cash flow (A) when the present value is known: 1 PV A= [1-(1+r) 3.4 Calculation of cash flow (A) when the future value is known: FV A= ((1+r)" -1 *** Annuity Due 3.5 Present value of an annuity due: [[1-(1+r) PV = A - [149] 3.6 Future value of an annuity due: FV-1(+/-]+r) ((1+r)"-1 =A (1) r

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts